Dollar Recovery Stalls Ahead of Friday's NFP Release

Dollar Sell-Off Pauses for Now

Following the heavy sell off we saw over July and August; the US Dollar is seeing some recovery action through the first week of Q3. DXY has bounced off the 100.92 level support and is currently around 1.2% higher. The move comes despite an uptick in Fed easing expectations on the back of Powell’s recent comments confirming that the Fed will ease in September. Powell told the Jackson Hole audience that the time to adjust monetary policy had now arrived and signalled that the Fed had plenty of scope to adjust policy levels as needed given current interest rates.

Fed Easing Expectations

The issue for USD bears now is that on the back of the heavy sell off through summer, the market now has a higher barrier for moving lower. Looking ahead, expectations are split over whether the Fed will cut by a larger .5% amount in September, or kick things off with a .25% cut. If the latter is seen, USD might struggle to move lower again unless the guidance is firmly dovish. However, if we see the Fed cutting by a larger amount, along with firmly dovish guidance, this should give bears enough ammunition to push lower. Traders will now be watching incoming jobs and inflation data ahead of the September meeting. If Friday’s labour market readings show fresh weakness, this should bolster expectations of a deeper cut, sending USD lower again near-term.

Technical Views

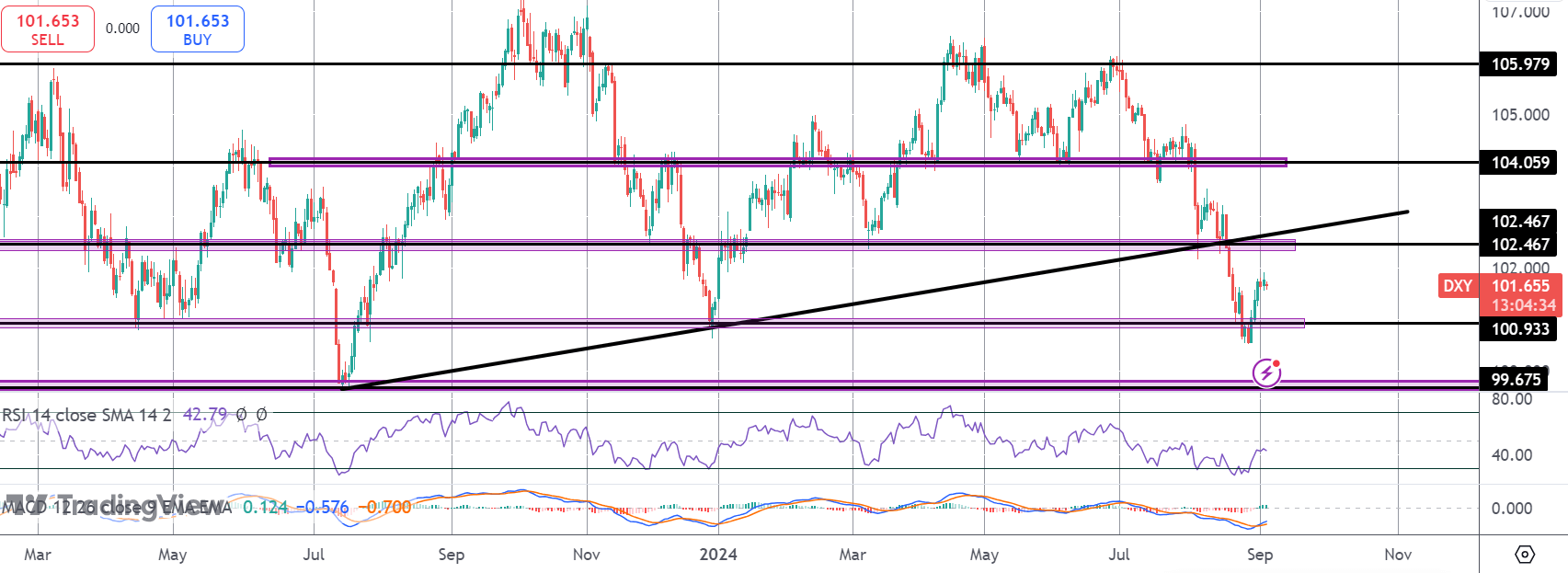

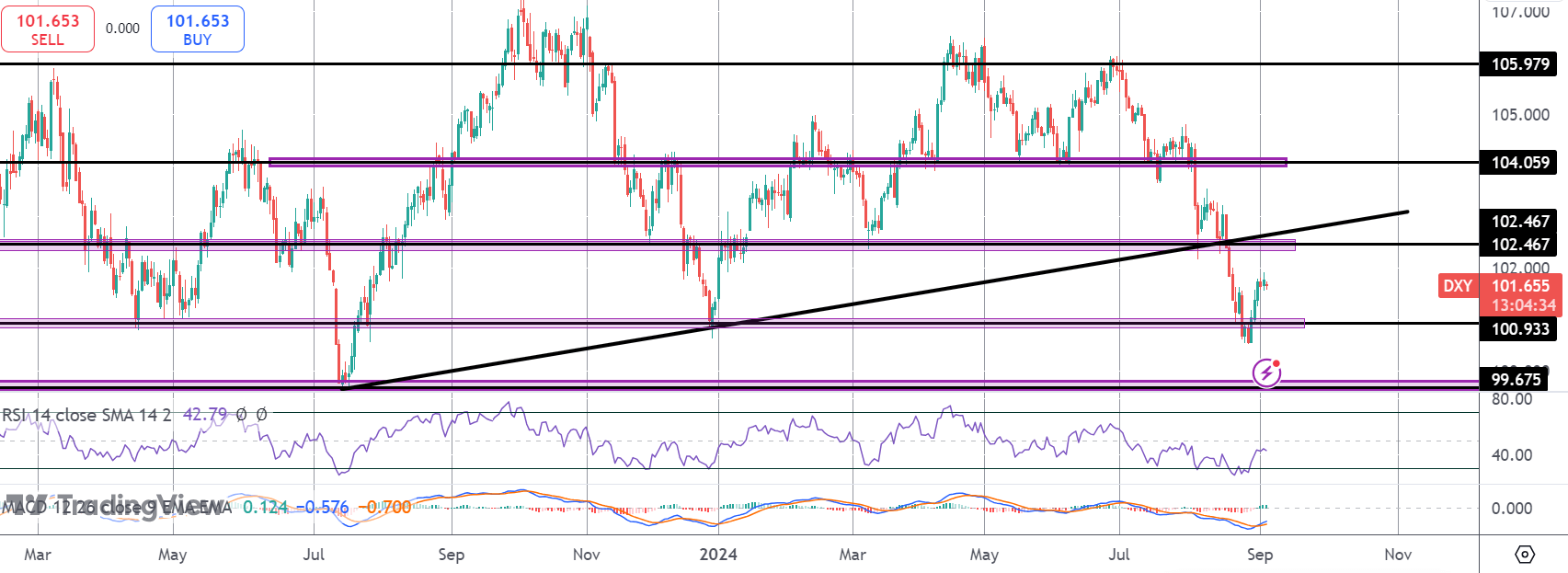

DXY

The sell off in the index has stalled for now into a test of the 100.93 level support. Price has bounced through, remains below the broken bull trend line and the 102.46 level. This is a key resistance area for the market and while price holds beneath, focus is on a further push lower. Back above there, focus shifts to 104.05.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.