Daily Market Outlook, July 31, 2024

Daily Market Outlook, July 31, 2024

Munnelly’s Macro Minute…

“BoJ Surprise Hike & Slowdown In Bond Purchases Sees Overnight Volatility Spike ”

Japanese stocks rebounded and the yen fluctuated as traders absorbed the BoJ's interest rate hike and slowdown in bond purchases. The BoJ raised interest rates to around 0.25% and announced a reduction in bond purchases to about ¥3 trillion ($19.6 billion) per month in Q1 2026. Japanese government bonds pared losses, with analysts having expected a more aggressive cut. The Nikkei 225 index advanced 0.2%, while the yen alternated between gains and losses.

Meanwhile, the Australian dollar sank and short-term bonds surged as core inflation unexpectedly declined in the fourth quarter, leading traders to increase bets on a Reserve Bank interest rate cut. Chinese markets rose on growing expectations that Beijing will boost support for its faltering economy. In the US, equities futures rose on speculation that Fed Chair Jerome Powell would hint at a probable rate cut in September..

Investors will now be waiting for the Federal Reserve's decision on interest rates, while the euro zone's inflation report will be the main economic focus. Quarterly results from major tech firms are highlighting a divide in the AI landscape, with AMD reporting strong earnings but Microsoft disappointing investors with slow cloud growth.

HSBC Holdings reported a slight decrease of 0.4% in first-half profit, but still exceeded analyst expectations. The company also announced the appointment of Jonathan Bingham as interim group chief financial officer, effective September 2. Meanwhile, Rio Tinto is considering a significant acquisition, but CEO Jakob Stausholm noted that it would need to offer exceptional value, which is challenging to find in the current hot copper market, as he discussed the company's first-half results.

Overnight Newswire Updates of Note

Australian Inflation Rises Amid Hopes Of RBA Rates Doves

US Carries Out Strike In Iraq Amid Middle East Tensions

BoJ Raises Interest Rate To 0.25% In Aggressive Move

Harris Wipes Out Trump’s Swing-State Lead Polls

US: Start Of New China Tariffs Will Be Delayed

US Carries Out Strike In Iraq, Regional Tensions

BoJ, Monthly JGB Buying Yield Curve Control

Oil Dips To Monthly Low Amid Shaky Demand

Tech Earnings; Nvidia, Meta CEOs Discuss AI

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 155.00 ($2.27b), 158.50 ($1.74b), 158.00 ($1.5b)

EUR/USD: 1.0800 (EU571.9m), 1.0700 (EU474.1m), 1.0920 (EU412.1m)

USD/CNY: 7.3000 ($745.9m), 7.3800 ($548m), 7.2789 ($499m)

AUD/USD: 0.6550 (AUD592.6m), 0.6650 (AUD559.3m), 0.6600 (AUD466m)

USD/BRL: 5.6000 ($1.39b), 5.6500 ($1.08b), 5.5000 ($838.2m)

USD/CAD: 1.3625 ($590.1m), 1.3750 ($324.8m)

GBP/USD: 1.4821 (GBP445.3m)

EUR/GBP: 0.8420 (EU549.2m)

Month-end FX flows are expected to be weak to neutral, according to various bank models. Barclays anticipates weak USD demand against major currencies, while Credit Agricole forecasts neutral USD but potential EUR buying from corporate flows.

CFTC Data As Of 23/7/24

Equity fund managers cut S&P 500 CME net long position by 2,812 contracts to 994,529

Equity fund speculators trim S&P 500 CME net short position by 89,786 contracts to 280,356

Japanese yen net short position is -107,108 contracts

Swiss franc posts net short position of -42,237 contracts

British pound net long position is 142,183 contracts

Euro net long position is 35,906 contracts

Bitcoin net short position is -661 contracts

Technical & Trade Views

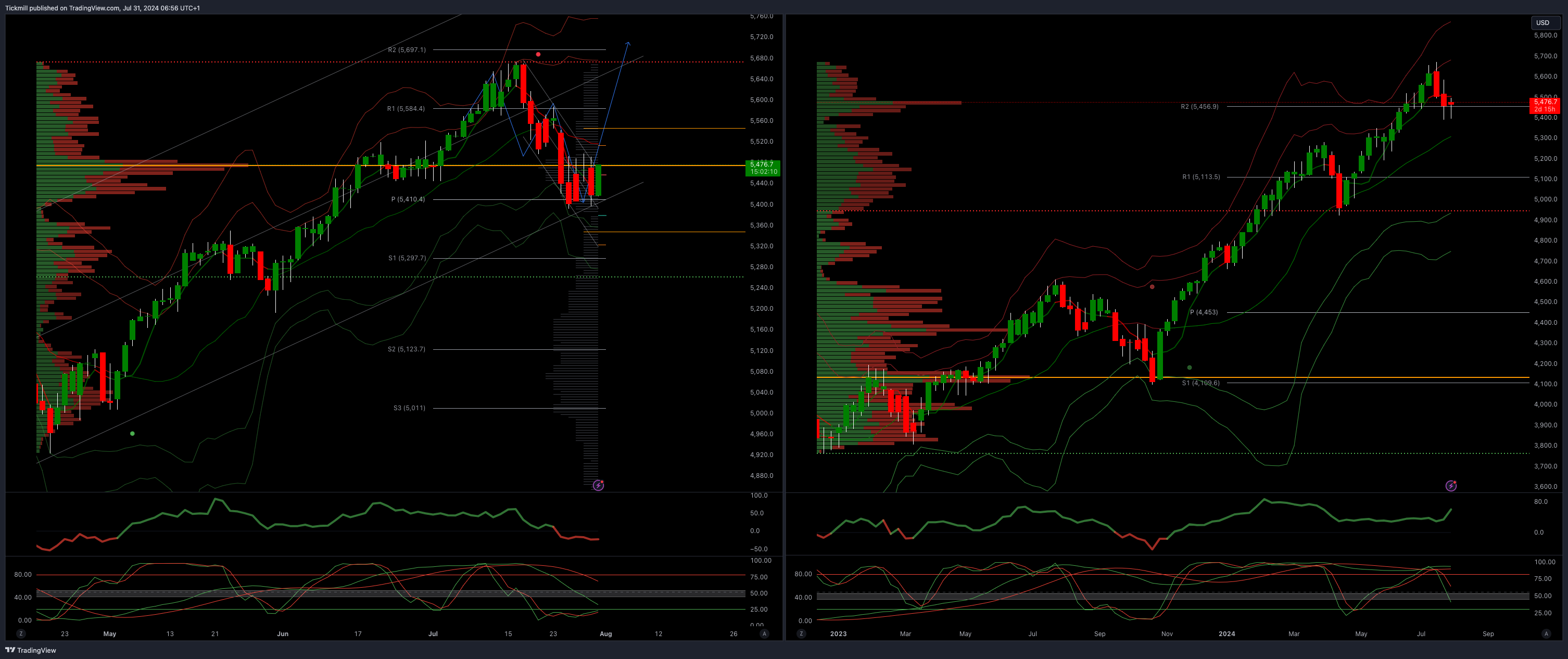

SP500 Bullish Above Bearish Below 5480

Daily VWAP bullish

Weekly VWAP bearish

Below 5400 opens 5350

Primary support 5400

Primary objective 5700

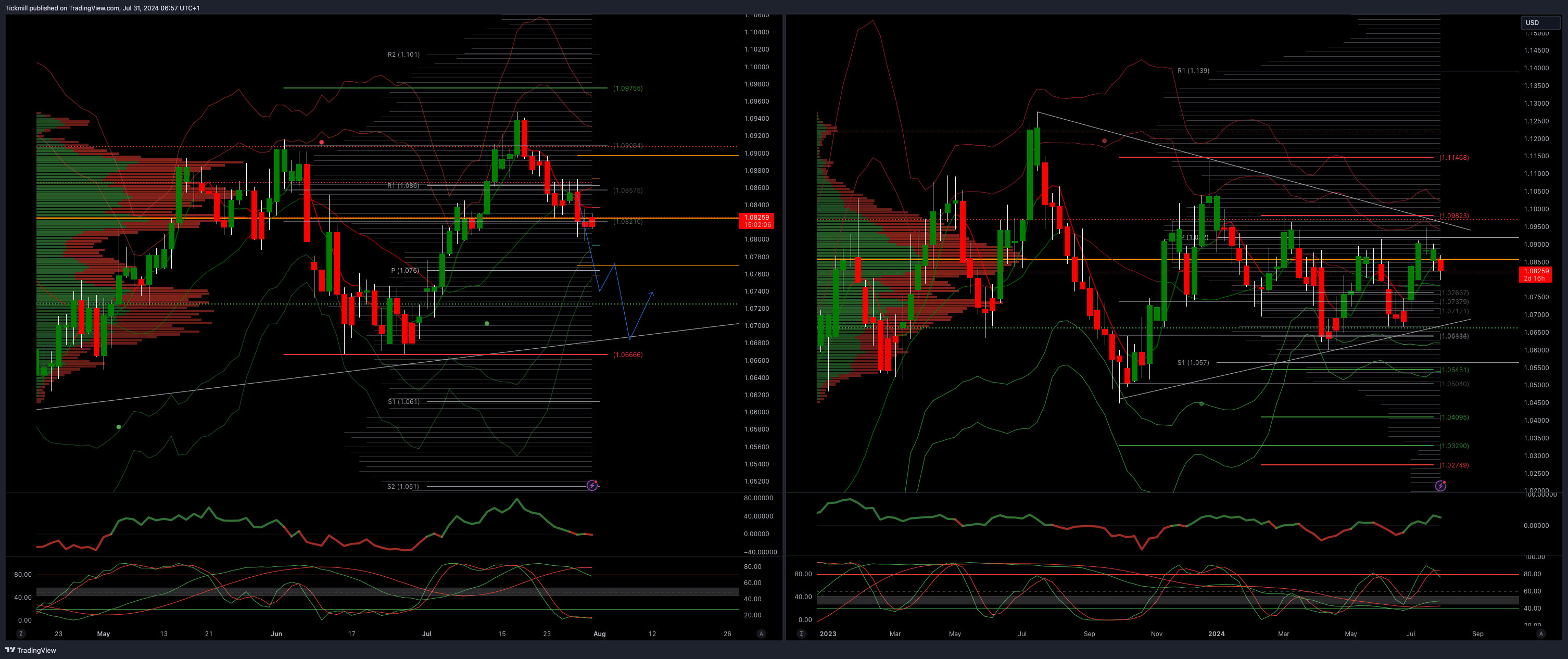

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.07

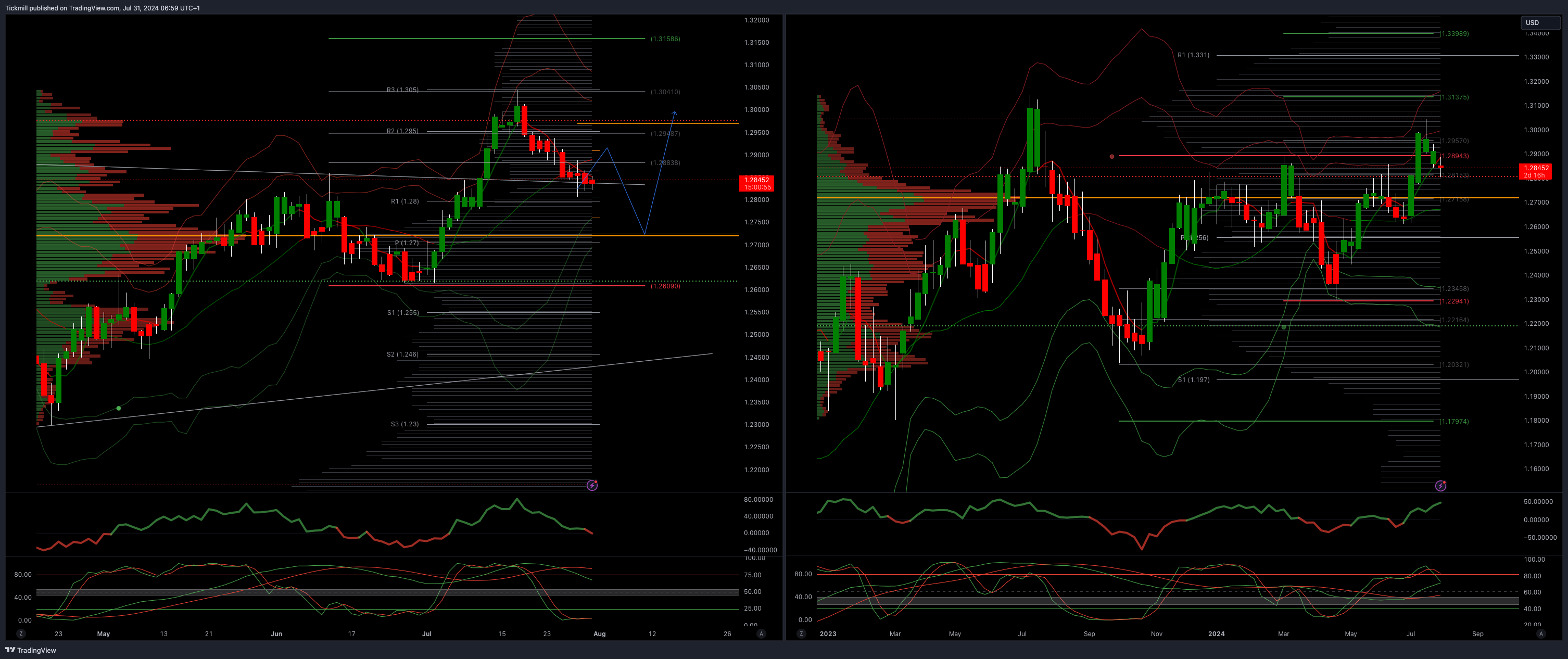

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.3160

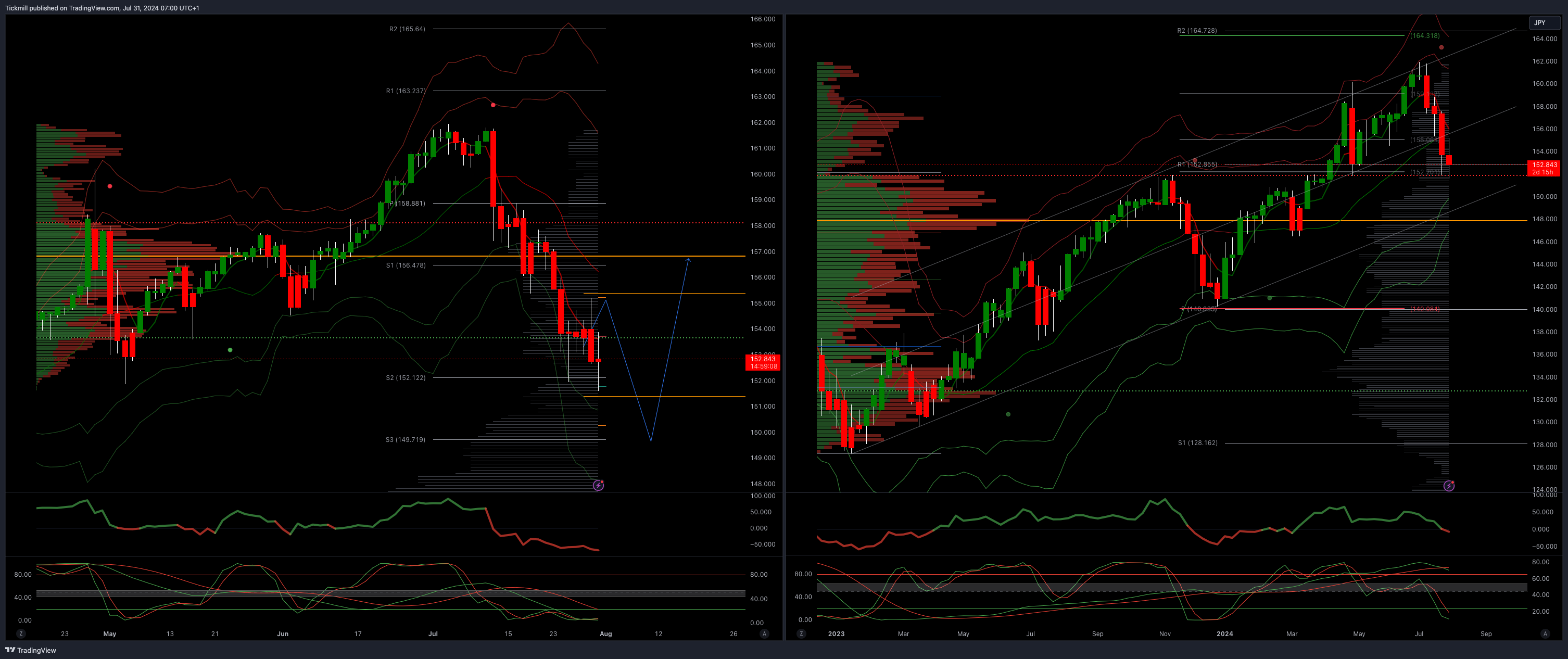

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bearish

Below 152 opens 148.70

Primary support 148.70

Primary objective is 164.30

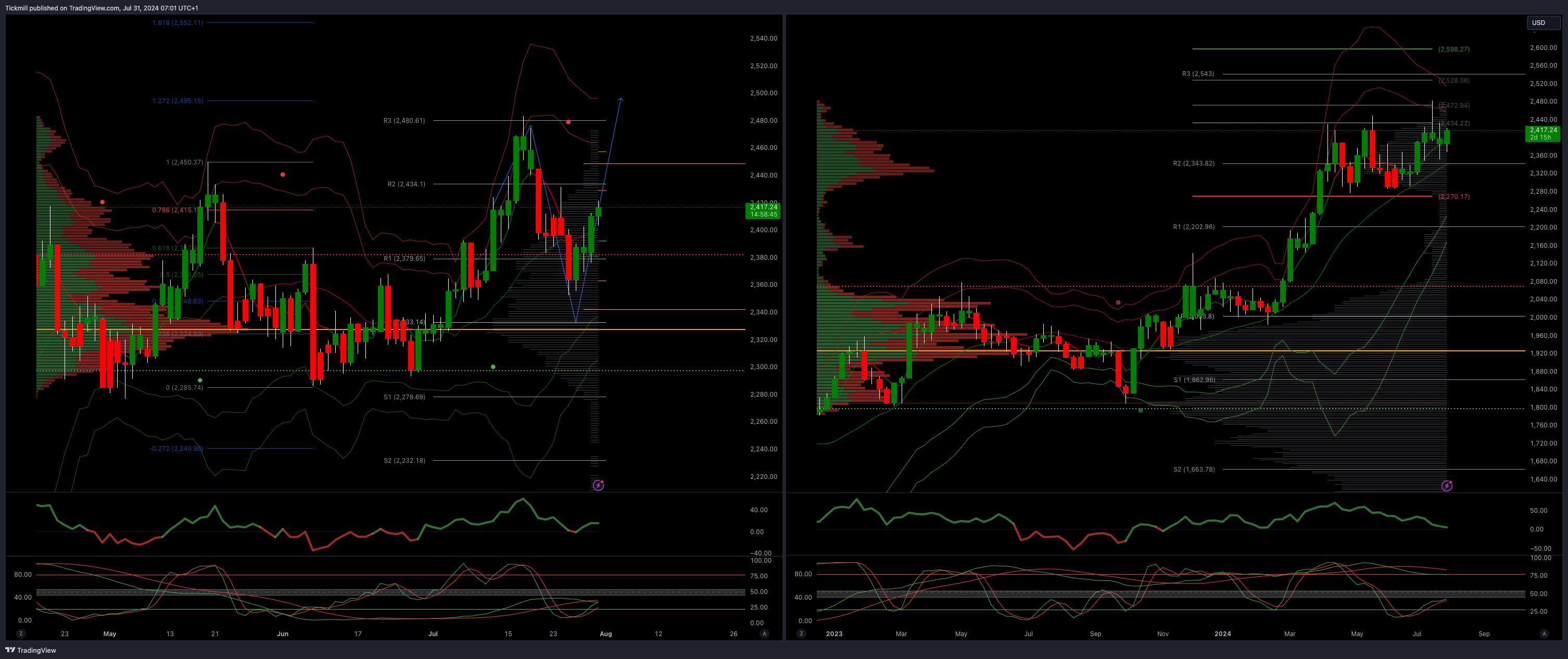

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bearish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!