Daily Market Outlook, July 10, 2024

Daily Market Outlook, July 10, 2024

Munnelly’s Macro Minute…

“Markets Hit Record Highs As Fed Chair Powell Strikes A Dovish Tone”

US stocks hit new highs, leading to volatile swings in Asian markets as traders assessed Fed Chairman Powell's remarks on the US economic outlook. Australian and Chinese stocks fell, while those in Hong Kong and Japan rose. China's consumer prices barely increased in June, indicating ongoing deflationary pressures. The S&P 500 rose for a sixth straight session, while the Nasdaq 100 set another record. In Asian trade, European and US equity futures saw gains.

Central bankers around the world are becoming more confident that markets may be moving towards a period of lower interest rates, as they have struggled to control inflation for a long time. The Reserve Bank of New Zealand (RBNZ) recently announced that they expect headline inflation to return to the target range of 1% to 3% in the second half of this year, signaling a less aggressive stance compared to their previous outlook in May. This led to increased speculation of rate cuts in New Zealand, causing the kiwi to decline by 0.7%. Federal Reserve Chair Jerome Powell also indicated that the U.S. economy is no longer overheated and the job market has cooled, hinting at a potential easing cycle in the future. Market expectations for a Fed rate cut in September have risen significantly, although a surprise increase in U.S. inflation could change this outlook. Japan, on the other hand, is an exception to the trend, as an uptick in wholesale inflation has kept alive expectations of a near-term rate hike by the central bank. The Bank of Japan is expected to lower its economic growth forecast but maintain its inflation target. In China, consumer prices grew for the fifth consecutive month but fell short of expectations, while producer prices continued to decline due to weak domestic demand despite government support measures.

Overnight Newswire Updates of Note

RBNZ Maintains OCR At 5.50%, Suprises With Dovish Statement

China’s Inflation Numbers Miss Expectations, Rising 0.2% In June

China PPI Y/Y Jun:- 0.8% (est -0.8%; prev -1.4%)

BoJ To Trim Growth Forecast, Inflation Projected To Move Nearer Target

Japan PPI Y/Y Jun: 2.9% (est 2.9%; prev 2.4%)

Biden Forcefully Defends NATO As He Hosts Summit Leaders

ECB McCaul: Alarms Rising Risks From Shadow Banking

Dow, Texas Gulf Coast Petrochemical Producers Restart After Hurricane

VW Group Lowers Forecast On Possible Closure Of Brussels Site

Samsung Labour Union Plans Indefinite Strike

Microsoft Give Up Non-Voting Board Observer Seat At OpenAI

Yemen's Houthis Targeted Maersk Sentosa Ship In Arabian Sea

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0775-70 (2.7BLN), 1.0795-1.0800 (1.1BLN), 1.0835 (236M),

1.0875-80 (1.5BLN), 1.0900 (1.3BLN)

GBP/USD: 1.2750 (201M). EUR/GBP: 0.8455 (422M)

AUD/USD: 0.6595-0.6600 (1.4BLN), 0.6710 (359M), 0.6750 (426M)

0.6770 (1BLN), 0.6795-0.6810 (1.1BLN)

NZD/USD: 0.6175 (435M). AUD/NZD: 1.1000 (344M)

USD/CAD: 1.3660-65 (1BLN)

USD/JPY: 160.00 (2.9BLN), 161.00 (834M), 161.15-20 (950M), 161.50 (1.2BLN)

CFTC Data As Of 5/7/24

JPY: -184,223 contracts

EUR: -9,519 contracts

GBP: 62,041 contracts

CHF: -43,443 contracts

Bitcoin: -912 contracts

Equity fund managers cut S&P 500 CME net long position by 24,005 contracts to 953,130

Equity fund speculators trim S&P 500 CME net short position by 5,025 contracts to 293,675

Technical & Trade Views

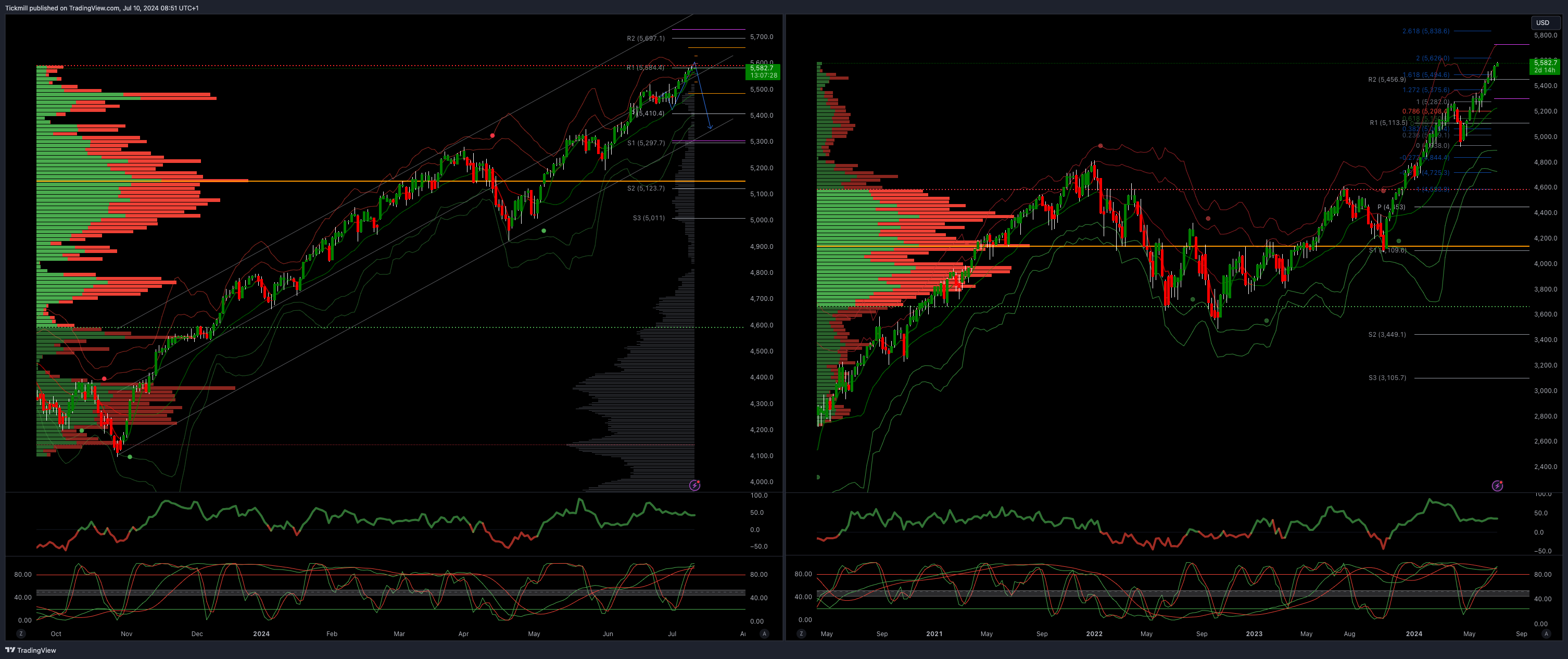

SP500 Bullish Above Bearish Below 5480

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5370

Primary objective is 5580 - TARGET HIT NEW PATTERN EMERGING

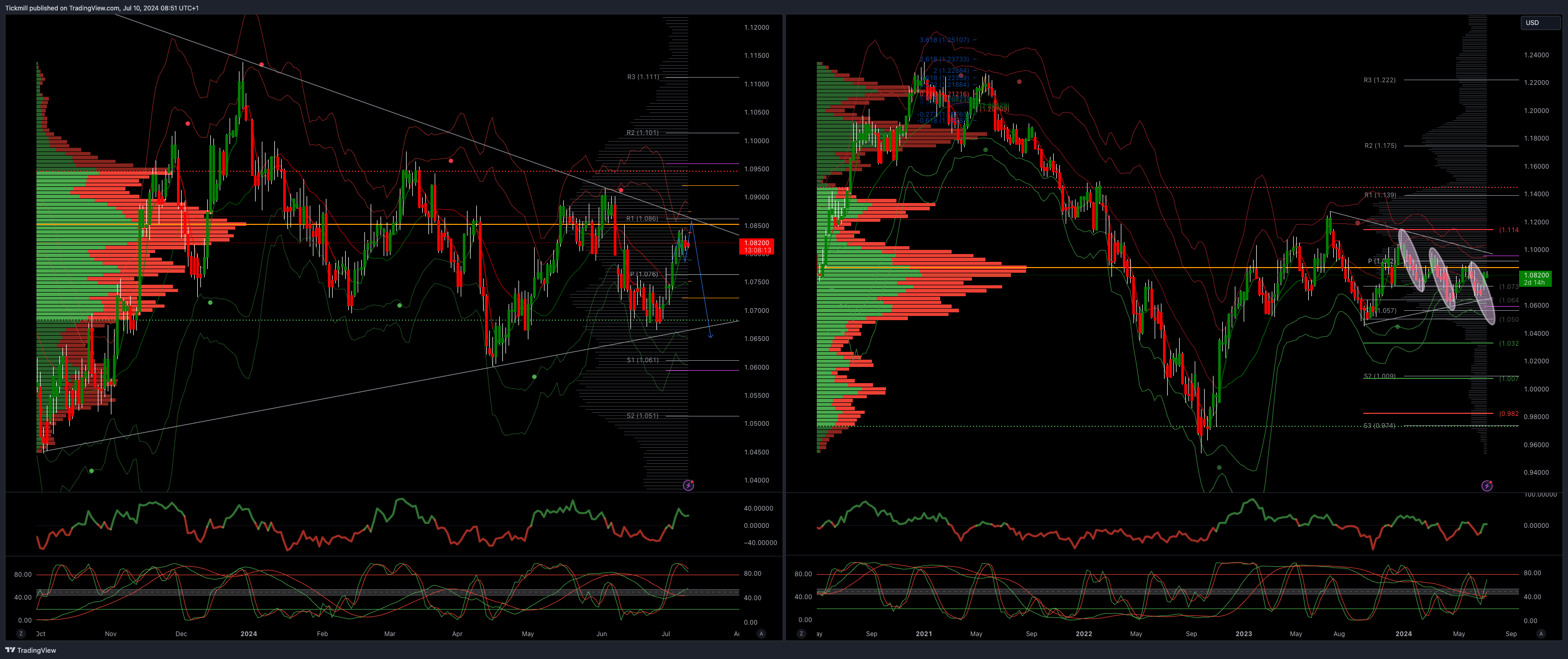

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

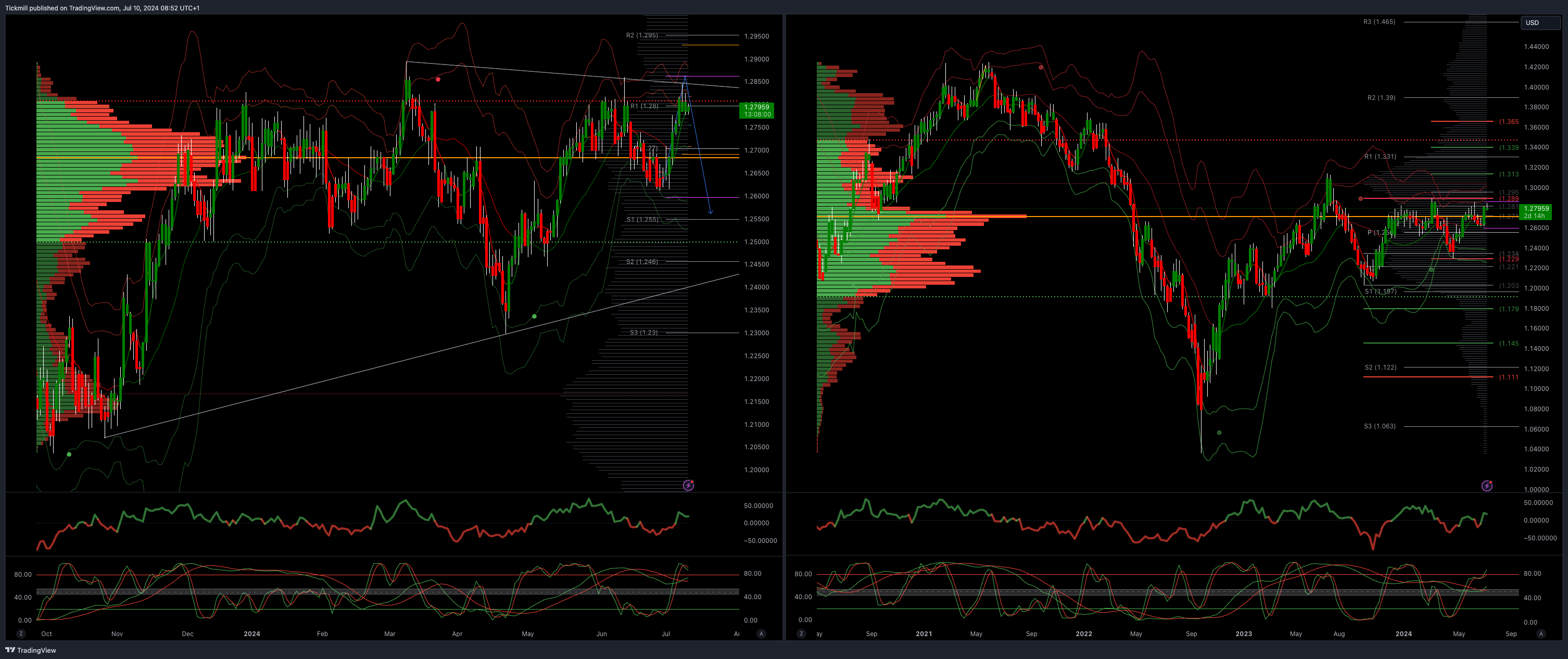

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bearish

Above 1.29 opens 1.3130

Primary resistance is 1.2890

Primary objective 1.2570

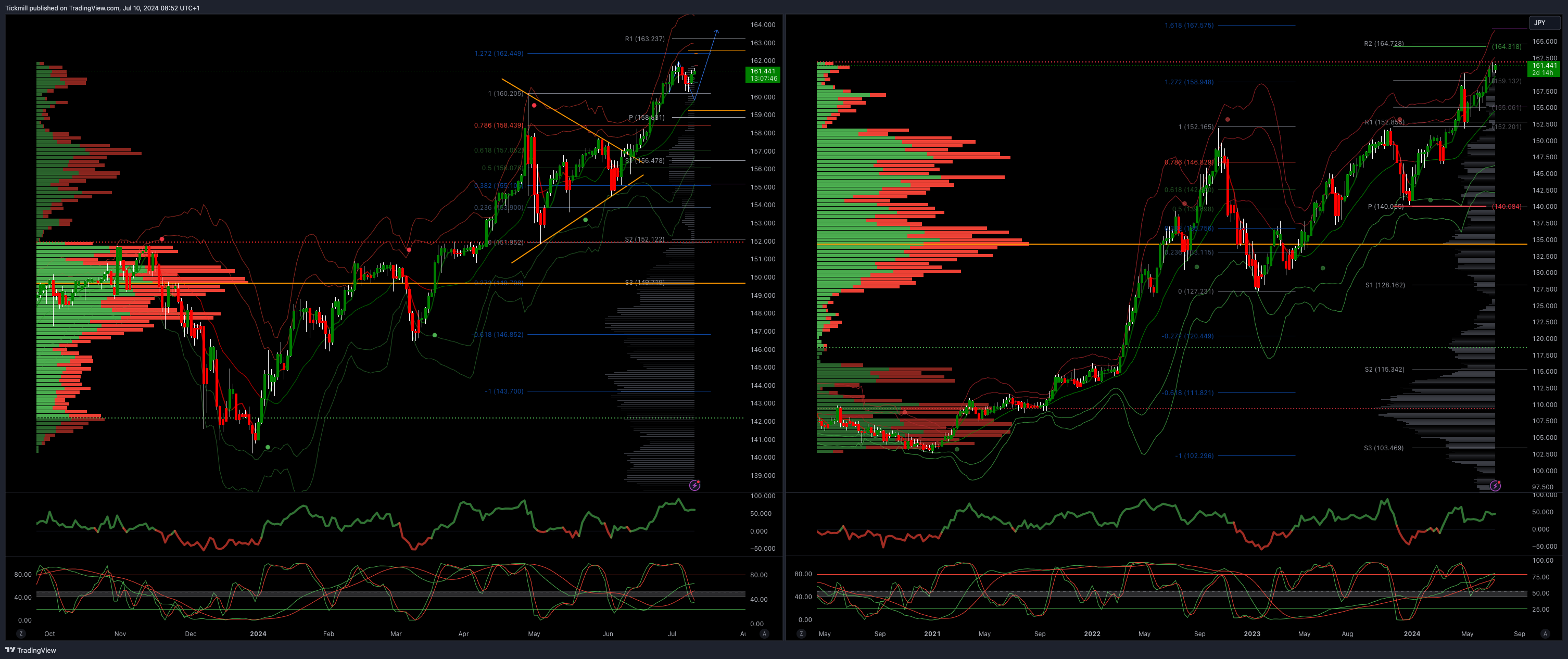

USDJPY Bullish Above Bearish Below 160

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 164

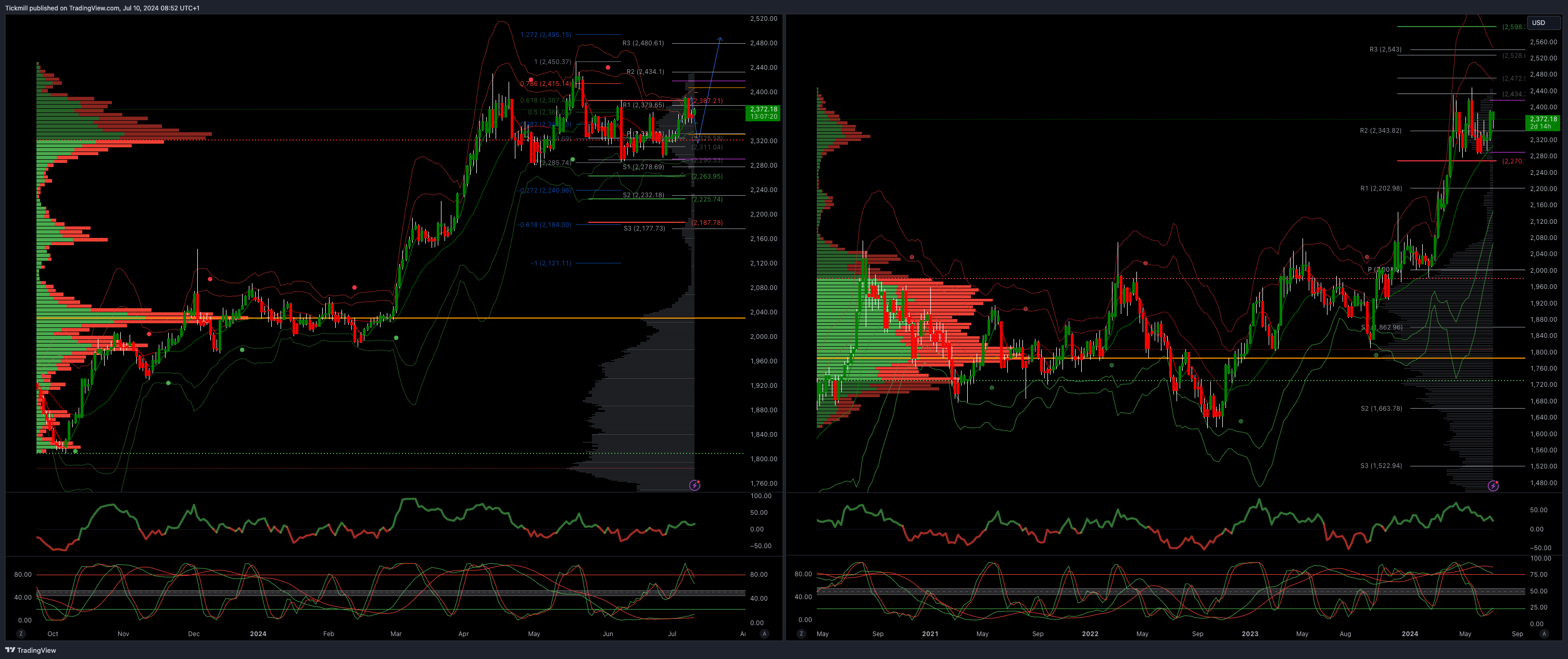

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Above 2415 opens 2495

Primary resistance 2387

Primary objective is 2262

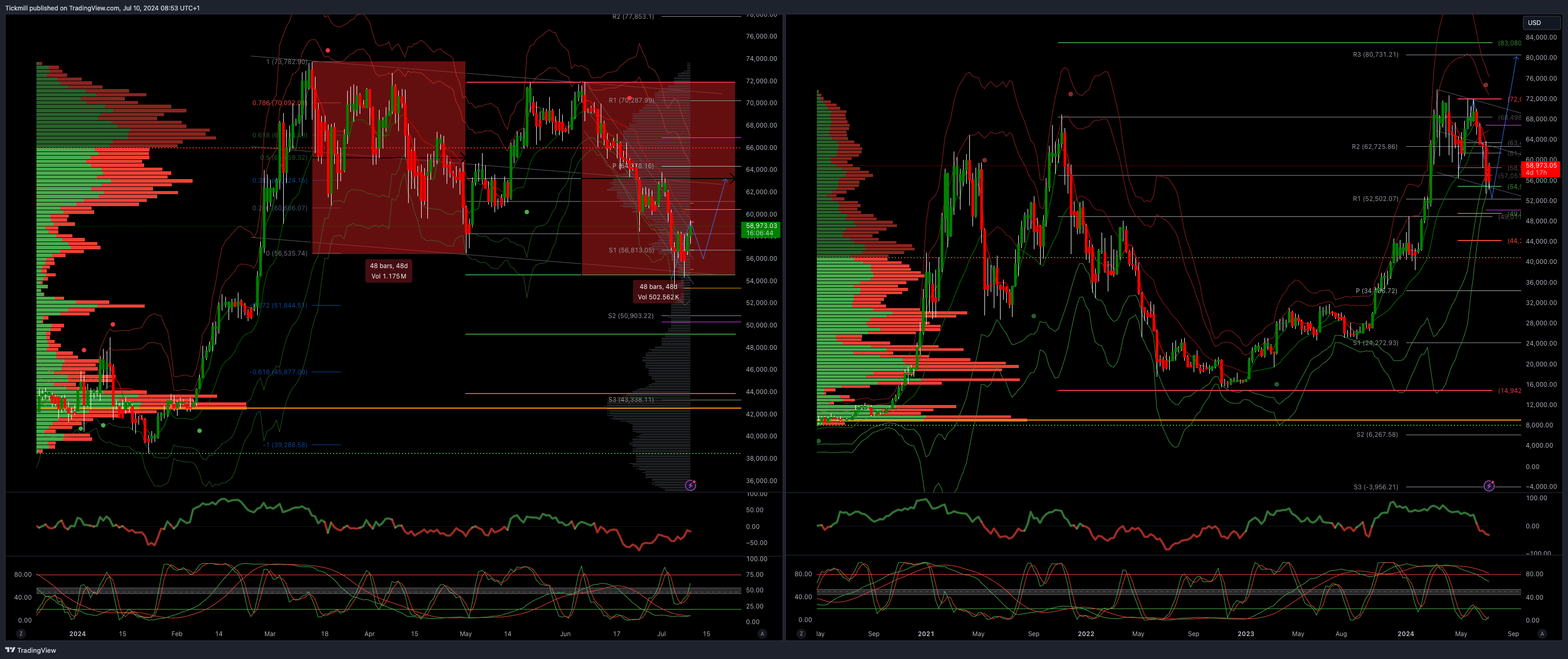

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 54500 - TARGET ACHIEVED NEW PATTERN EMERGING

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!