机构洞察:高盛全球外汇交易员更新

.jpeg)

机构洞察:高盛全球外汇交易员更新

以下是高盛对美元、日元和英镑的看法

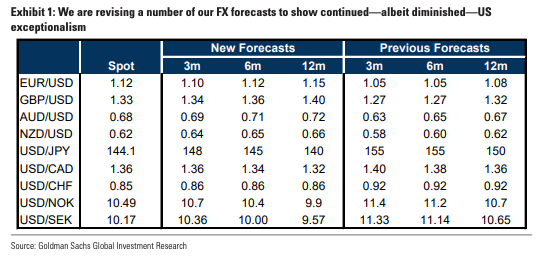

美元:美联储带来更好的平衡;调整我们的预测。通过降息 50 个基点,FOMC 最有可能选择导致经济和金融波动性降低的选项。更大的紧迫感应该有助于缓解过去几个月外汇市场出现的衰退风险。这在美元与美元之间的分歧中很明显,美元自 6 月底以来仅下跌了 2% 左右,在过去一年中持平,而美元指数则下跌了近 5%,因为美元指数在日元和欧元等避险资产中占有较大的比重。这种分歧还表明,我们可能已经达到仅通过定价美联储的政策反应函数就可以实现美元贬值的极限。如果这些衰退风险现在消退,而劳动力市场没有出现明显和意外的恶化,美元进一步下跌的构成可能会略有不同,驱动因素将是更具周期性的货币,而不是欧元和日元。退一步来说,我们一直认为,过去几个月美元贬值是美联储即将降息的自然结果,但如果美联储未能兑现承诺而美国经济超额完成承诺,美元最终应该会贬值。然而,鉴于劳动力市场势头放缓,以及美联储表现出相对于其他货币更积极应对这一风险的意愿,美元全面重置的理由较弱。但是,展望未来,我们仍然预计:(i) 美国经济将跑赢大盘,(ii) 中国和欧元区将跑输大盘,以及 (iii) 美国实际回报率将保持相对于其他货币和上一个周期的吸引力。鉴于这些考虑,我们正在修改一些外汇预测,以显示美国例外论将继续存在(尽管有所减弱)(图表 1)。我们认为这种平衡应该会导致美元随着时间的推移而走弱,但我们仍预计这将是一个渐进且不平衡的过程。我们仍然相信美元的高估值不会迅速或轻易地被侵蚀,但门槛已经降低了一点。

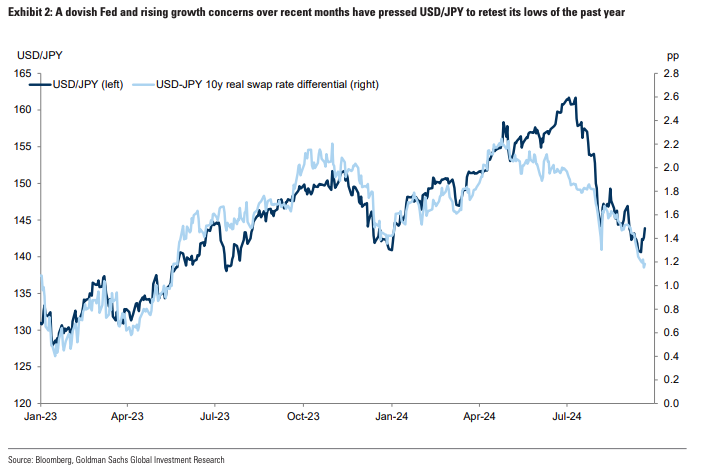

JPY: Slow down, you move too fast. The initiation of the Fed’s cutting cycle was always going to be an important milestone, and coupled with the BoJ’s journey in the opposite direction (and Yen-supportive interventions earlier in the year), this development points in the direction of Yen strength. And markets have increasingly taken that view as a dovish Fed and rising growth concerns over recent months have pressed USD/JPY to retest its lows of the past year (Exhibit 2). But while we think gradual Yen strength is the right directional view, we think it will be a much slower process than consensus expectations or forward-market pricing—both because we think continued expansion in the US is more likely than imminent recession and because a very rapid Yen appreciation would prove self-defeating for the BoJ’s objective of restoring sustained positive inflation rates. Accordingly, we now see USD/JPY at 148 in 3 months, 145 in 6 months, and 140 in 12 months (vs. 155, 150, 150 previously). We also see more gradual appreciation over the longer-run to 135 in 2026 and 130 in 2027 (vs 125 and 120 previously). Despite slow appreciation over time, our forecasts imply nearer-term upside. More broadly, we think we may be approaching the limits of Dollar weakness on a dovish Fed alone (see USD bullet). But other factors also press against Yen strength. First, even if the Fed decides to continue cutting at a faster pace than currently priced, that should further reduce recession risk, pushing up equities and supporting long-end yields, mitigating any boost to JPY. Second, we expect CNY to face renewed weakness, an important anchor for most of Asia FX, including JPY. Finally, as long as US recession odds remain low, Japanese investors have a limited incentive to hedge US assets, even with a narrowing rate differential. So despite our economists now looking for sequential Fed cuts through mid-2025 and our relative rates forecasts implying USD/JPY a bit below current spot over the coming months, we see some limited near-term upside in USD/JPY

GBP: Riding risk. The BoE kept rates on hold and sent a slightly hawkish message this week, emphasizing a “gradual” approach to removing policy restraint. EUR/GBP took another leg lower on the news and is making new cycle lows as we close out the week. At the current juncture, support for Sterling is coming both from its risk beta as well as solid growth momentum and a patient Bank of England. The Fed began easing this week into relatively robust US growth. And as a result, markets have priced out US recession risk, benefiting risky assets and pro-cyclical currencies like Sterling. Assuming US growth continues to outperform and the Fed still eases quickly, this pattern should support further upside in GBP, particularly versus safe havens like CHF. Long GBP positioning looks stretched on some metrics, but we do not see that as enough of a headwind when the broader pro-cyclical backdrop is driving gains and is likely to remain supportive

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。