Daily Market Outlook, May 23, 2024

Daily Market Outlook, May 23, 2024

Munnelly’s Macro Minute…

“Nvidia Earnings Beat Sees US Markets Soar To New All Time Highs ”

Following the release of positive quarterly results by Nvidia, US market futures experienced a surge and Asian stocks saw an increase, reigniting expectations for a global artificial intelligence boom. The prominent chipmaker surpassed expert predictions by announcing an estimated second-quarter revenue of around $28 billion. Additionally, the company raised its quarterly dividend by 150% to 10 cents per share and declared a 10-for-1 stock split. Nvidia's shares rose by up to 7% during trading hours in response to the company's performance. The gains in semiconductor manufacturers in South Korea, Taiwan, and Japan contributed to the overall rise in Asian equities. A Bloomberg index tracking chipmakers also saw a 1.9% increase, following the lead of Nvidia.

Today's flash PMI surveys for May will be closely scrutinized, especially for the UK and the Eurozone. Expect stabilization in services activity and improvements in manufacturing. Overall, the survey is expected to indicate that the economic recovery is continuing into the middle of Q2. However, there will be notable differences between sectors and between the UK and the Eurozone. In both regions, services activity is predicted to significantly outperform manufacturing. UK activity and price signals have also surpassed those of the Eurozone, aligning with the Bank of England’s cautious approach to easing policy. In contrast, the European Central Bank has indicated a high likelihood of reducing rates next month. Expect the UK and Eurozone manufacturing PMIs to increase to 50.1 and 46.2, respectively. For services PMIs, look for slight declines to 53.6 in the UK and 53.0 in the Eurozone, but they are still expected to drive the recovery. In the Eurozone, the ECB will release Q1 negotiated wage data. The most recent Q4 data showed a decrease to 4.5% from a high of 4.7% in Q3. Policymakers will be hoping for further progress towards more sustainable wage growth to promote moderation in services price inflation.

Stateside, the release of Markit flash PMIs is also scheduled, although they typically receive less market and policymaker attention than their UK and Eurozone counterparts. Additionally, US weekly jobless claims data and monthly new home sales figures are due.

Central bank speakers today include the Bank of England’s Chief Economist, Pill, who has previously expressed caution about easing policy. Yesterday’s UK CPI inflation data likely did little to ease his concerns about persistent services price inflation.

Overnight Newswire Updates of Note

Fed Officials Saw Longer Wait For Cuts After Inflation Setbacks

Goldman’s Solomon Says He Sees ‘Zero’ Rate Cuts This Year

Rick Scott Enters Race To Succeed McConnell As GOP Senate Leader

ECB’s Schnabel Sees Modest Revival In Euro-Zone Economy

BoE Will Cut Interest Rates In August, Says Goldman Sachs

Prime Minister Rishi Sunak Calls UK National Election For July 4

Japan's Factory Activity Expands For First Time In A Year, PMI Shows

Australian PMI Points To Resilience In Economy, Stubborn Inflation

Orr Says RBNZ Would Only Hike To Curb Inflation Expectations

South Korea Sets Aside Record $19 Billion To Fuel Chipmaking

Russia Pledges To Make Up For Crude Overproduction In April

Nvidia Gives Strong Forecast, Reflecting Sustained AI Momentum

Tesla Pushes Suppliers To Produce Parts Outside Of China, Taiwan

BHP Has A Week To Convince Anglo Its South African Plan Can Work

China Holds Biggest Military Drills In A Year Around Taiwan

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0830 (250M), 1.0850 (260M), 1.0870 (246M), 1.0885 (293M)

1.0900 (1.7BLN)

EUR/GBP: 0.8510 (330M), 0.8525-30 (411M)

GBP/USD: 1.2670 (404M), 1.2690 (226M), 1.2735 (368M), 1.2750-55 (527M)

NZD/USD: 0.6125 (438M), 0.6175 (479M). AUD/NZD: 1.0900 (420M)

USD/CAD: 1.3665-75 (1.3BLN), 1.3685 (300M), 1.3755 (500M)

CFTC Data As Of 17/05/24

Japanese yen net short position is -126,182

British pound net short position is -20,075

Euro net long position is 17,155 contracts

Swiss franc posts net short position of -41,107

Bitcoin net short position is -177 contracts

Equity fund managers raise S&P 500 CME net long position by 60,168 contracts to 920,863

Equity fund speculators increase S&P 500 CME net short position by 40,882 contracts to 279,337

Gold NC Net Positions: $204.5K vs $199.6K

Technical & Trade Views

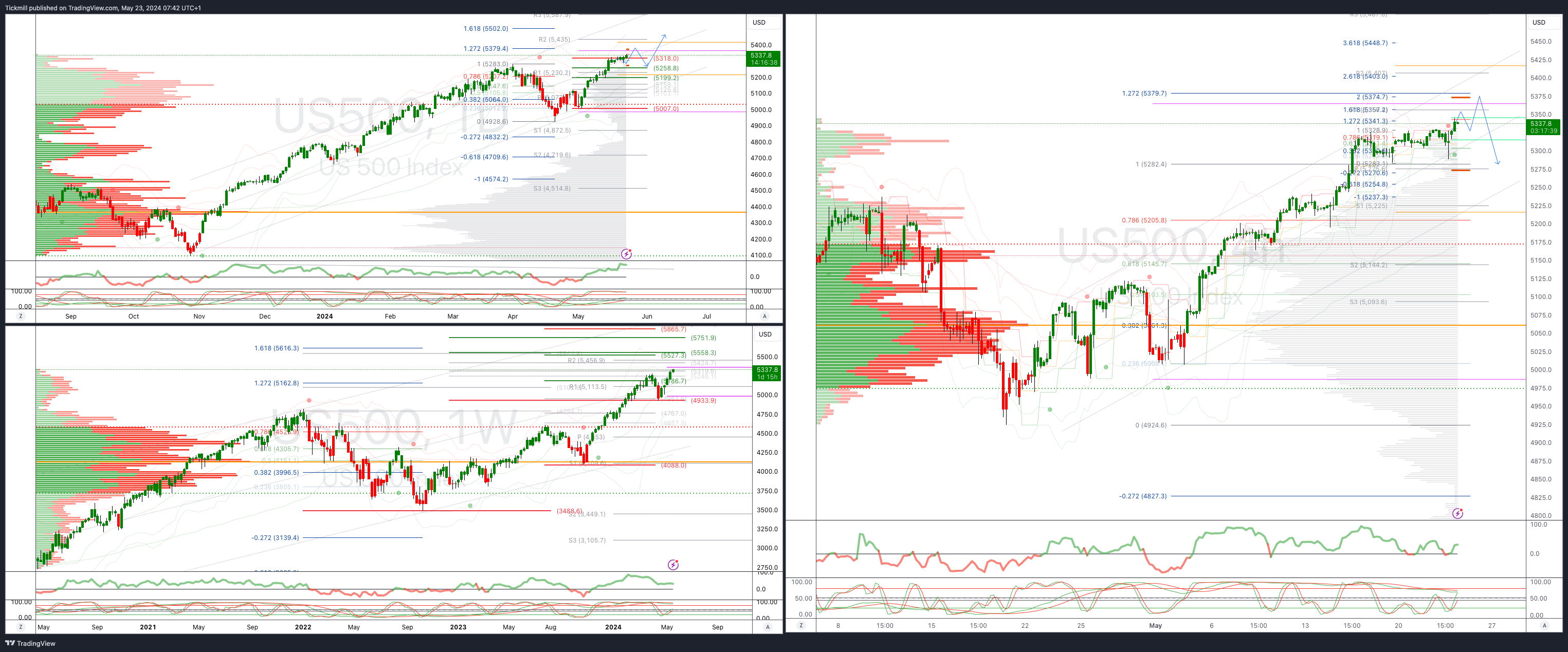

SP500 Bullish Above Bearish Below 5330

Daily VWAP bullish

Weekly VWAP bullish

Below 5314 opens 5285

Primary support 5250

Primary objective is 5379

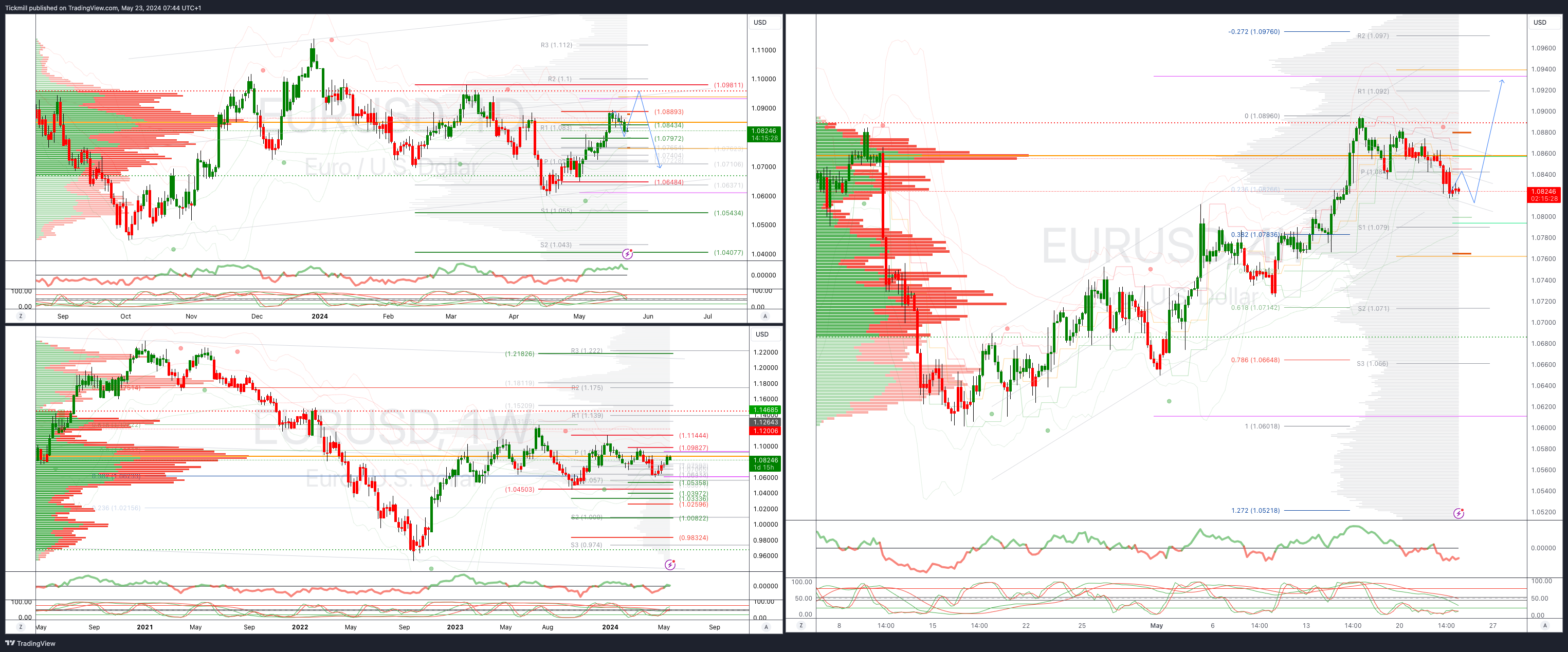

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.10 opens 1.11

Primary resistance 1.0981

Primary objective is 1.0550

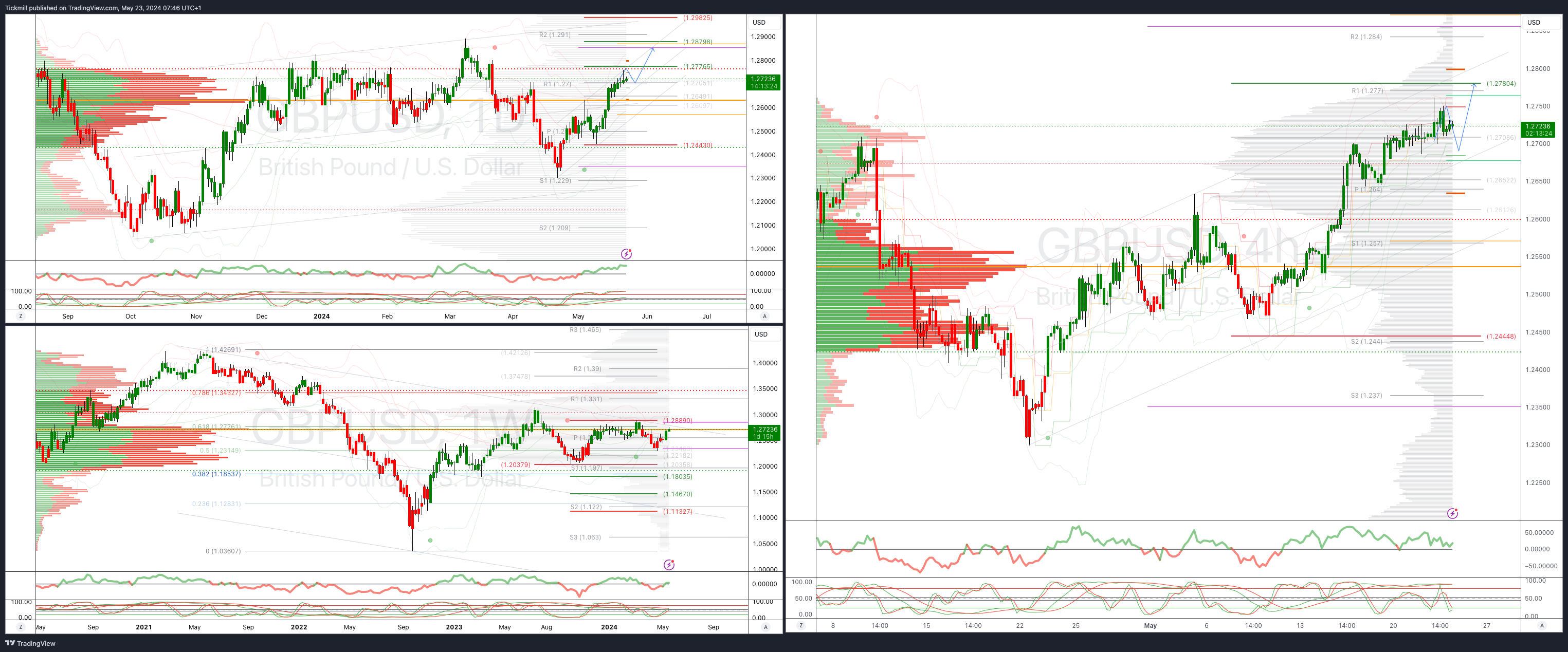

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2780

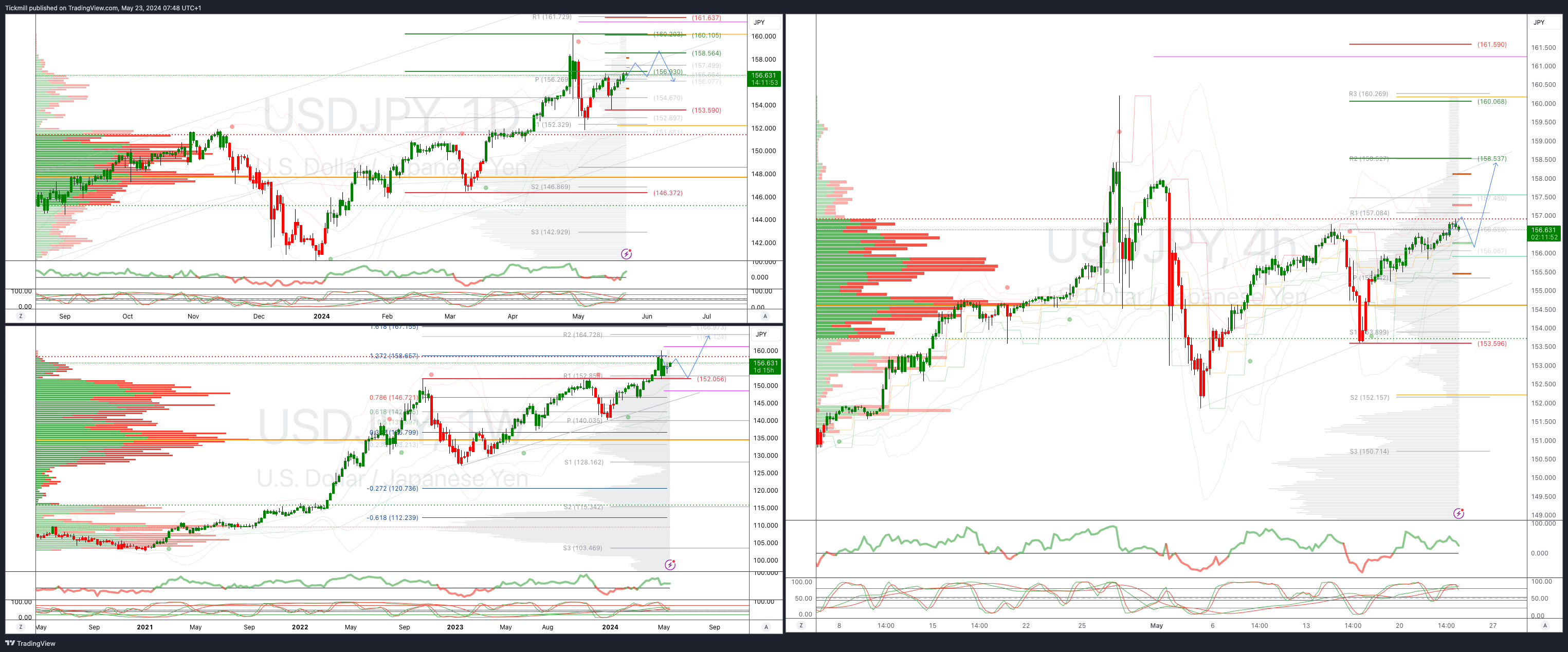

USDJPY Bullish Above Bearish Below 153.59

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

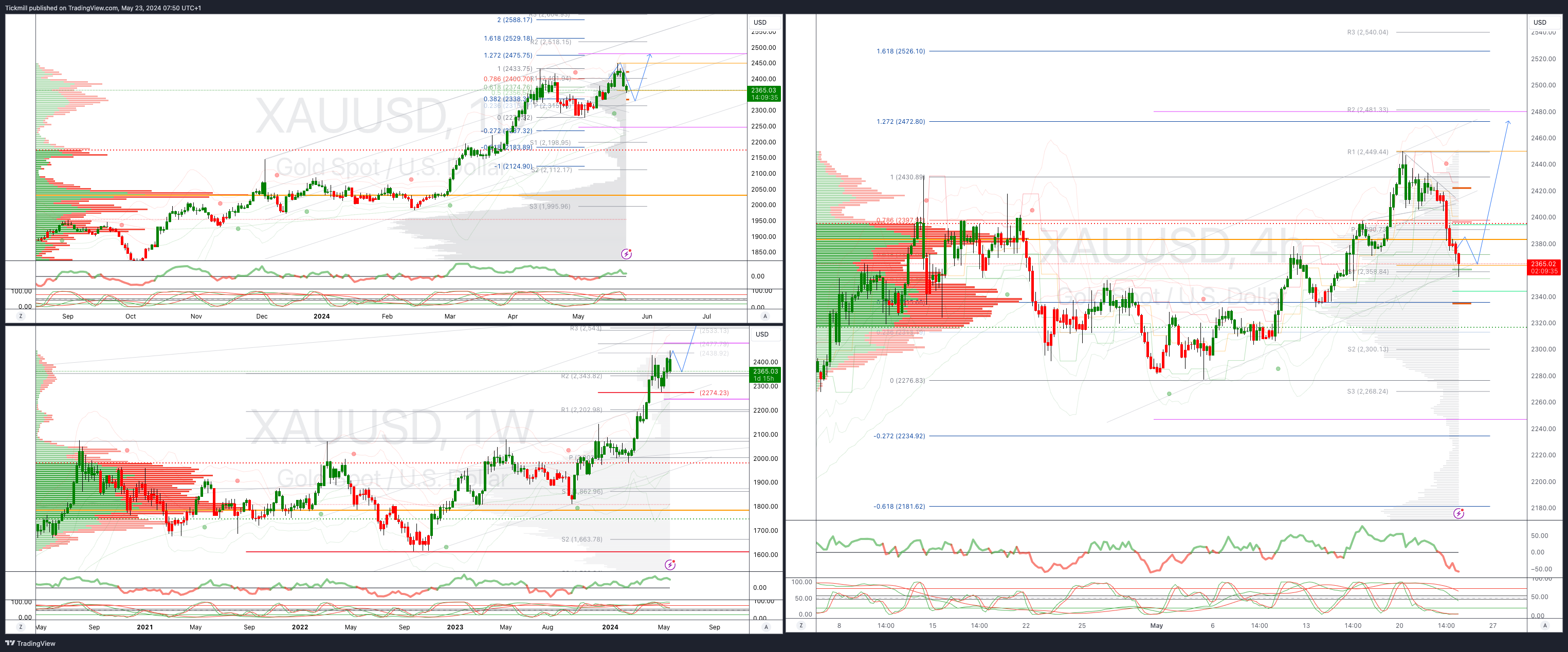

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bullish

Weekly VWAP bullish

Below 2330 opens 2280

Primary support 2330

Primary objective is 2560

BTCUSD Bullish Above Bearish below 67000

Daily VWAP bullish

Weekly VWAP bullish

Below 65000 opens 63000

Primary support is 65000

Primary objective is 78500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!