Yen Soars on Hawkish BOJ Signal

USDJPY Dropping Lower

USDJPY is seeing heavy selling interest through early European trading on Monday. The pair is down around .6% on the day so far, now down almost 2% from the November highs. The move lower comes amidst a dovish repricing of traders’ Fed rate expectations and growing speculation that the BOJ will hike rates this month. This divergence in central bank outlooks has capped the USDJPY rally for now and looks set to drive the pair lower near-term. Looking ahead this week, we have plenty of potential catalysts to watch including US data, commentary from Fed’s Powell as well as the possibility of Trump announcing the next Fed chair.

US Data & Fed Commentary

On the data front, with rate cut expectations so well entrenched, USD bears will be looking for in-line readings and below to maintain the dovish outlook. If seen, USD should remain pressured through the week with rate-cut expectations likely to move above the 90% level. Comments from Fed chair Powell on the end of the QT program should also see rate-cut pricing lifting this week. Finally, if Trump announces Kevin Hassett (dove) as the next Fed chair, this should also drive USD lower.

Hawkish BOJ Signal

On the Yen side of things, comments from BOJ governor Ueda this week that the BOJ is weighing up the pros and cons of a hike at the next meeting have sparked hawkish interest. On the back of much jawboning form Japanese officials in recent months amidst the decline in JPY, BOJ rate hike expectations have grown. Ueda’s comments have now been taken as a clear signal that a rate hike is likely. If the Fed cuts and the BOJ hikes, this should see USDJPY coming back down below the 150 level through year end.

Technical Views

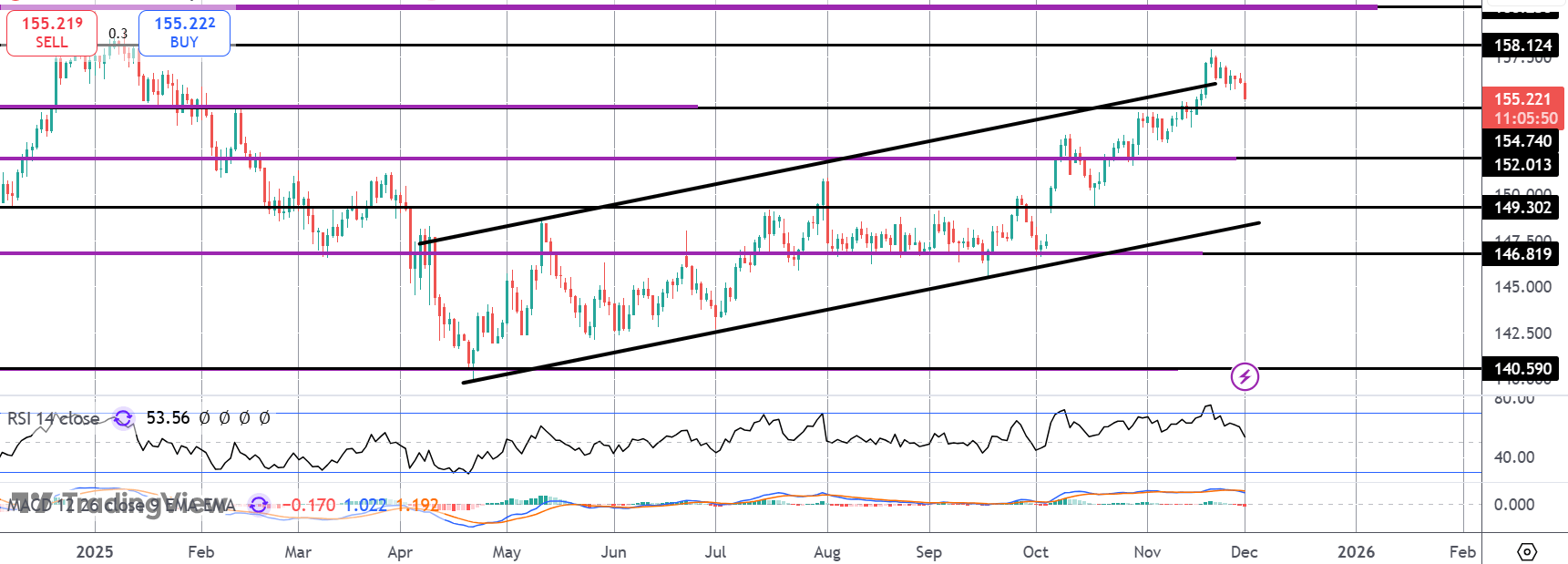

USDJPY

The failure at the 158 level has seen the pair reversing back inside the bull channel with price now fast approaching a test of support at 154.74. With momentum studies bearish here, risks of a deeper push are seen with 152 the next support to note if we do cut back deeper into the channel.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.