Wild Bitcoin Swings Continue

Bitcoin Bouncing off Lows

Bitcoin volatility shows no signs of reducing as we kick off the new week. The futures market gapped down by 6% at the open, now down around 13% from last week’s highs, which themselves were the result of a more than 10% gap higher at the weekly open. With wild swings in both direction its clear that plenty of volume is being exchanged though the market is, as yet, lacking direction. News of Trump’s crypt reserve bill, and following crypto summit at The White House, have failed to spark the super-bull rally that many were calling for. However, bulls are still holding on and once again today we are seeing demand into the lows.

Issue With Trump’s Crypto Plan

The big disappointment with Trump’s crypto reserve is that the US plans to acquire Bitcoin and other cryptocurrencies through budget neutral strategies, meaning there will be no outright purchases. This was a major blow to the bullish argument. However, longer-term players argue that the mere creation of a US crypto reserve is an important milestone for Bitcoin and the chances of a shift to outright purchases in future are seen as healthy. Furthermore, the creation of the fund is seen as likely inviting many countries around the world to follow-suit, which should prove positive for BTC demand longer-run. For now, BTC remains subject to near-term volatility however, until we see fresh developments that add more clarity.

Technical Views

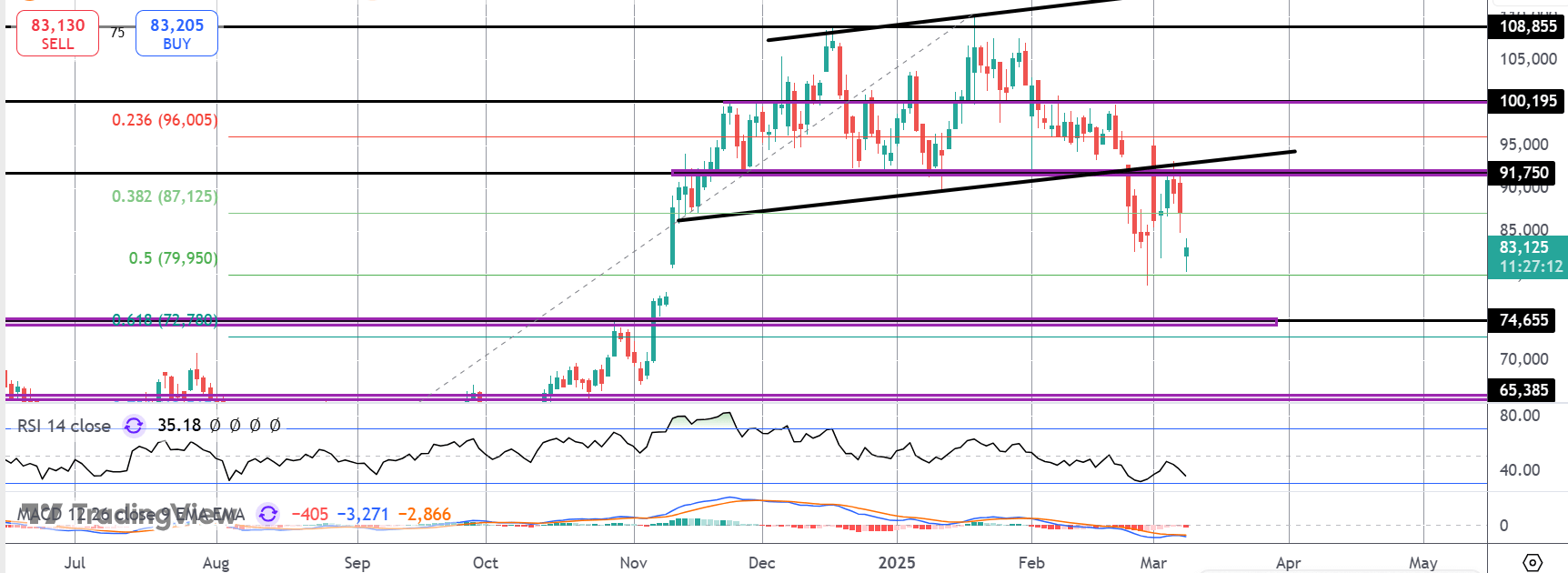

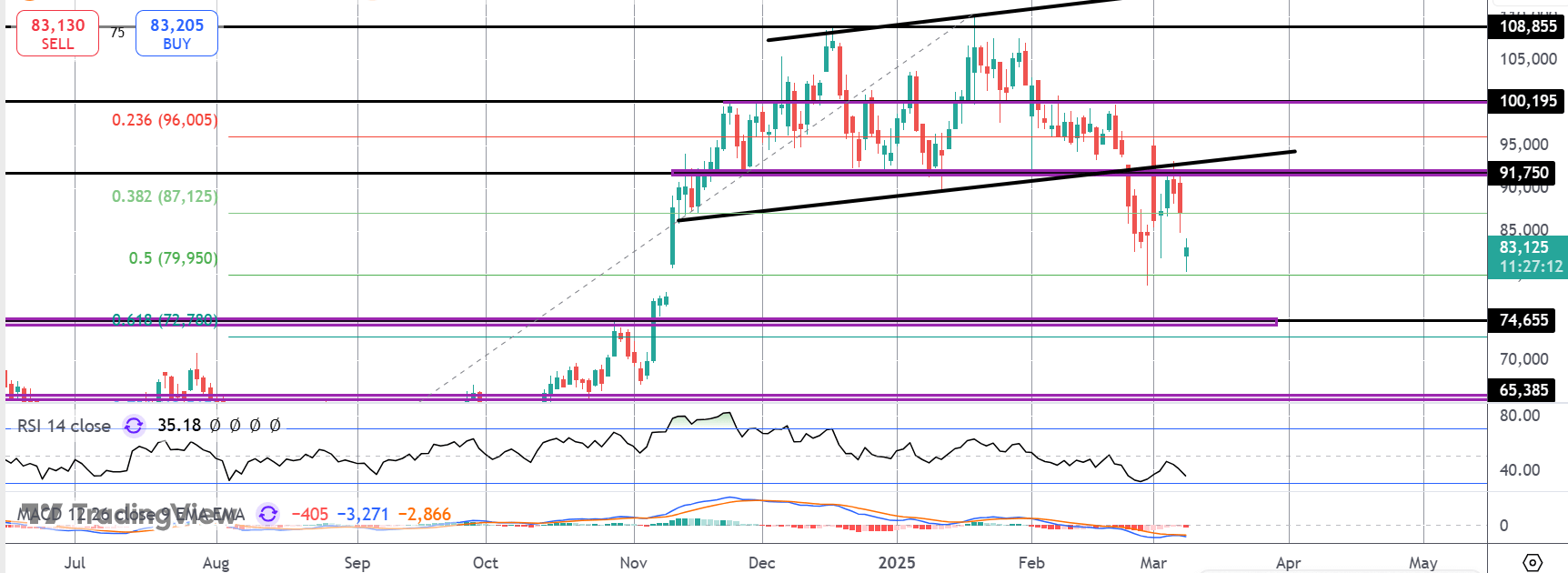

BTC

The gap lower this week has found strong demand for now into a fresh test of the 50% fib retracement level. While this level holds, a recovery higher is still the main focus with the $91,750 level (and retest of broken bull channel) the key hurdle for bulls. Above there, $100k is the next objective. Downside, $74,655 is the key support to watch below current lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.