USDJPY Spikes Higher Following Powell Comments

Yen Falling Hard Midweek

Despite coming under pressure elsewhere in FX markets today, the Dollar is rallying firmly against the Japanese Yen. The higher-for-longer view on US rates has seen JPY coming fresh selling pressure through the middle of the week, eroding the divergence in central bank outlooks which had previously favoured the Yen. Yesterday, Powell told congress that the Fed would wait to see further progress on inflation before cutting rates again, warning that it was in no rush to do so. Against that backdrop, US yields have risen sharply in the last 24 hours with traders now looking to today’s US inflation readings as pivot for near-term market direction.

US CPI On Watch

If US inflation surprises to the upside today, Fed easing expectations will fall again, leading USD firmly higher against the Yen. The ball will then be in the BOJ’s court with JPY likely to continue lower near-term unless we hear some firmly hawkish guidance from the BOJ. With the market now only fully pricing in just one cut from the Fed this year, a continued uptick in inflation could drive a meaningful rally in USD, putting the Fed’s whole easing agenda into question. Of course, the data could also go the other way today and if we see a downside surprise this should lead to a sharp reversal lower in USDJPY as traders rebuild near-term, Fed easing expectations on the premise that the top in the current inflation push is in.

Technical Views

USDJPY

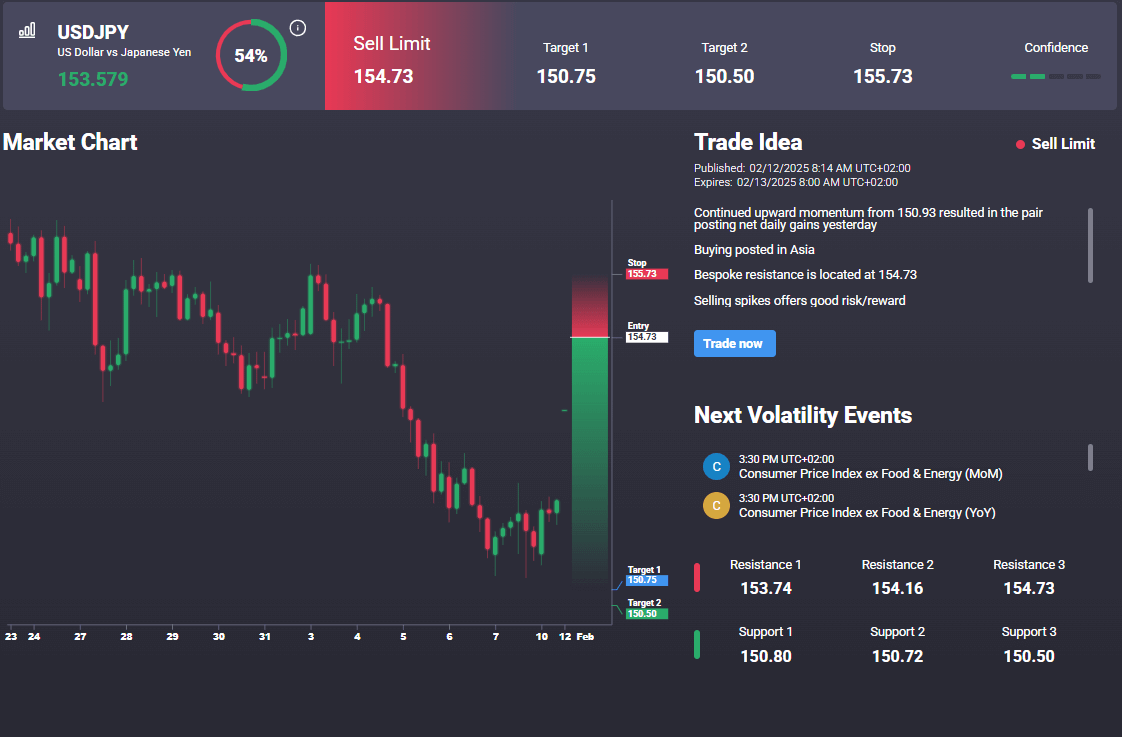

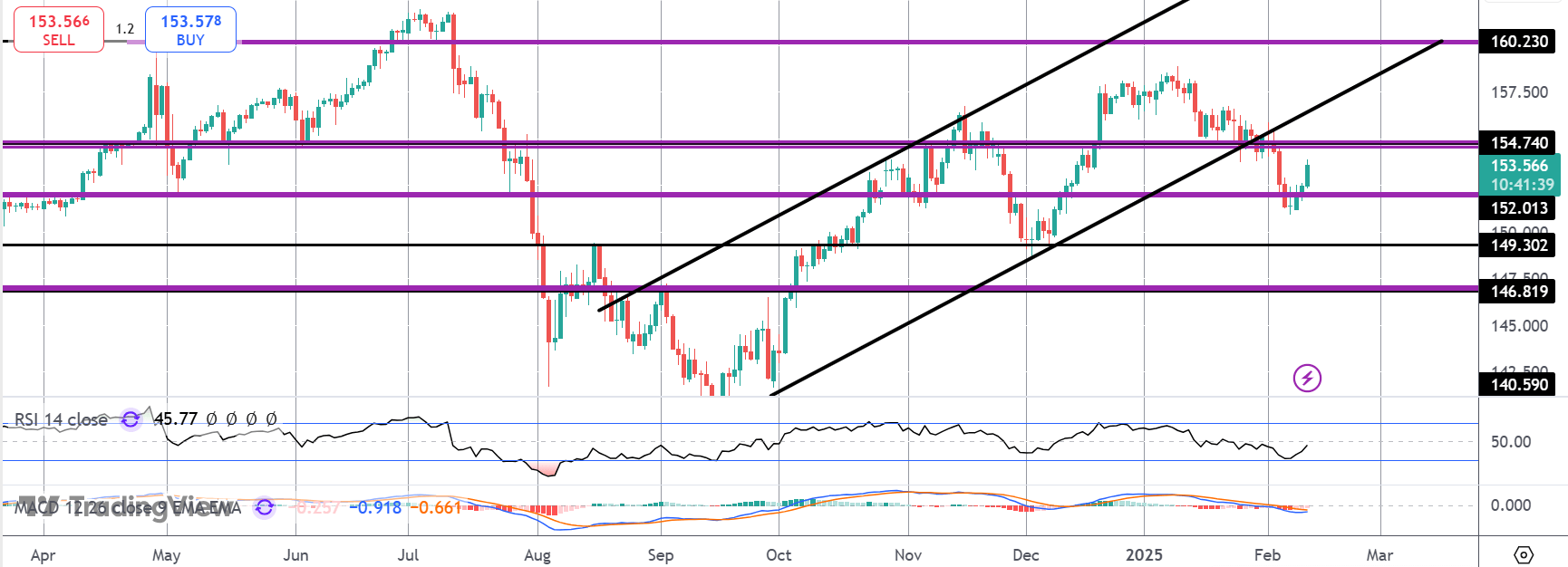

The downside break of the bull channel has stalled for now into the 152 support level with price bouncing firmly. 154.74 will now be the key level to watch with bulls needing to see a clean break higher to put focus on a fresh test of YTD highs. Failure at the level risks a fresh turn lower instead and a continuation of the downside channel break. Notably, in the Signal Centre today we have a sell limit at 154.73 suggesting a preference to fade the rally into that resistance area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.