USD Volatility Risks into US PMIs Today

US Dollar on Watch

The US Dollar is on watch today as traders brace to receive the latest set of US PMI readings. This morning, heavy weakness in euro area PMIs saw ERU collapsing as October ECB easing expectations ballooned. That weakness is helping keep USD better bid ahead of the data. However, should today’s US data undershoot forecasts too, focus will likely shift back to Fed easing expectations. Powell warned traders last week not to expect further .5% rate cuts, saying that there is no set-in-stone path for Fed policy adjustments. However, if data continues to trend lower, expectations of further, aggressive easing, are likely to lead USD lower near-term.

US PMI Forecasts

Looking at the forecasts for today’s data, the market is expecting the August manufacturing PMI to print 48.6, up from 47.9 prior. The services PMI is expected to print 55.3 from 55.7 prior. If seen, data in the region should limit upside in USD. However, if data falls below forecasts, USD looks vulnerable to a strong push lower. Finally, if we see any upside surprise today, that should see current USD buying extending through the first part of the week as traders await Consumer Confidence data tomorrow.

November Fed Pricing

Currently, the market is pricing in only a 50% chance of a further Fed cut in November. As such, there is plenty of room for USD to turn lower if incoming data shows further softness, pushing rate-cut pricing higher.

Technical Views

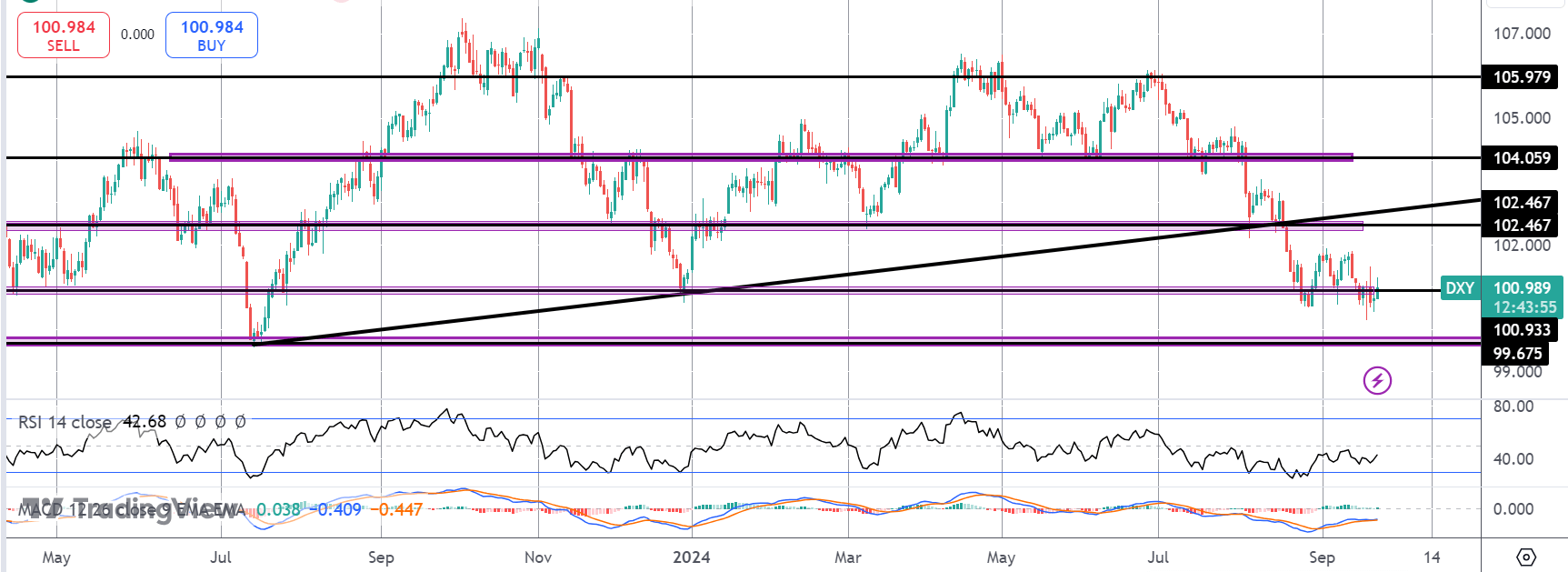

DXY

For now, the index remains tightly congested around the 100.93 level. Price has remained around current level since late August and given the prior downtrend, focus is on an eventual break lower with 99.67 the next support to note. Topside, bulls need to get back above 102.46 and the broken bull trend line to alleviate near-term bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.