USD At Lows Ahead of Powell Comments

USD Holding At Lows

As we pass through the middle of the week, geopolitical risks markets have significantly lessened, with the ceasefire between Israel and Iran holding for now. While there is still a high degree of risk that the ceasefire breaks down, for now it seems there's a clear tilt towards optimism, reflected in the rapid decline of oil prices. However, the sell off in USD as a result of this reduced risk looks to have run its course for now. As such, any further USD weakness is likely to hinge on more US-centric factors such data surprises, Fed moves, Trump headlines and trade tariffs.

Powell in Focus

Yesterday Fed chairman Powell kicked off the first of two testimonies in Congress, set to conclude later today. He reiterated a cautious stance on easing, and subtly resisted Trump’s pressure, yet appeared slightly more open to discussing potential rate cuts in the future. Markets seemed to take this as a small dovish signal, particularly after the recent calls from Fed members Waller and Bowman for a July rate cut, which resulted in a positive reaction in Treasuries. Looking ahead today, if Powell gives any further sign that the Fed is moving closer towards beginning easing again, this could pave the way for fresh selling in USD. Without any clear dovish signals, however, DXY is likely to continue tread water around current levels while traders await fresh directional cues.

Technical Views

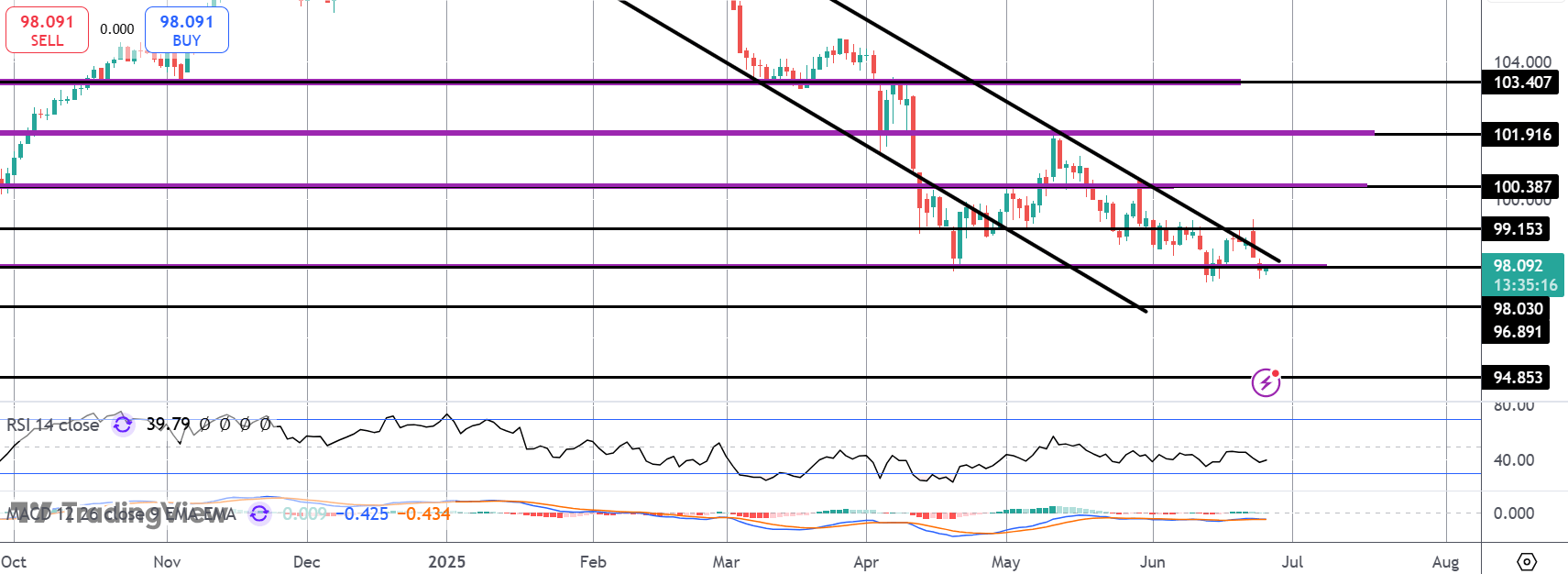

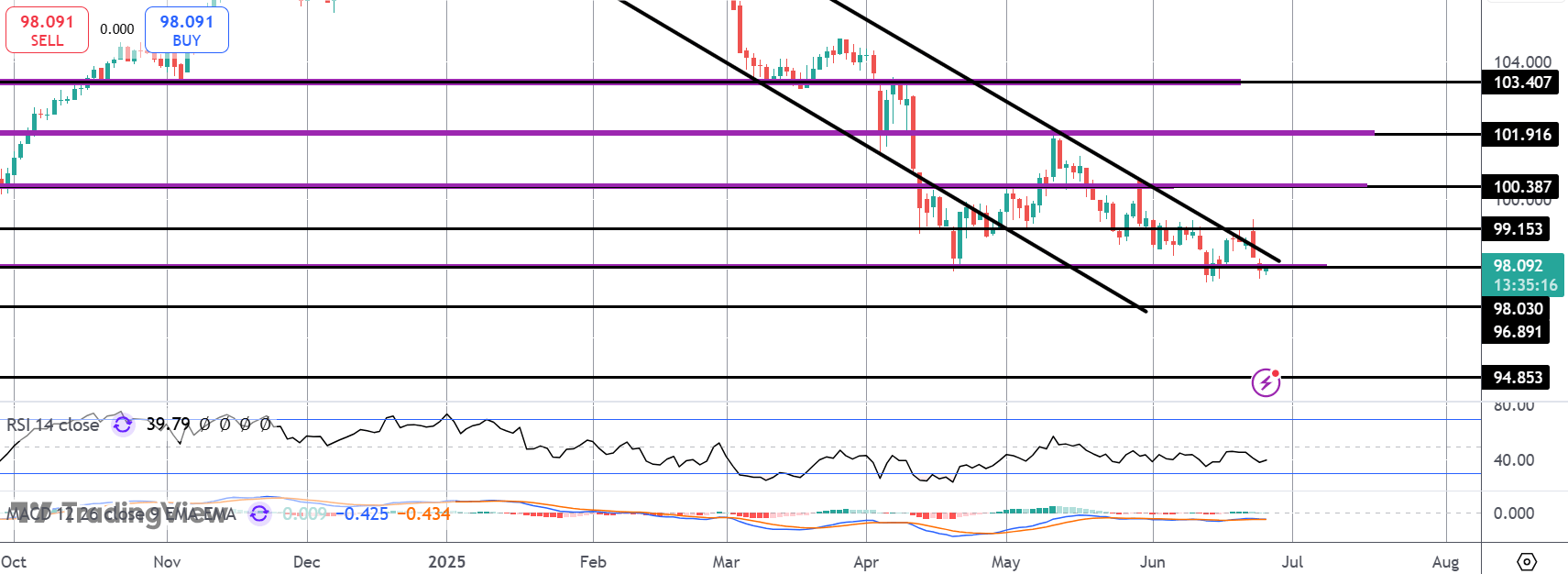

DXY

The reversal lower on Monday has seen price falling back inside the bear channel with the index now retesting the YTD lows around the 98-level support. If we break lower here, the next downside target will be 96.89 and 94.85. Bulls need to see a break back above 99.15 to alleviate near-term bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.