US/China Talks Make-Or-Break for USD

USD Rally on Watch

The US Dollar recovery remains a key theme to watch ahead of the weekend. A more market-friendly tone from Trump, including news of a trade deal between the US and UK has been welcomed by traders this week, seeing both USD and risk assets higher. For now, however, DXY is still struggling to break back above the 100.38 mark, which remains a key pivot for the market. If bulls can successfully breach this level, the next leg higher in USD can be seen across the board.

Fed Speakers Due

Looking ahead today, there is little in the way of key US data and focus will instead be on a slew of Fed speakers across the European afternoon session. Worth noting that no hawks are scheduled to speak and as such, comments today might lean more to the dovish side, offering USD bulls nothing to drive price higher.

US/China Trade Talks

However, with the US/China trade story still the bigger focus, USD has room to push higher today on any headlines offering fresh optimism ahead of the talks. The US/UK trade deal has been seen as a good omen and a sign that Trump is willing to negotiate. However, China might not be as receptive to keeping 10% baseline tariffs in place as the UK was. If talks stumble this weekend, USD could easily come under fresh pressure on Monday as risk appetite weakens. If talks go well, however, USD looks poised for a fresh rally next week.

Technical Views

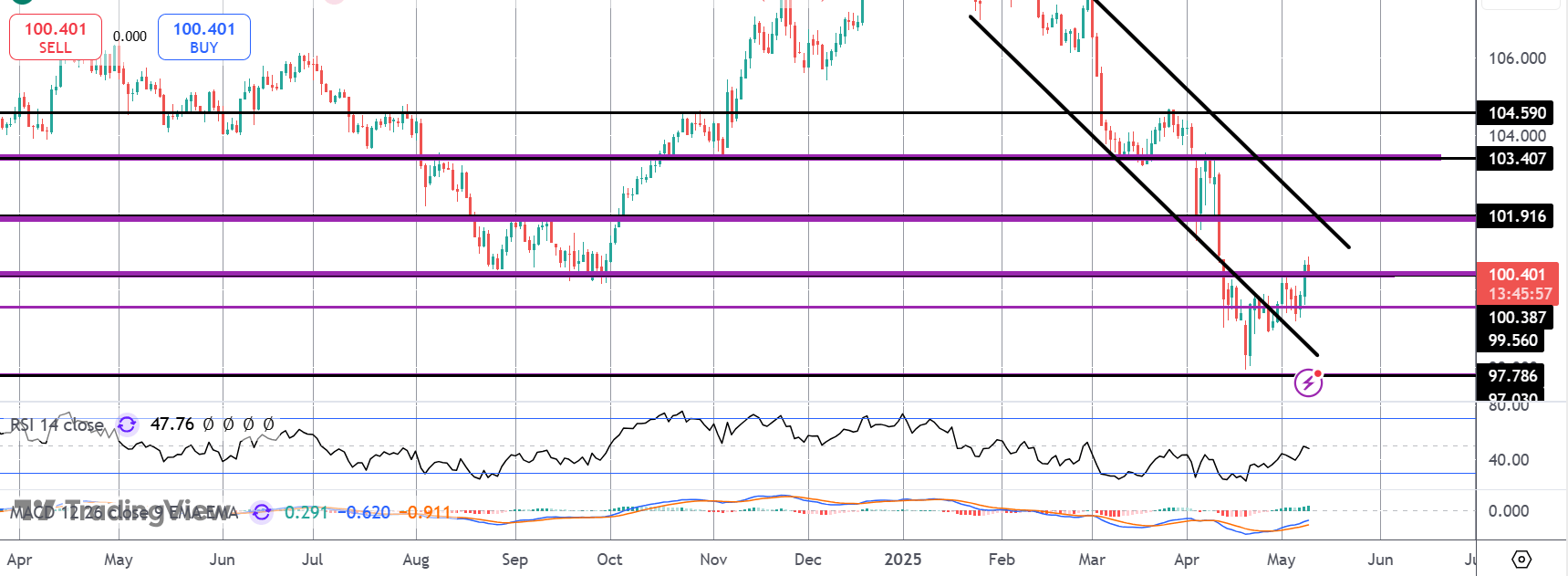

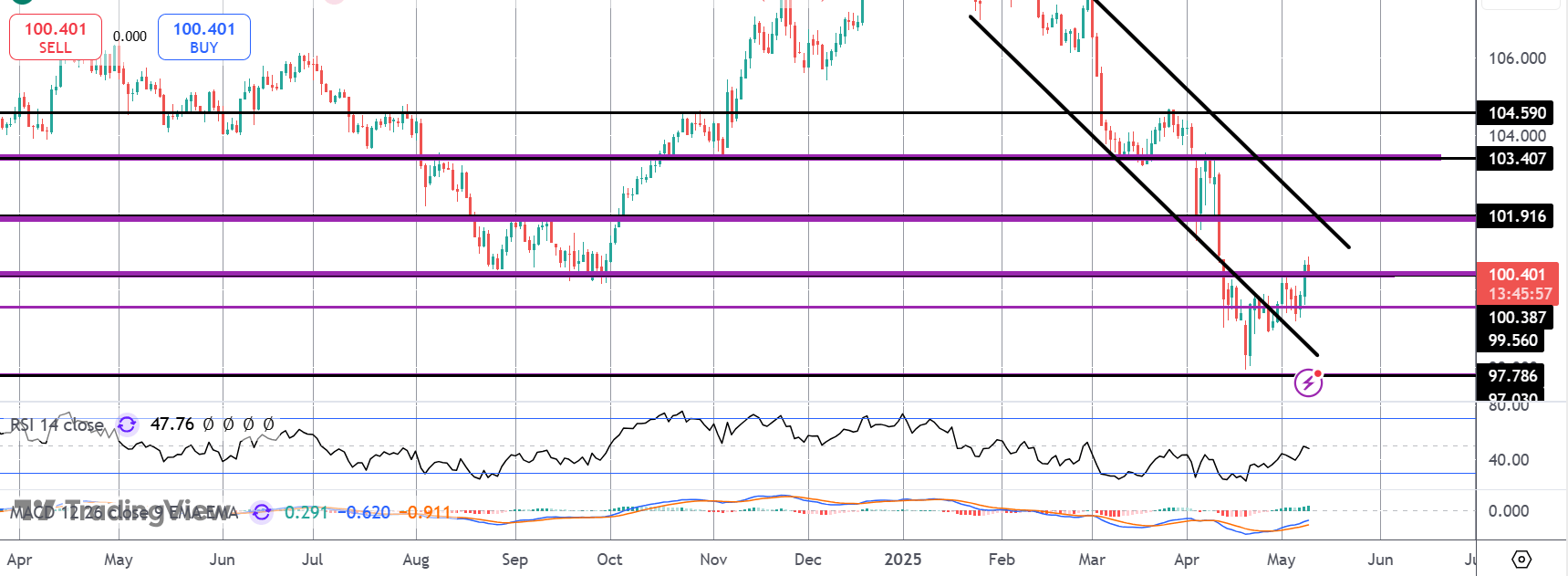

DXY

The rally in DXY has stalled for now into the 100.38 level. This remains the key near-term pivot for the market with bulls needing a break above this level to turn focus to the bear channel highs and 101.91 level next. For now, price remains within the bear channel and until price is back above the 101.91 level, risks of a fresh turn lower towards 97.78 remain intact.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.