The FTSE Finish Line: July 30 - 2025

TSE Finish Line: July 30 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's major stock indexes showed mixed performances on Wednesday, as investors analysed a wave of corporate earnings ahead of the August 1 tariff deadline set by U.S. President Donald Trump. The FTSE 100, heavily influenced by international markets, edged down, while the domestically focused FTSE 250 posted modest gains. Automobile and parts stocks led the losses, dropping 2.1%, with Aston Martin tumbling 3.7% after the luxury carmaker issued a profit warning, citing U.S. import tariffs and sluggish demand in China. In contrast, the personal goods sector posted the strongest gains, rising 1.3%. In the United States, it is anticipated that the Federal Reserve will maintain its current interest rates during its policy meeting scheduled for later on Wednesday. Meanwhile, the Bank of England is likely to reduce borrowing costs on August 7, marking the fifth reduction since August of the previous year.

Single Stock Stories & Broker Updates:

Shares of GSK, the British pharmaceutical company, rose by 1.7% to 1,420p, making it one of the leading gainers on the FTSE 100 index. The company anticipates reporting annual sales and profits near the higher end of its forecast after exceeding expectations for second-quarter sales and earnings. GSK projects a revenue increase of 3% to 5% for 2025, along with core profit growth per share of 6% to 8%. With session changes factored in, GSK has gained 5.5% year-to-date

Shares of HSBC listed in London fell by 4.6% to 925.6p. The stock is one of the top losers on the FTSE 100 index, which has decreased by 0.46%. HSBC's half-yearly pretax profit dropped 26%, falling short of analyst expectations. The bank incurred an additional hit of $2.1 billion from its investment in the Bank of Communications. Year-to-date, HSBC has risen 18%, while the FTSE has increased by nearly 11%.

Aston Martin shares fell 2.2% to 77 pence. The company expects FY adjusted operating profit to break even, down from a previously positive outlook, with gross margins in line for FY 2024. CEO Adrian Hallmark cited U.S. tariff issues as detrimental to Q2 operations. Year-to-date, AML stock is down approximately 27%.

Shares of UK homebuilder Taylor Wimpey fell 4.5% to 102.4 pence, making it a top loser on the FTSE 100, which is up 0.6%. The company expects a 2025 operating profit of £424 million, down from a prior forecast of £444 million. Year-to-date, shares are down approximately 16%.

Sage Group rises 4.37% to 1,312p, leading FTSE 100 gainers; reports 9% y/y revenue growth and reaffirms full-year guidance. SGE down 1.2% year-to-date.

Shares of BAE Systems dropped by 2.8% to 1,768.5p. The company has raised its annual sales and underlying EBIT forecast; however, Jefferies analysts indicate that a consistent EPS outlook may not meet investor expectations. The half-year order intake declined to 13.2 billion pounds ($17.64 billion) from 15.1 billion pounds the previous year. Sales for the half-year increased by 11% year-over-year, and underlying EBIT rose by 13%. Year-to-date, BAE Systems' stock has risen by approximately 56%.

Technical & Trade View

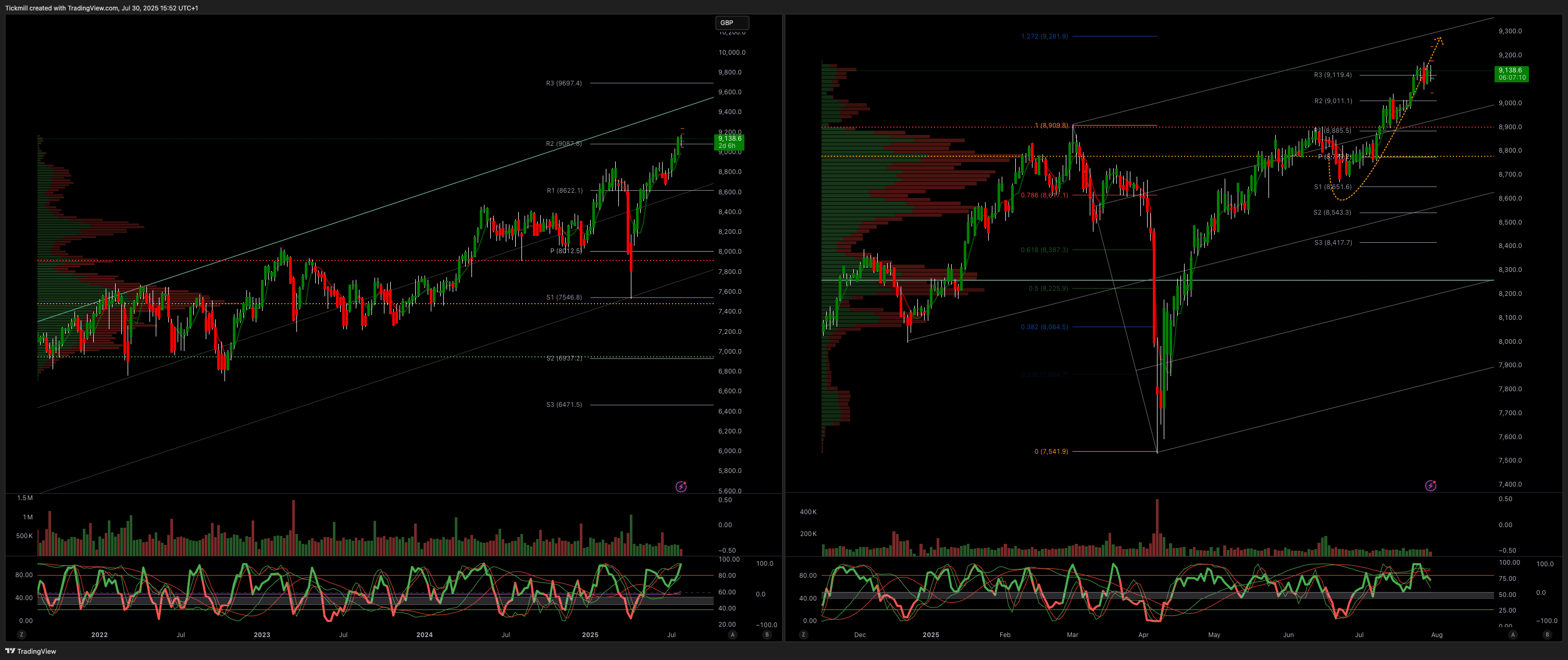

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!