The Great Gold Unwind

Gold Selling Deepens

Since posting record highs on October 30th, gold futures have been heavily sold with investors exiting long positions at a rapid pace. Now down around 7% from those highs, the market shows no sign of rebounding with the futures price quickly approaching a retest of the 2,530-breakout zone. With USD rallying in the initial aftermath of Trump’s re-election news and Fed easing expectations quickly falling, gold traders are poised for further downside near-term. With global markets bracing for a return to the heavily tariffed environment of Trump’s first presidency, bullish bets in gold are being quickly dumped as investors move capital back into USD.

Powell & Inflation Due

Looking ahead this week, there is plenty to watch with US inflation, a speech by Fed chairman Powell and US retail sales due. If we see any stickiness or fresh upside in US inflation data on Wednesday, USD is vulnerable to a sharper move higher )and gold a sharper move lower) as traders scale back near-term Fed easing expectations. Currently, the market is pricing in a roughly 65% chance of a further cut in December, If this pricing moves lower through data and Fed speak this week, gold prices should trade closer to a retest of the April highs.

Technical Views

Gold

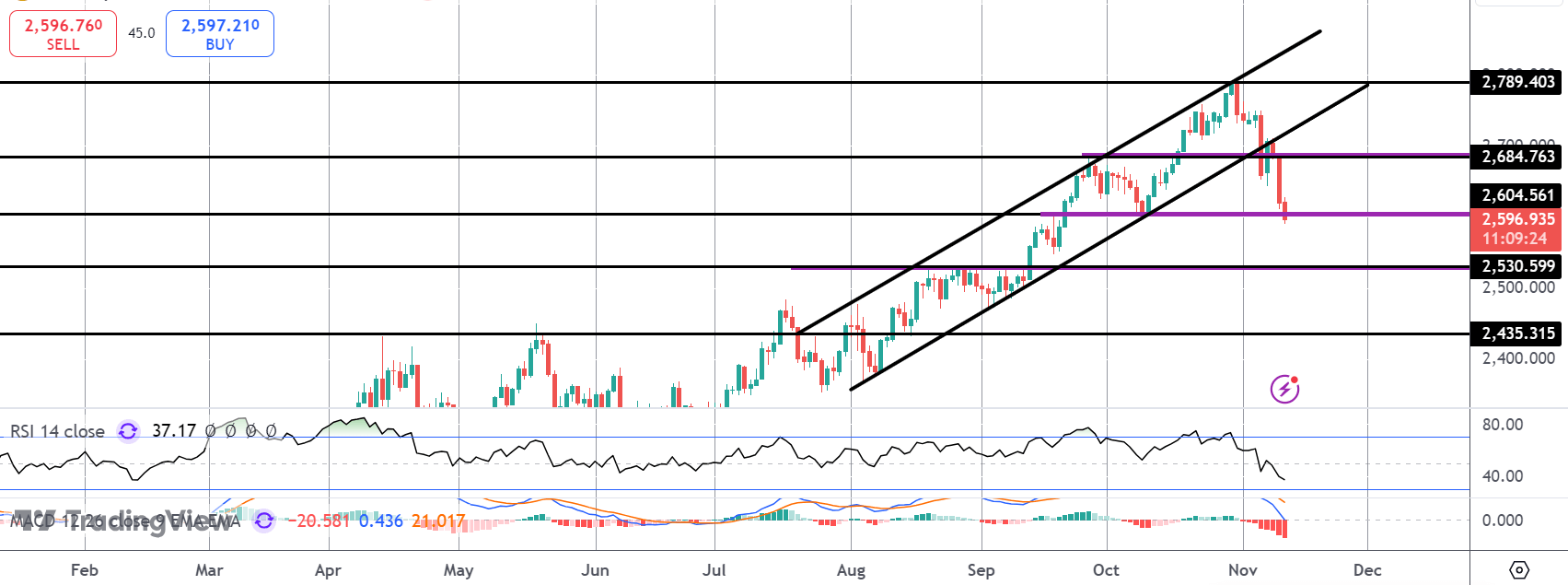

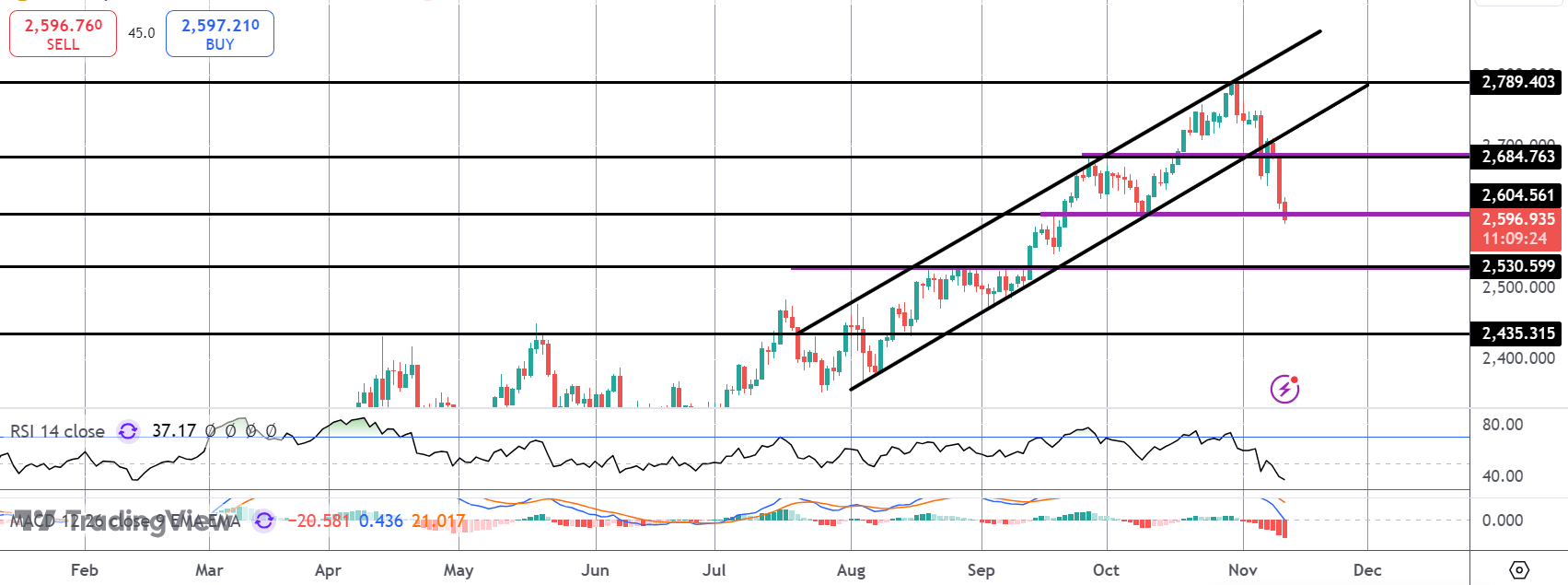

The breakdown below the bull channel in gold is gathering steam now, with price currently testing support at the 2,604 level. With momentum studies bearish, focus is on a continuation lower with 2,530 the next support zone to watch. Bulls need to get back above 2,684 near-term to alleviate bearish pressure.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.