The FTSE Finish Line - October 29 - 2024

The FTSE Finish Line - October 29 - 2024

FTSE Falls Hard Into The Close, As Investors Turn Cautious Ahead Of The Budget

After HSBC announced a $3 billion buyback and reported a better-than-expected third-quarter profit, the UK's FTSE 100 index initially climbed on Tuesday, driven by financial firms. However, losses in industrial metal miners prevented further advances. The banking industry increased 2.2% as a result of HSBC, HSBC shares on the London Stock Exchange rose as much as 3.9%, the highest level since July 2018. HSBC's shares are leading the FTSE 100 index. HSBC reported a 10% increase in third-quarter profit, exceeding analyst expectations, and announced an additional share buyback of up to $3 billion, on top of a $6 billion buyback programme announced earlier this year. sector competitors Standard Chartered and Prudential also saw increases. However, as base metals moved in a narrow range, industrial metal miners saw a 0.6% decrease, and the oil and gas industry saw a 0.2% decline as BP's shares fell. Shares in BP decline 3.6% to 384.95p, the second-biggest loser on the FTSE blue-chip index. The oil major reports a 30% drop in Q3 profit to $2.3 billion, the lowest in almost four years, due to weaker refining margins and oil trading results. Net debt rises to $24.3 billion as of the end of September, up from $22.6 billion at the end of June. CEO Murray Auchincloss says BP will focus on value, not volume, for its operations, stating that chasing volume in the past has been a mistake. The stock is down around 17% so far this year.

As investor attitudes turned cautious ahead of tomorrow's UK budget, the FTSE 100 gave back early gains to trade down more than 0.95%. Prices in British shops declined at the quickest rate in over three years this month, but the upcoming budget announcement by Finance Minister Rachel Reeves could help drive a return of inflation. Reeves is set to present the new government's budget on Oct. 30, where she will outline her initial tax and spending plans, which must address a challenging fiscal situation without significantly raising taxes on workers.

Technical & Trade View

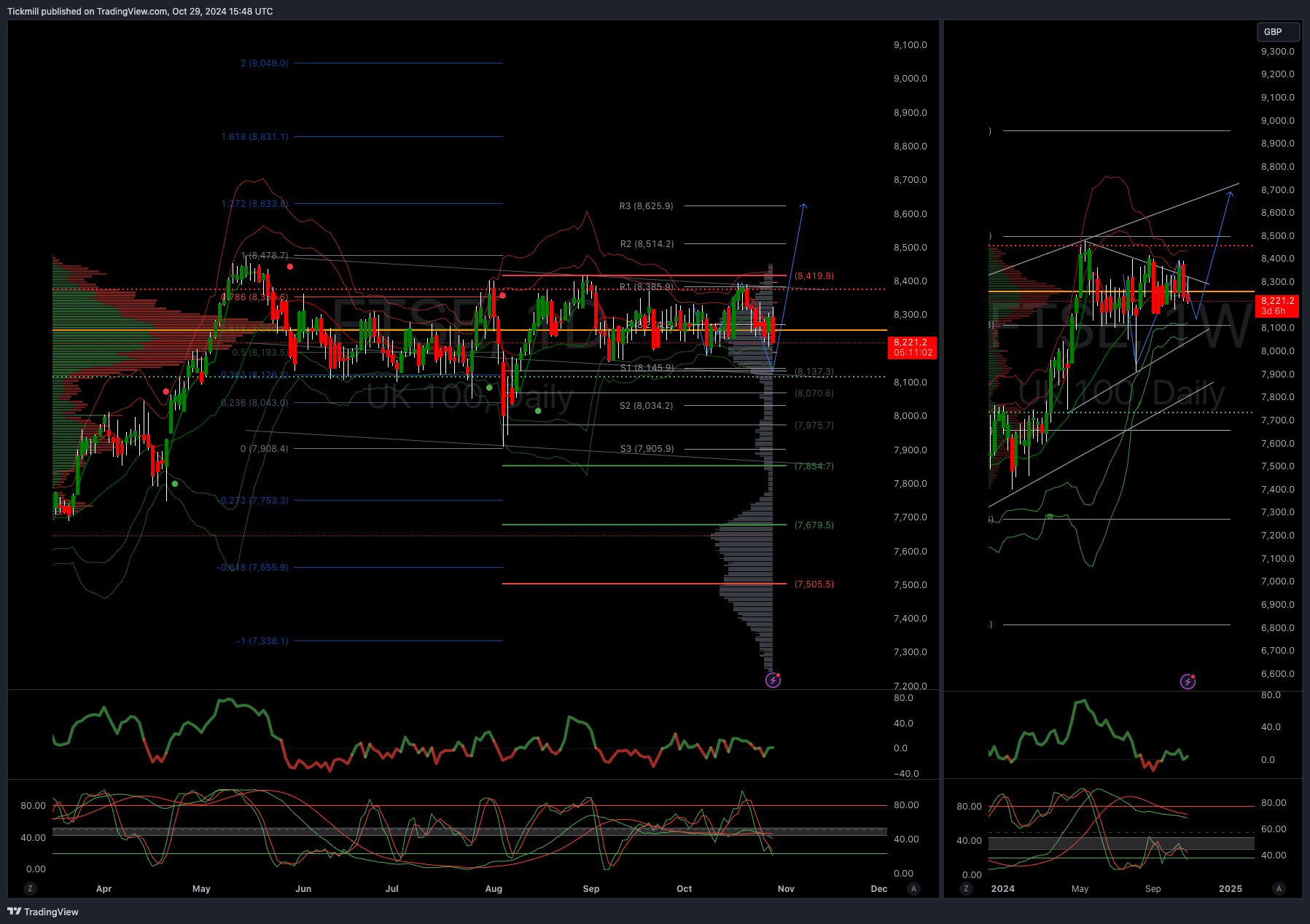

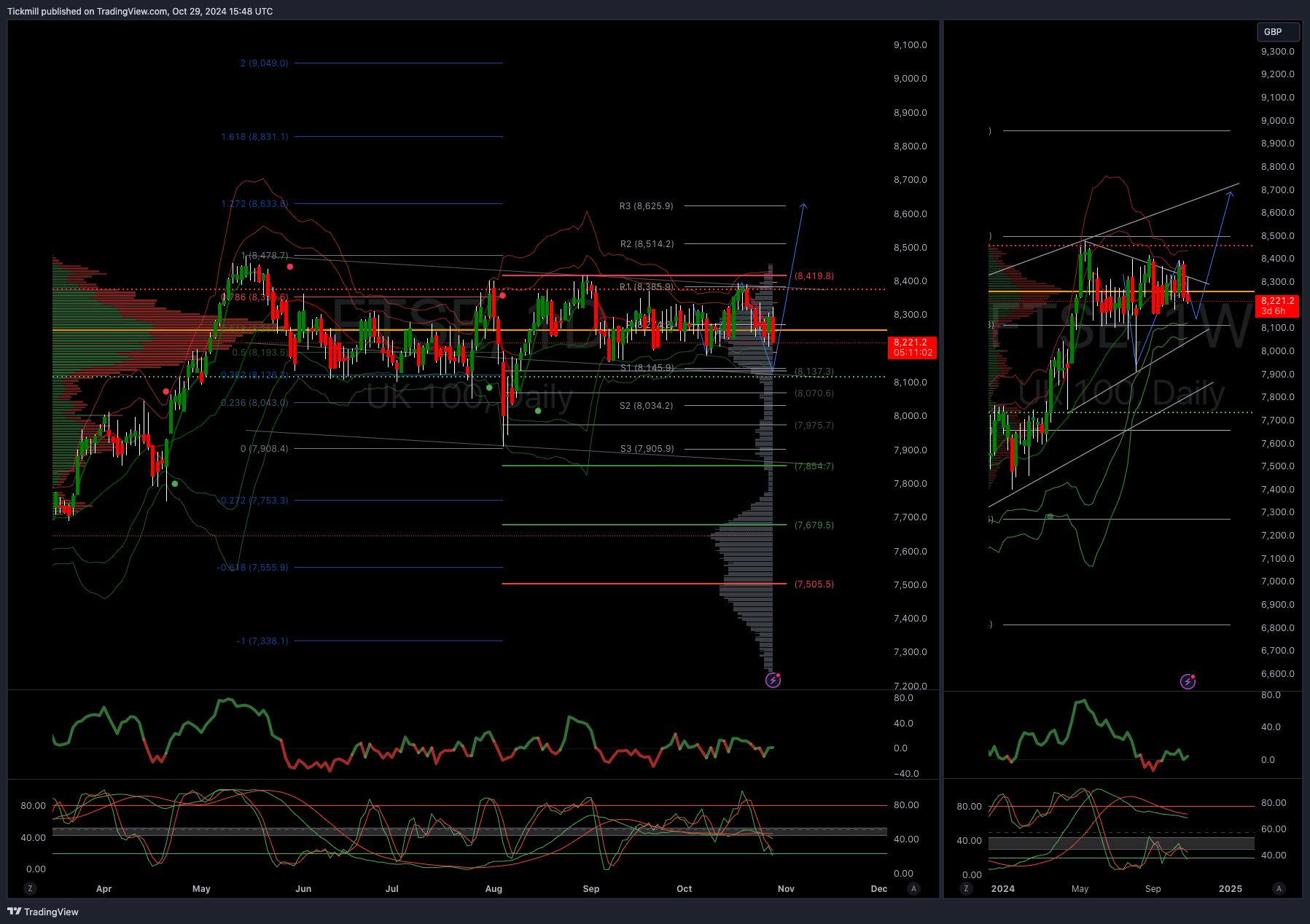

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!