The FTSE Finish Line - October 17 - 2024

The FTSE Finish Line - October 17 - 2024

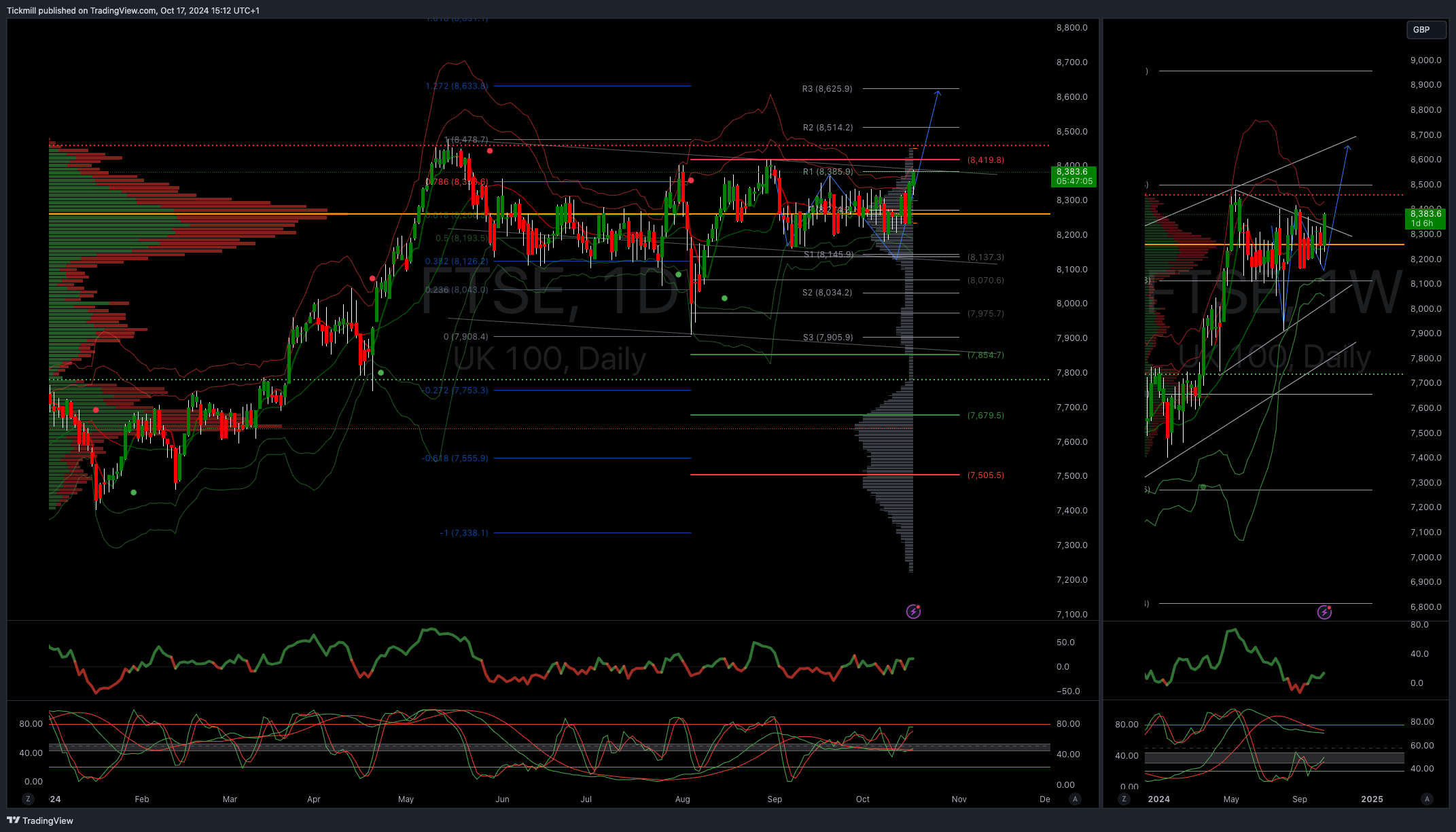

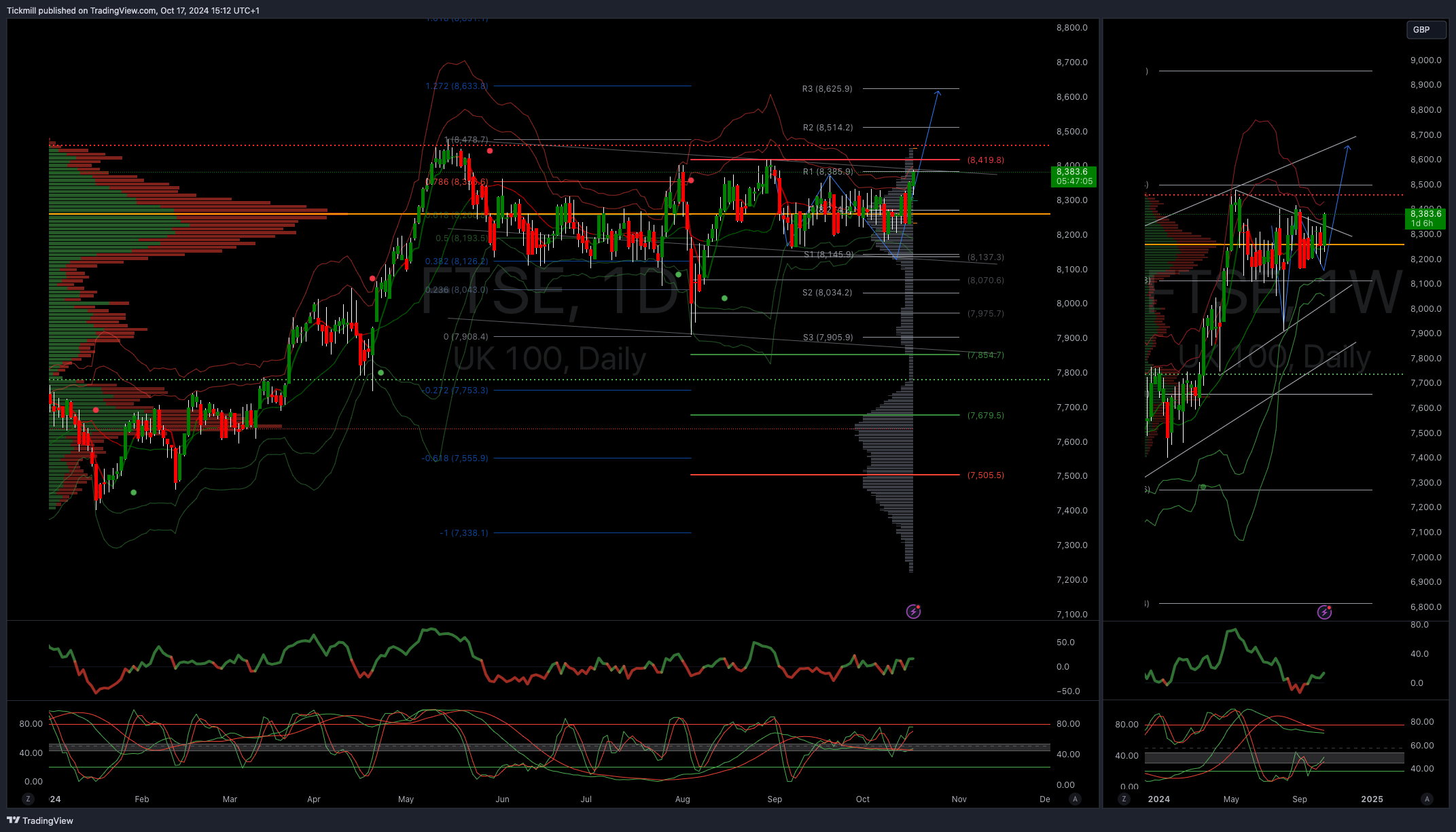

FTSE Eyes A Test Of 8400

As hopes of quicker interest rate decreases were bolstered by indications of reducing inflation, U.K. stocks slightly increased on Thursday. On Thursday, the GBP hit a two-week high. Although the ECB lowered interest rates by 25 basis points as anticipated, the statement said that recent negative surprises in economic activity indices had an impact on the inflation forecast. Incoming data indicates activity is less than anticipated, according to ECB President Christine Lagarde. The language suggests that the ECB is shifting its emphasis to economic expansion, which may lead to a more aggressive round of rate cuts. After rising 1% the day before, the FTSE 100 benchmark increased 17 points, or 0.2%, to 8,346. Mining stocks were mixed, with Antofagasta down more than 2% as investors were not impressed by yet another eagerly awaited policy update from China's housing ministry. On an ex-dividend basis, Smiths Group and Persimmon both saw a 2% decrease.

In single stock stories UK-based Mondi was the biggest percentage fall on the FTSE 100 index, which stayed mostly unchanged, as its third-quarter profit declined sequentially, causing its share price to drop 6.8% to 1,295p. The stock of the corporation fell to its lowest level since October 2023. Reduced demand and more scheduled maintenance were blamed for the 36% quarter-over-quarter drop in core earnings. In addition, the business noted that, in comparison to the preceding three months, pulp and paper selling prices in the uncoated fine paper segment had decreased. This year, Mondi's stock has fallen over sixteen percent, behind the FTSE 100 index's 7.6 percent increase.

Rentokil Initial, a British pest control company, saw its shares rise as much as 10.1% to 375.4 pence, making it the top gainer on the FTSE 100 index. The company is expanding its initiatives to increase organic growth in North America. Rentokil Initial is reviewing its Terminix integration program early in the new year to assess various elements, slightly delaying the timing of synergy delivery by approximately 2-3 months. The company acquired Terminix for $6.7 billion in 2021 but has struggled to integrate the two companies. Rentokil Initial reported a 3.6% increase in group revenue for the third quarter with organic revenue growth of 2.6% and maintained its full-year revenue and margin outlook. However, the stock is down 22.6% year-to-date as of the last close.

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!