The FTSE Finish Line: March 21 - 2025

The FTSE Finish Line: March 21 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

UK stocks dropped on Friday, particularly in the travel and leisure sectors, as a significant power failure at Heathrow Airport led to extensive travel disruptions. The FTSE 100 index declined by over 0.5%, yet is still expected to register a minor gain this week following two weeks of declines. UK markets seek reassurance from fiscal policy as the US and UK central banks maintain policy flexibility and leave interest rates unchanged, uncertainty reigns supreme. Markets look to the Chancellor's Spring Statement next Wednesday for confirmation that the UK's finances are sustainable. Key US and UK inflation figures are expected to remain unchanged. Flash PMIs will monitored for the most recent indications of employment and economic activity.

Single Stock Stories & Broker Updates:

IAG, owner of British Airways, fell 3% after Heathrow Airport closed due to a fire at an electrical substation, disrupting global flight schedules. British Airways had 341 flights set for Friday. ICAG is down approximately 3.7% year-to-date.

Shares of J D Wetherspoon fell 11.5%, making it a top loser on the FTSE mid-cap index. The company expects reasonable outcomes for the fiscal year, contingent on future sales, and reported 5% growth in like-for-like sales in the last seven weeks, compared to 5.8% a year earlier. However, a weak market and poor UK economic outlook dampen prospects. Interim profit before tax decreased 8.6% to £32.9 million, with the stock down approximately 4.67% year-to-date.

Shares of Ferrexpo fell 8.6% to 65p after Ukraine suspended VAT refunds for two subsidiaries, totaling $12.5 million. The company warned this will impact liquidity and lead to reduced production and sales. The suspension is linked to sanctions on majority owner Kostiantyn Zhevago. Year-to-date, the stock has lost 32.8%.

Energean (ENOG) shares rose 4.2% after terminating a deal with Carlyle for asset sales due to regulatory approval delays in Italy and Egypt. The parties couldn't extend the agreement's long-stop date beyond March 20. CEO states the company did not initiate the asset sale and is not seeking another buyer. ENOG is down ~16% YTD.

Shares of Crest Nicholson rose 5.7% making it a top gainer on the FTSE 250 index. RBC Capital Markets upgraded the homebuilder's rating from "sector perform" to "outperform" and raised the target price from 180p to 230p, noting that operational issues are mostly resolved. The stock has gained about 7% since Thursday, following a positive update on sales rates and a medium-term forecast, but is still down 2% year-to-date, including today's gains.

UK sportswear company JD Sports Fashion shares drop 6.6%, the largest FTSE 100 index loser. Nike forecasted a wider Q4 revenue drop than projected, urging caution as it tries to regain customer attention from trendier competitors. JD fell ~21% YTD, including session losses.

ASOS, a British clothes retailer, rises 24.8%, leading the FTSE mid-cap index. The company expects strong profitability improvement in H1 FY25, with revenue growth and EBITDA ahead of consensus. Own brand full-price sales will return to growth in H1 FY25. According to Jefferies, the update is unclear given there is no guidance for FY25, but the H1 EBITDA beat and return to positive territory are positives. ASOS stock is down ~43% as of last close.

Technical & Trade View

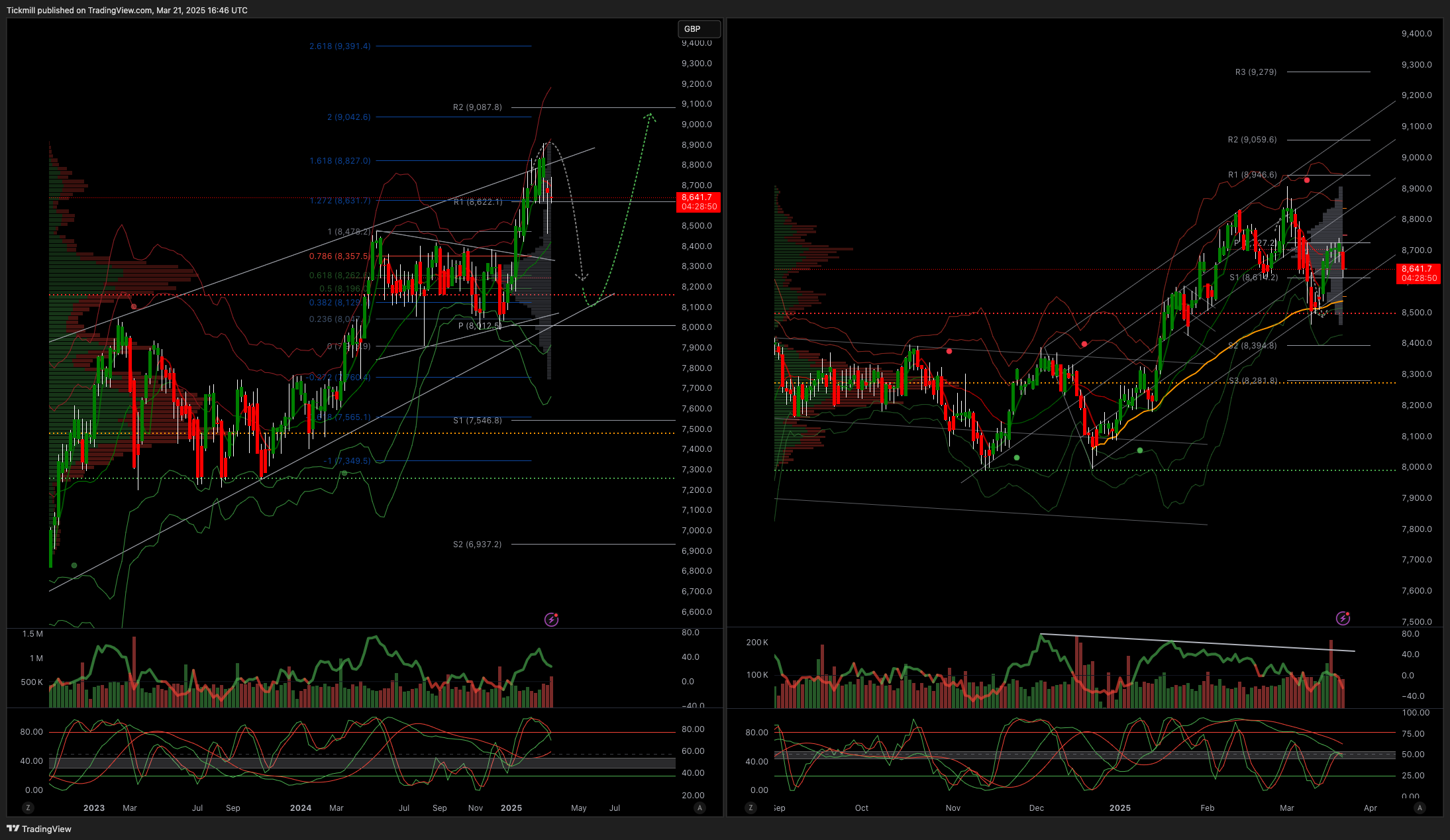

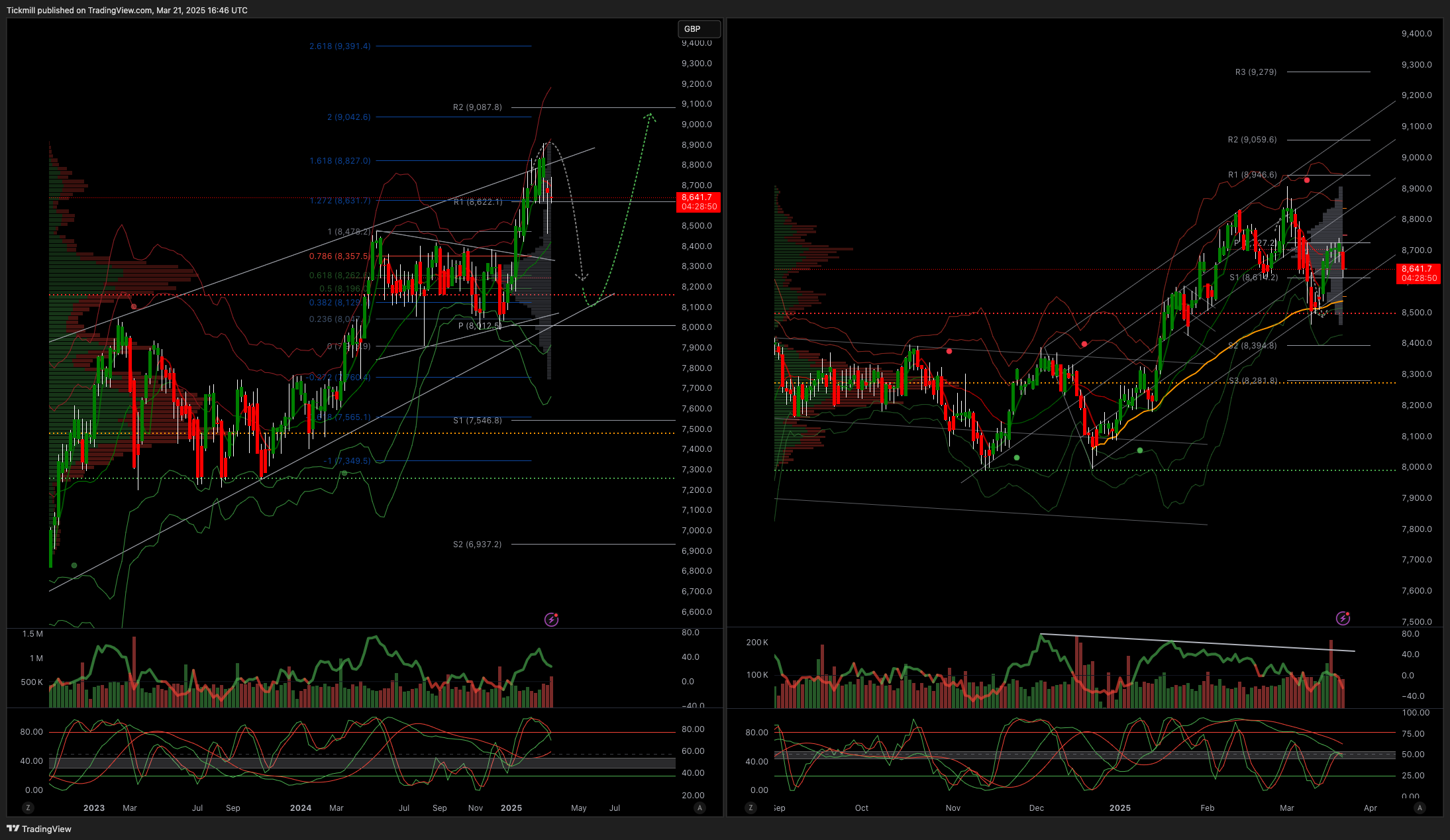

FTSE Bias: Bullish Above Bearish below 8950

Primary support 8700

Below 8700 opens 8600

Primary objective 9050

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!