The FTSE Finish Line: June 5 - 2025

The FTSE Finish Line: June 5 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London benchmarks pared earlier losses and turned modestly positive on Thursday following a reported phone call between Chinese President Xi Jinping and U.S. President Donald Trump, which hinted at a potential easing of trade tensions. Meanwhile, silver surged past the critical $35 mark, reaching a 13-year high. According to Chinese state media, Xi and Trump spoke by phone on Thursday amid escalating tensions over critical minerals, which had threatened an already fragile trade truce. The call is expected to allow Trump to present a more optimistic outlook on U.S.-China relations, potentially reducing the risks of economic decoupling between the two nations—one of the key drivers behind increased investment in precious metals. The British pound climbed to a new high of 1.3616 in 2025, supported by weak U.S. economic data and assertive remarks from ECB President Christine Lagarde, both of which are likely to further bolster GBP/USD. Disappointing trade figures and rising unemployment claims in the U.S. have heightened concerns about slowing growth, exacerbated by underwhelming ADP employment and ISM non-manufacturing reports earlier in the week. Market forecasts now suggest nearly 60 basis points in Federal Reserve rate cuts by December, up from just under 50 basis points before the ADP data release. The fading U.S. economic edge, combined with expectations of an end to ECB rate cuts, points to continued dollar weakness. At the same time, the pound remains well-supported due to favourable interest rate differentials between the U.S. and UK, underpinned by Britain's robust economic performance and persistently high inflation above target levels.

Single Stock Stories & Broker Updates:

Dr Martens' shares rose 17.9% to 70.7p, making it the top gainer on the FTSE 100, which is up 0.06%. The stock is on track for its best day since June 2022. The company plans to cut discounts in the Americas and EMEA regions this fiscal year and expects FY26 adjusted pre-tax profit to meet market expectations of £54-74 million ($73.26-$100.40 million). Prices for the spring/summer collection will remain unchanged as stock is available in the U.S. Doc Martens reported a better-than-expected FY25 adjusted pre-tax profit of £34.1 million, exceeding the consensus of £30.6 million. Despite today's increase, DOCS stock is down nearly 2% year-to-date.

Wizz Air shares fell 26.5% to 1,230p, the lowest since Feb 5, making it the top loser on the FTSE mid cap index, which is down 0.3%. FY operating profit was £167.5 million, below expectations of €246 million. The company will not provide a 2026 outlook due to limited visibility. Stock is down 12.7% this year.

Mitie Group shares fall 10.8% to 142.7p, the largest one-day loss since November 2024, after suspending a £125 million share buyback to focus on M&A. The company will acquire Marlowe for around £366 million, expected to be accretive in the first full year. Marlowe shares rise 8% to 438.5p, while Mitie is up 30% YTD.

British trading platform CMC Markets saw shares drop 17.9% to 233.5p, marking their largest percentage loss in four months. The stock is among the top losers on the FTSE mid-cap index, which is down 0.28%. CMC reported FY25 adjusted PBT of £84.5 million, below analysts' estimate of £90.6 million. The company noted supportive trading conditions and plans to maintain cost control while investing in efficiency and platform capability. Year-to-date, the stock has decreased by 0.74%.

Technical & Trade View

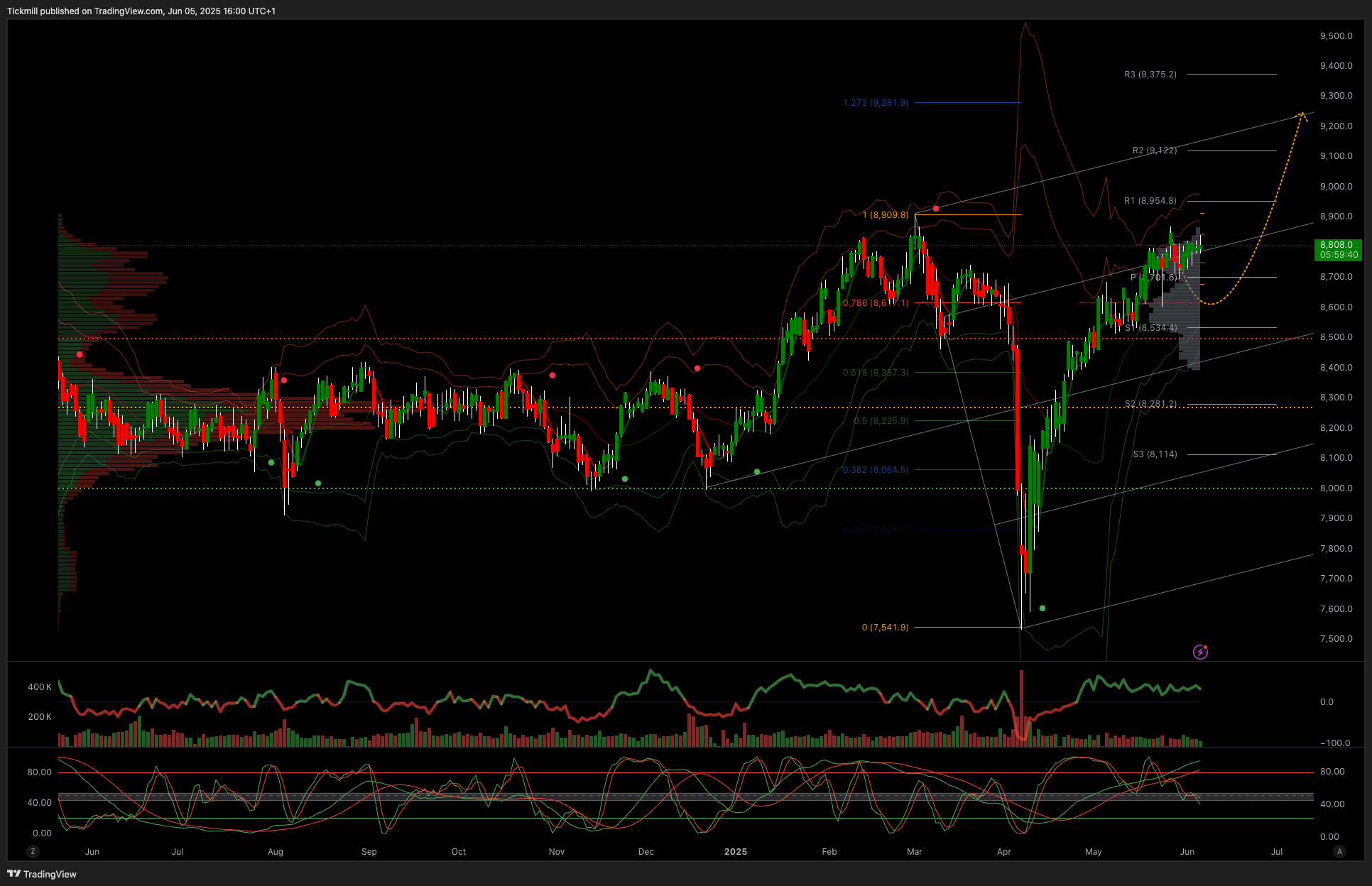

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8500

Below 8500 opens 8250

Primary objective 8900

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!