The FTSE Finish Line: June 4 - 2025

The FTSE Finish Line: June 4 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London shares rose modestly on Wednesday after Britain secured an exemption from the United States' doubled tariffs on steel and aluminium imports, alleviating trade tensions that have unsettled markets for much of the year. The U.S. decision, announced in a proclamation signed by President Donald Trump on Tuesday, exempts British steel and aluminium from a tariff increase to 50%, while raising tariffs on metal imports from other countries starting June 4. UK markets showed positive momentum this morning as investors appeared increasingly indifferent to tariff-related headlines. Industrial and precious metal miners posted gains exceeding 1%, supported by stable gold and copper prices throughout the day. Midcap company DiscoverIE surged 11.2%, leading the index, after reporting a 4% rise in its preliminary adjusted pretax profit for 2025, driven by its custom electronics design and manufacturing business.

Meanwhile, S&P Global PMI data revealed a slight recovery in Britain’s services sector in May, following a contraction in April attributed to concerns over Trump’s tariff policies. Investors remain focused on the slow progress of trade negotiations, particularly as the deadline for U.S. trading partners to submit proposals to avert Trump's "Liberation Day" tariffs, set for early July, looms. Despite earlier turbulence, British stocks have rebounded from their April lows, bolstered by a limited trade agreement with the U.S. reached in May. The blue-chip FTSE 100 index is now approximately 1% below its record high, signalling a gradual recovery in investor confidence.

Single Stock Stories & Broker Updates:

Shares of discoverIE rose 10.4% to 697.5p. The company reported a 4% increase in FY25 adjusted pretax profit to £50.1 million, despite a 3% revenue decline to £422.9 million due to industry-wide destocking. The adjusted operating margin target for FY28 has been upgraded to 15%, and the target for FY30 is also set at 15%. CEO Nick Jefferies noted concerns about volatile economic conditions affecting customer demand. Year-to-date, the stock is down approximately 11%.

Shares of Ninety One Plc rose 2.6% to 166.4p, with FY assets under management up 4% to £130.8 billion. CEO Hendrik du Toit notes that despite ongoing economic uncertainty, demand for their offering is encouraging. A previously-announced transaction with Sanlam is on track. The stock is up ~12% YTD.

WH Smith up 1.8% at 1046p; reports 7% travel revenue increase for 13 weeks to 31 May vs prior year; well positioned for summer trading; full year expectations unchanged; stock down ~13% YTD.

Cab Payments Holdings rises 9.1% to 45p, becoming the top gainer on the FTSE small cap index. Crown Agents Bank, a unit of the money transfer group, receives a license to operate a U.S. office in New York, which will serve as a regional business hub. Analysts from Equity Development expect this development to enhance growth in the Americas, particularly in LATAM. However, CABP has seen a YTD decline of 34.5%.

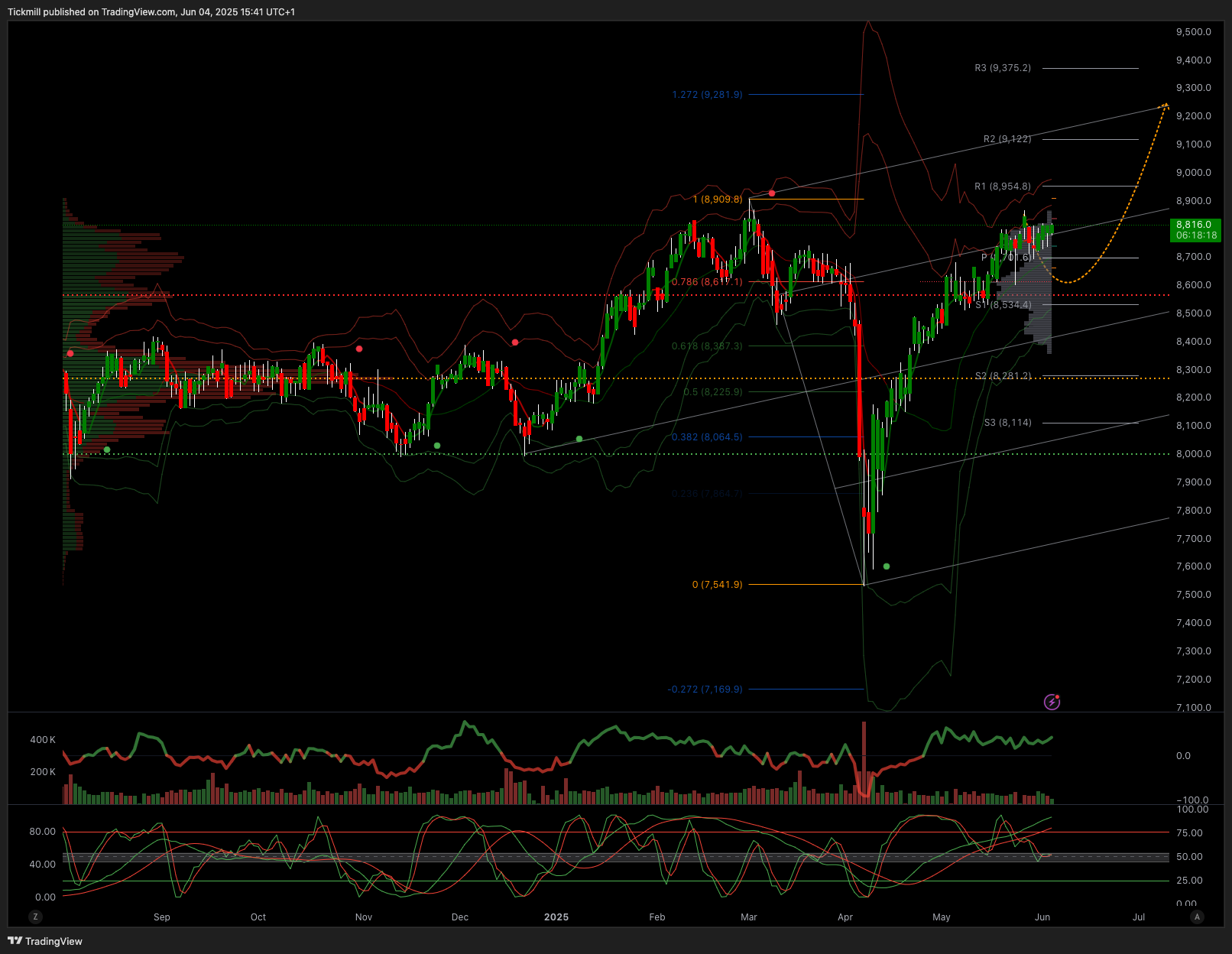

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8500

Below 8500 opens 8250

Primary objective 8900

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!