The FTSE Finish Line: June 3 - 2025

The FTSE Finish Line: June 3 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

Britain's primary indexes declined on Tuesday, weighed down by mining and financial shares, as investors grew wary of the uncertain U.S. trade policies, which affected market sentiment. The Organisation for Economic Cooperation and Development (OECD) has revised its global growth forecast downward, indicating that the trade conflict is having a more significant impact on the U.S. economy than previously thought. The Paris-based organisation also called on the British government to take more decisive action to reduce borrowing and debt just days before Finance Minister Rachel Reeves is set to unveil her long-term spending proposals. Investors were already on edge, following U.S. President Donald Trump's announcement on Friday to raise tariffs on imported steel and aluminium from 25% to 50%. Industrial metal miners were hit hardest by the trade concerns, with shares declining by 2.5%, as London copper prices fell amidst worries about potential U.S. tariffs on the metal. Losses in financial stocks further affected both indexes, with an index measuring UK banks declining by 1.4%. Conversely, the aerospace and defence subindex has continued to rise for the second straight day after Prime Minister Keir Starmer revealed a £15 billion ($20.3 billion) spending plan on Monday aimed at enhancing Britain's "warfighting readiness."

Single Stock Stories & Broker Updates:

Shares of Rockhopper Exploration fell 10.3% to 46.8p after Italy annulled a €190 million arbitration award related to the Energy Charter Treaty, meaning the company will not receive the tranche 2 payment from the 2023 monetisation agreement. The company’s balance sheet remains solid with tranche 1 payment received and plans to claim a €31 million payout under an insurance policy. Including recent gains, the stock is up approximately 78%.

Shares of Pennon Group fell 2.69% to 490.8p, marking it as a top loser on the FTSE 250 index. The company reported an adjusted loss before tax of £35.1 million for 2024-25, down from a profit of £16.8 million in 2023-24, but expects to be profitable by 2025-26. The 2024-25 results align with expectations, and shares are up 6.03% YTD.

Shares of the UK's defence sub-index rose 1.5% to an all-time high of 17,923.6 pence, bolstered by the UK government's pledge for the largest rise in defence spending since the Cold War and an expansion of attack submarines. BAE Systems hit a record high (+2.1%), Rolls Royce rose nearly 1%, Babcock increased by 1.8% to an 8-1/2-year high, and Chemring gained 6%. The sub-index is up 55.5% this year.

GSK's shares fell 1.2% to 1,492p after Berenberg downgraded its rating to "hold" from "buy" while maintaining a price target of 1,600p. The brokerage noted GSK is trading 30% below the value of its marketed drugs, but strong upcoming product rollouts may attract investor interest. Concerns remain about the impact of President Trump's drug pricing policies. Berenberg recommends Sanofi over GSK for value investors. GSK is up 11.1% YTD, while Sanofi is down 7.9%.

Kier Group shares rise 3.6% to 174.4 pence, their highest since June 2019, despite the FTSE mid-cap index declining 0.3%. The company has increased its operating profit margin target to 4.0%-4.5% in 3-5 years, up from 3.5%. The order book stands at ~£11 billion, up about 2% from year-end, with the stock up 17.5% year-to-date.

Shares of MJ Gleeson fell 26.4% to 380p, making it the top loser in the FTSE small-cap index, on track for its largest daily percentage drop. The company anticipates a 15-20% lower annual operating profit for Gleeson Homes due to increased costs and a failed land deal in East Yorkshire. They noted that the housing market recovery hasn't been strong enough to counteract margin pressures, and planning delays may further impact margins into FY26. GLEG stock has declined about 21% YTD, including today's drop.

Technical & Trade View

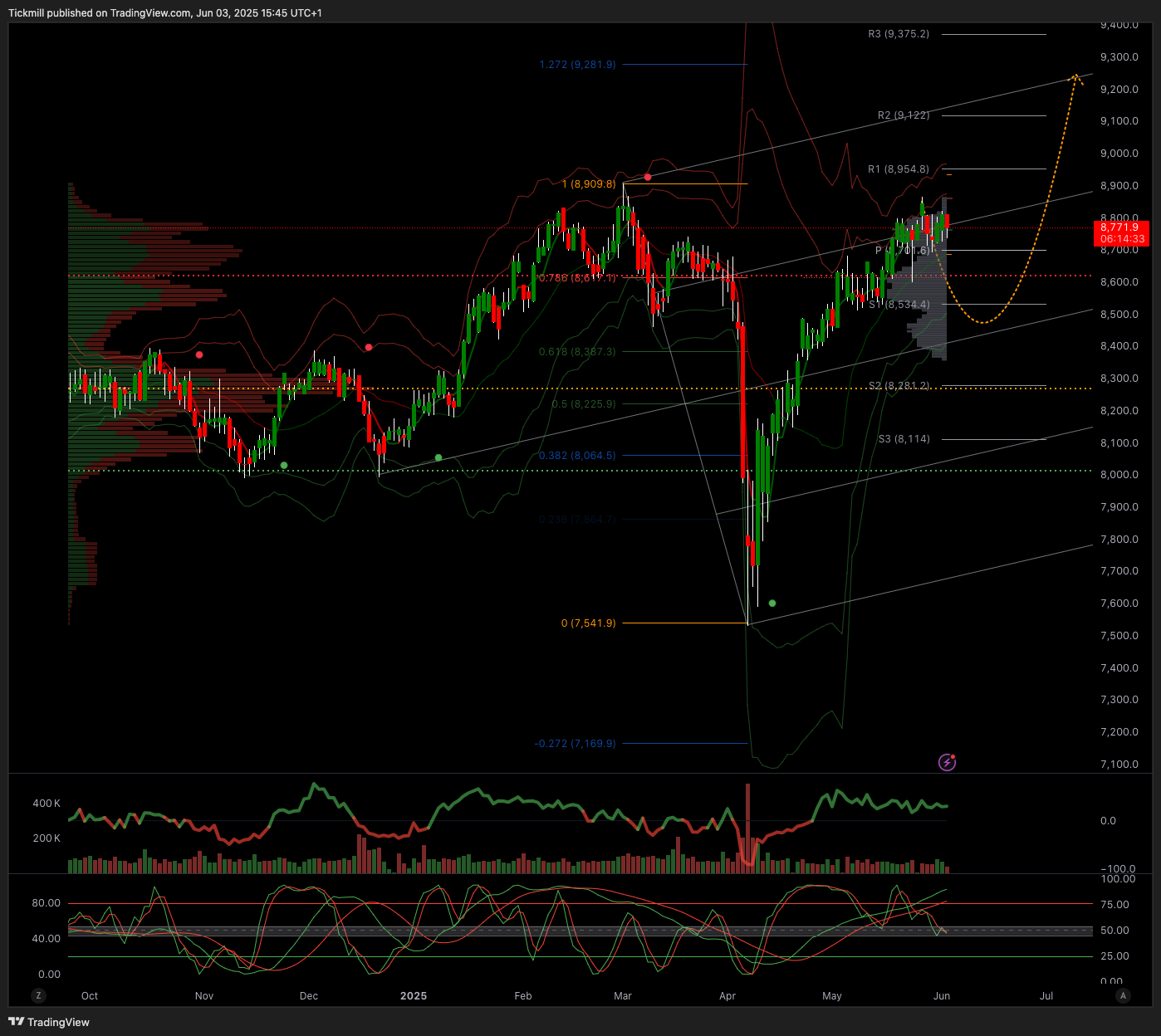

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8500

Below 8500 opens 8250

Primary objective 8900

Daily VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!