The FTSE Finish Line: June 27 - 2025

The FTSE Finish Line: June 27 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

The stock indices in the UK rose on Friday, with midcap stocks reaching a 10-month peak, fuelled by positive global sentiment regarding earnings, trade policies, and monetary policy direction. This week, markets have recovered as worries about the Middle East conflict have lessened, trade talks between the U.S. and China appear to be progressing, and the possibility of U.S. interest rate reductions looms. Asian stocks climbed to their highest levels in more than three years, while both the S&P 500 and Nasdaq reached near-record closings. In a positive development, the United States has come to an agreement with China to speed up rare earth shipments to the U.S., as stated by a White House official, in the midst of efforts to resolve the trade war between the two largest economies. At the same time, British Prime Minister Keir Starmer has significantly reduced proposed welfare cuts to address a severe backlash from lawmakers within his ruling Labour Party. Starmer's initial plans aimed to cut 5 billion pounds ($6.9 billion) annually from a rapidly increasing welfare budget. These reforms are scheduled to be presented for a parliamentary vote on July 1.

Attention is centred on the political rebellion challenging the UK government over its plan to implement £4.8 billion in annual welfare budget savings by 2029-30. As the day unfolded, pressure increased as it became evident that the rebels would win next Tuesday’s vote, compelling the Prime Minister to retreat. Reports from last night suggest that the concessions made by Starmer to avoid defeat are substantial and could reduce the planned Treasury savings by nearly half. The actual impact of this reversal is subject to debate. Some argue the entire package represents only about 0.3% of government spending, while others point out that the intended £4.8 billion savings by 2029-30—now unlikely to be fully achieved—constitute roughly 50% of the government’s fiscal headroom. However, focusing too much on specific cost predictions overlooks the larger issue. The key takeaway from this episode is the shift in power from Downing Street to the backbenches, with MPs clearly signaling they will not support spending cuts. This development significantly restricts the government’s options for shaping the Autumn Budget. As a result, expectations are likely to solidify regarding the possibility of further tax increases aimed at rebuilding fiscal headroom, although these measures will undoubtedly have political consequences. The critical risk for market participants to watch is whether the government, faced with the unpopularity of these measures, might reconsider its commitment to the current fiscal rules.

Single Stock Stories & Broker Updates:

Shares of JD Sports rose 7.2% to 87.6 pence, making it the top gainer on the FTSE 100, which is up 0.3%. Nike forecasted a smaller Q1 revenue drop and plans to reduce its reliance on Chinese production for the U.S. market amid tariff impacts. J.P. Morgan notes Nike's solid sports results reflect overall demand trends in the U.S. JD Sports is down 8.9% year-to-date.

Shares of Next 15 Group surged by 14.7% to 238.5p. The consultancy and marketing services firm announced that it is in preliminary discussions regarding a possible sale of certain brands. Next 15 stated that there is currently no assurance that any agreement will be finalised, nor any details about the deal's terms. Earlier, Sky News reported that NFGN has been negotiating the sale of its 'legacy' advertising and public relations divisions, which include the financial public relations firm MHP. NFGN has experienced a decline of approximately 40% year-to-date, which includes recent fluctuations.

Technical & Trade View

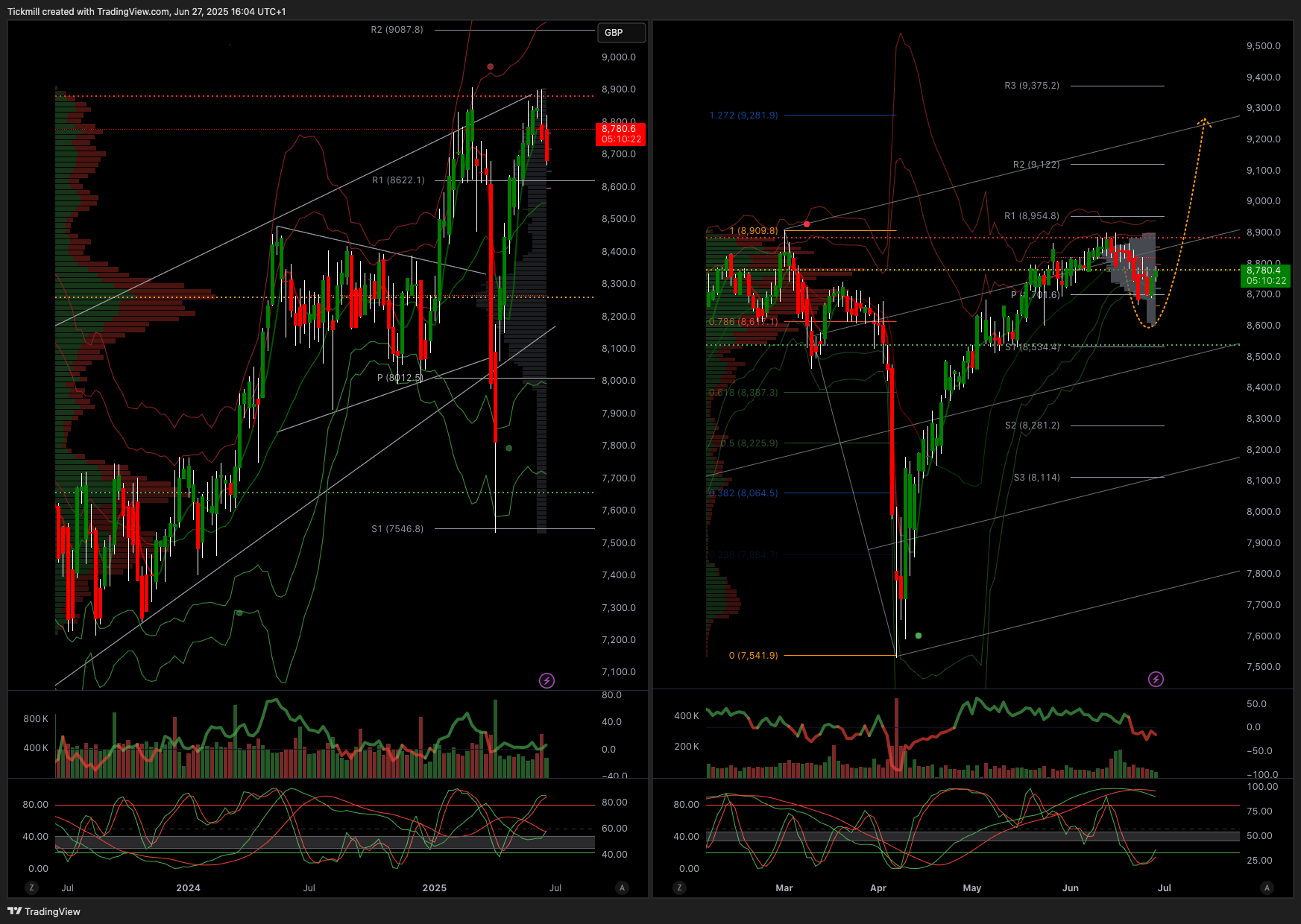

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!