The FTSE Finish Line: July 9 - 2025

The FTSE Finish Line: July 9 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

The primary stock indexes in the UK initially increased on Wednesday as investors concentrated on various corporate news while anticipating additional updates regarding tariffs. GBP bulls are gaining confidence due to recent updates in UK fiscal policy and the forthcoming Fed minutes, which weighed on the UK benchmarks. The currency pair rose from a low of 1.3574 during the North American session to a high of 1.3620, supported by a stabilisation of UK gilt prices after the Bank of England's Financial Policy Committee (FPC) offered reassurances against fiscal uncertainty. The pound has been under considerable strain lately, primarily due to worries over the UK government's indecisiveness regarding welfare reductions and the Office for Budget Responsibility's (OBR) caution about the precarious state of public finances in the aftermath of COVID. Nonetheless, the FPC's positive view on the strength of British households and the local banking sector has eased some of these concerns. As geopolitical tensions diminish, market focus is shifting towards central bank strategies and global trade dynamics. The release of the Federal Reserve minutes today is eagerly awaited, as traders look for clues on possible interest rate reductions. Although Fed officials, including Chair Jerome Powell, have stressed the importance of gathering more data before any judgements are made, the potential for a dovish shift could impact the market.

Single Stock Stories & Broker Updates:

Shares of Close Brothers fell by 6% to 374p, which made the company one of the top losers on the LSE. The British lender cited rising customer service costs, broker consolidation, and operational complexity affecting the attractiveness of personal lines. It plans to reduce costs by £20 million ($27.18 million) annually by FY2030 by streamlining its premium finance business, which will shift focus to commercial lines and expects a 30% decline in its premium finance loan book over the next three years. Year-to-date, CBRO stock is up 60.8%, despite the session losses.

London-listed miners fell 1.6% as copper prices dropped after President Trump's proposed 50% tariff on imports. Antofagasta and Glencore decreased by 2.3% and 1.7%, while Anglo American fell 2.2%. They are among the top losers on the FTSE 100 index, with Rio Tinto down 0.7%. The sub-index is down approximately 8% YTD.

Hunting PLC shares rose 12.7% to 337.9p, the highest since February 2025, making it the top gainer on the FTSE mid-cap index. The company announced a $40 million share buyback program and plans to grow its annual dividend by 13%, up from a previous target of 10%. Year-to-date, HTG is up approximately 16%.

UK-based video game developer Everplay's shares rise 11.2% to 346p, the highest since November 2023. It expects FY results to slightly exceed market expectations due to strong back catalogue performance and positive momentum heading into H2. The company reports strong H1 performance with new game releases and YTD, EVPL stock is up 57%.

Shares of British vehicle rental provider ZIGUP fell 9.7% to 327p, marking the largest intraday loss since December 2024. The company's FY pretax profit decreased by 7.6% to £166.9 million ($226.9 million) year-over-year, while the stock is up 1.87% YTD.

Shares of Genuit Group rose 6.6% to 403.5 pence, marking its best one-day gain since December 2023, after J.P. Morgan upgraded the stock to "overweight" and raised the 18-month price target to 490p from 450p. This indicates a potential 29.5% upside. JPM noted early recovery signs, particularly in new build residential, and expects stronger performance in FY26/FY27 due to market share gains and upcoming investment cycles. The average rating from nine analysts is "buy," with a median 12-month price target (excluding JPM) of 482.5p.

Technical & Trade View

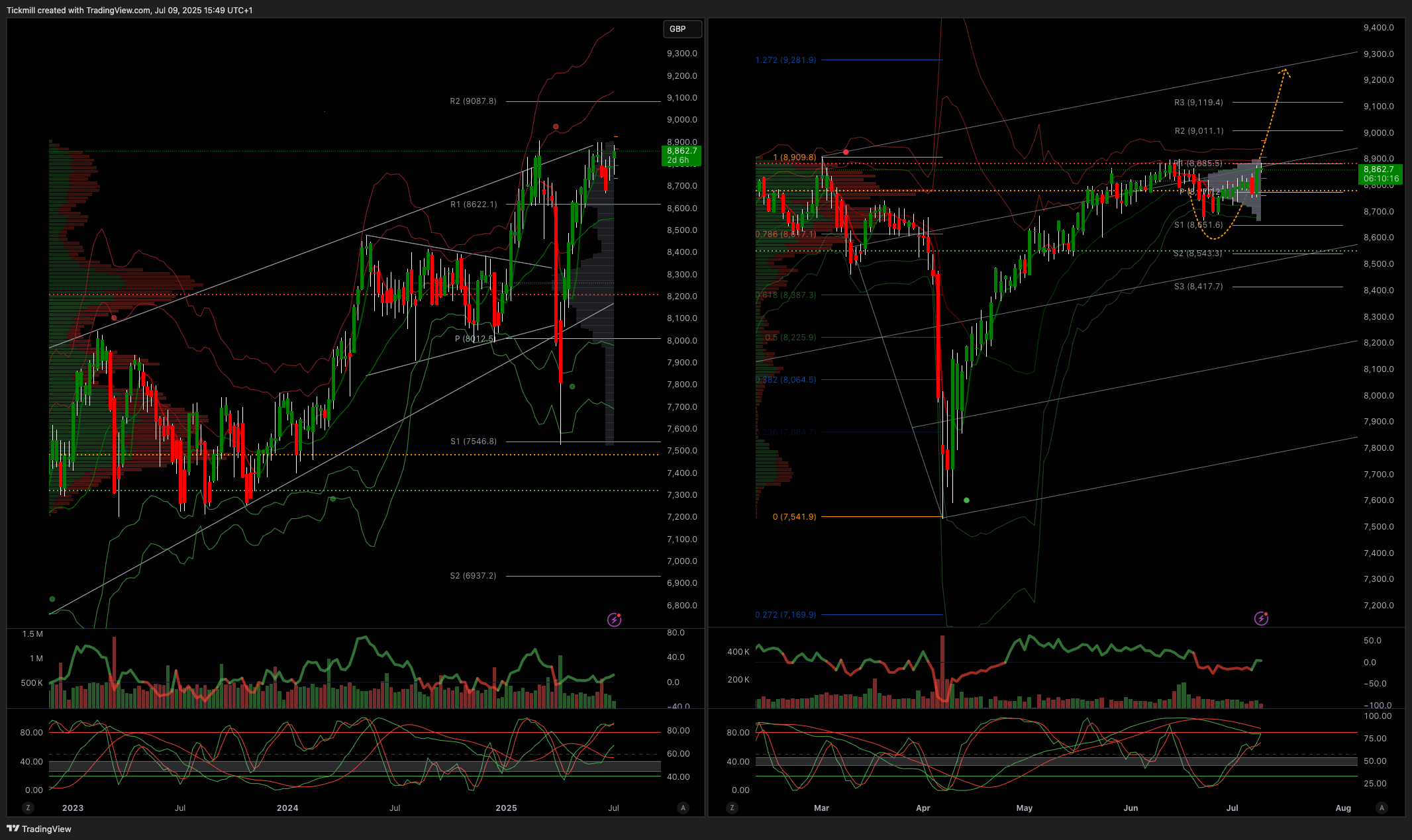

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!