The FTSE Finish Line: July 8 - 2025

The FTSE Finish Line: July 8 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's primary indexes advanced on Tuesday, as investors analysed recent tariff developments alongside a mix of corporate updates. On Monday, U.S. President Donald Trump announced that 14 nations, including Japan and South Korea, would face 25% tariffs starting August 1, while leaving room for potential negotiations. Notably, Britain and Vietnam have successfully secured agreements to bypass these new duties, which are separate from existing tariffs on vehicles, steel, and aluminium. Precious metal mining companies led the market gains, rising 2.3% while gold prices remained stable. Hochschild led the top performers with a 4.1% surge, followed by Fresnillo and Endeavour Mining with 2.5% and 1.6% rises, respectively. Industrial metals also showed positive momentum, with copper prices ticking higher. Glencore gained 2.9%, and Anglo American and Antofagasta recorded modest increases.

For the remainder of the week, key developments in the UK macroeconomic landscape include May's monthly GDP data (Friday), which is anticipated to show a contraction of 0.1% m/m, despite consensus forecasting a modest expansion of 0.1% m/m. Additionally, the Bank of England will release its semi-annual Financial Stability Report on Wednesday. Another notable event is the publication of the OBR’s Fiscal Risks and Sustainability Report on Tuesday. While this report has garnered increased attention, it is unlikely to significantly impact markets. Its conclusions are expected to offer little improvement to the overall fiscal outlook, as the focus will primarily be on a timeline extending well beyond the critical five-year horizon tied to fiscal rules.

Single Stock Stories & Broker Updates:

BofA Global Research upgrades Persimmon Plc to "buy" and raises its price target to 1,350p from 1,260p. The shares of the UK housebuilder, Persimmon Plc, have increased slightly. BofA notes that Persimmon's affordable products (15% cheaper than peers) and strong presence among first-time buyers will benefit from expected rate cuts by the Bank of England, with three more cuts anticipated in 2025. The firm also highlights Persimmon's vertical integration contributing to margin expansion. Of 17 brokerages, 13 rate the stock "buy" or higher, with a median price target of 1,518p. Year-to-date, the stock has fallen 0.1%, compared to a ~2.81% decline in the British homebuilders index.

Shares of UK-based polymer manufacturer Victrex dropped over 10% to 702 pence, potentially marking its largest decline since May 2023. The company appointed James Routh as CEO to replace retiring Jakob Sigurdsson and expects H2 pretax profit to match H1 due to Q3 sales trends. Year-to-date, Victrex's stock is down 34.3%.

Shares of SIG PLC are down 3.4% at 14p, with the company cautious about H2 market improvement and no notable demand increase in H1. Pim Vervaat has been appointed as CEO. FY underlying operating profit is expected to align with market consensus of £31.6 million ($43.06 million), according to a company poll. SHI is down approximately 12% YTD.

Technical & Trade View

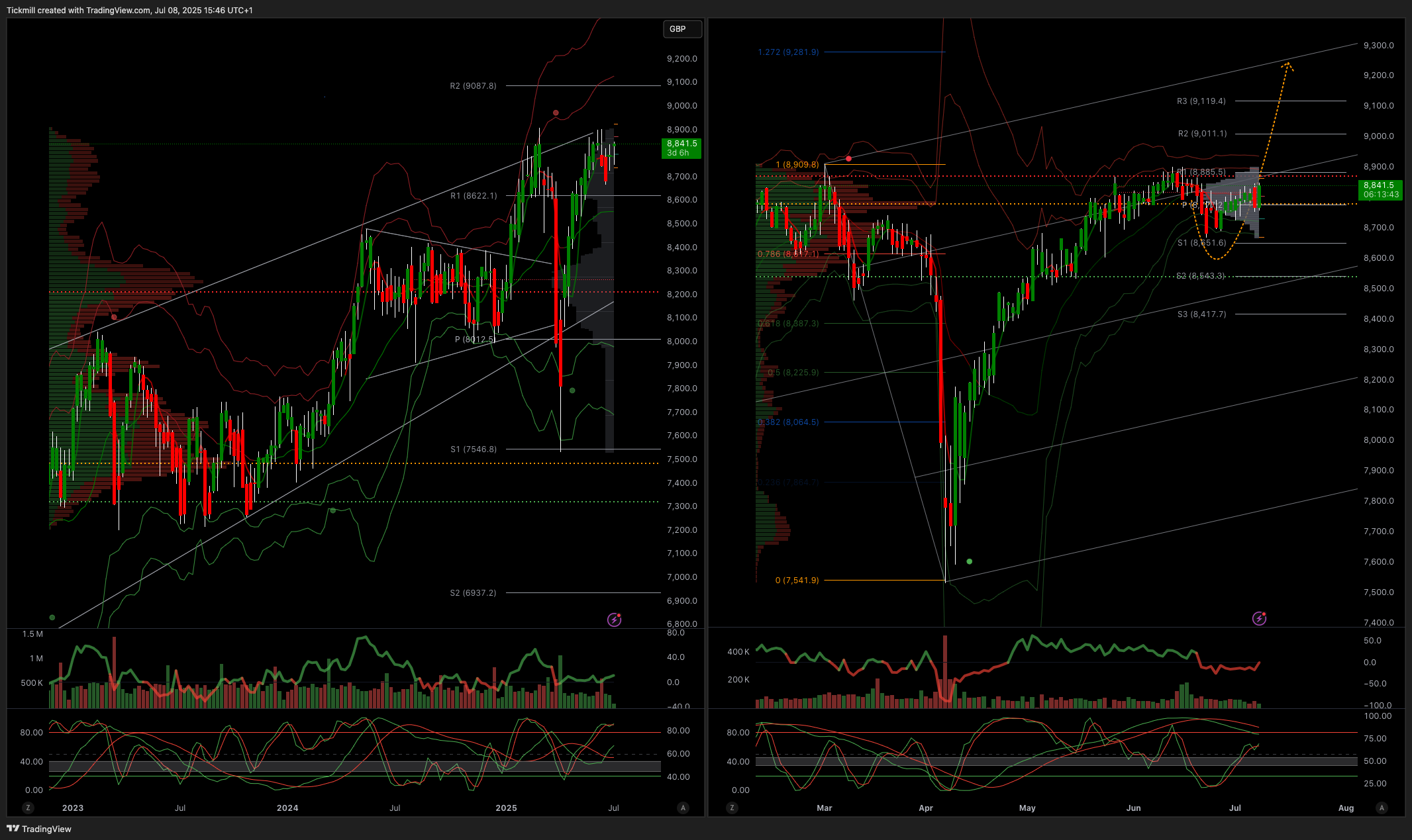

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!