The FTSE Finish Line: July 3 - 2025

The FTSE Finish Line: July 3 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

The main stock indices in the UK experienced gains on Thursday, driven by broad support after British Prime Minister Keir Starmer expressed his full support for finance minister Rachel Reeves, which alleviated fears regarding her position. The FTSE 100, a prominent blue-chip index, along with the midcap index, closed down on Wednesday after Reeves' emotional appearance in parliament, which followed a series of controversial reversals on welfare reforms that significantly impacted her budget proposals. Additionally, Britain's bond market stabilised after worries over debt prompted a selloff in the previous trading session. The government succeeded in passing its welfare reform bill on Tuesday; however, it had to eliminate long-term cost-saving provisions, raising concerns that achieving a balanced budget may necessitate increasing taxes or reducing spending in other areas. There are still some concerns about the government finding itself in a difficult position and losing control over public finances. According to the S&P UK services PMI, activity in the British services sector grew at its highest rate in nearly a year, while the increase in prices was at its slowest in almost four years. The Bank of England is carefully monitoring service sector prices to evaluate inflationary pressures, and investors largely anticipate a rate reduction in August.

Single Stock Stories & Broker Updates:

Shares of Currys rose by 9.8% to 130.1p, the highest since December 2021, after reporting annual adjusted pretax profit above expectations. The retailer has raised its annual profit target three times, driven by strong demand in mobile, gaming, and premium computing in the UK and Ireland. It remains confident in achieving a 2025/26 adjusted PBT of £167 million. Year-to-date, its stock is up nearly 25%, compared to a 5% rise in the FTSE mid-caps index.

Shares of Watches of Switzerland dropped 10.2% to 378.4p, warning that profit margins for fiscal 26 will be pressured as brand partners like Rolex and Cartier raise U.S. prices due to tariffs. Some partners are also cutting distribution margins. The company expects 6% to 10% constant currency revenue growth for FY26, assuming the 10% U.S. tariff remains after its 90-day pause, compared to 8% growth in 2025. Year-to-date, the stock is down approximately 29%.

Technical & Trade View

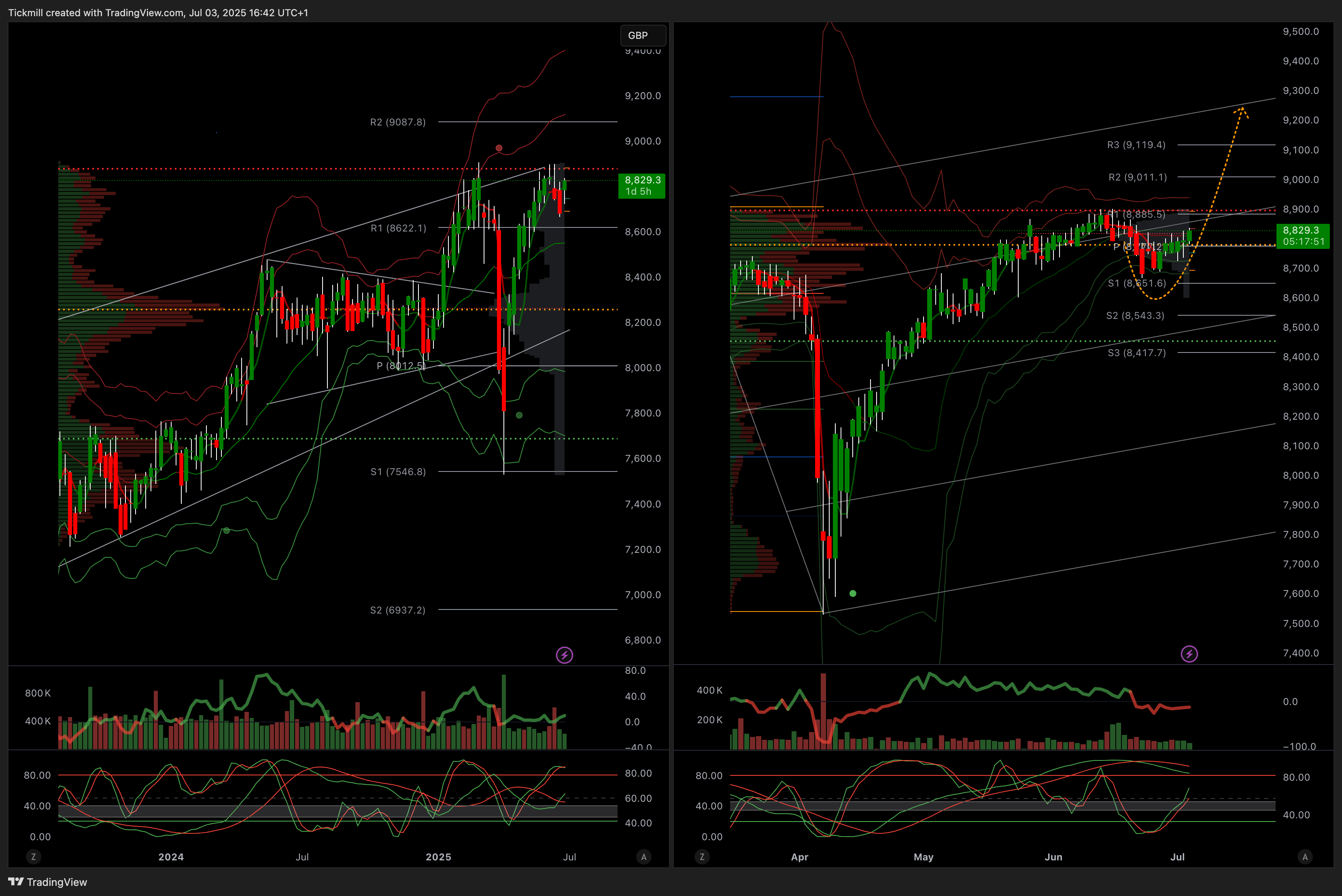

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!