The FTSE Finish Line: July 28 - 2025

The FTSE Finish Line: July 28 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's main stock indexes edged higher initially on Monday as investors evaluated a trade agreement between the United States and the European Union. However, enthusiasm waned toward the close, driven by a "buy the rumor, sell the news" sentiment.

On Sunday, the U.S. reached a preliminary trade agreement with the EU, which includes a 15% tariff on the majority of EU products and mandates the bloc to invest approximately $600 billion in the U.S. British Prime Minister Keir Starmer is scheduled to meet U.S. President Donald Trump in Scotland on Monday for discussions covering their recent bilateral trade agreement and the escalating hunger crisis in Gaza.

In the stock market, automobile and parts shares led the sector increases, with a rise of 1.1%. The real estate sector saw a gain of 0.8%, driven by Rightmove up 2.3% and Segro increasing by 1.1%. Conversely, industrial mining stocks experienced the largest declines, dropping by 0.9% as metal prices fell. Miners like Glencore decreased by 1.4%, while Rio Tinto fell by 1%.

Single Stock Stories & Broker Updates:

Shares of technology and services firm Computacenter fell by 4% to 2,144p, making it one of the largest decliners on the FTSE mid-cap index. The company anticipates a decline in H1 net interest income of over 6 million pounds ($8.1 million) compared to the previous year, having reported net interest income of 8 million pounds for H12024. Computacenter noted that trading in Germany and France was weaker during Q2 due to temporarily reduced public sector activity linked to political changes. Despite the recent shifts, the stock remains up 1.4% year-to-date.

Shares of Drax Group, a British power generator, increased by 1.7% to 689 pence. Citigroup has raised its rating on the stock from 'sell' to 'neutral' and increased the target price from 529 pence to 682 pence. The bank anticipates that the company will continue its buyback program to bolster share prices, supported by strong cash flow and reduced capital expenditures in the near future. Drax is expected to announce its quarterly results on July 31, according to data from LSEG. Of the 7 brokerages covering the stock, 4 have a "buy" or higher rating, while the rest have it rated as "hold," with a median price target of 725 pence, according to LSEG. With today's gains, the stock has risen 6.3% year-to-date.

Shares of digital media firm STV Group plummeted over 27% to 138 pence. This marks the potential for the largest single-day percentage decline, with the stock price reaching its lowest point since early 2013. The company anticipates that its full-year revenue and adjusted operating profit will fall short of expectations. Group revenues for the full year are projected to be between £165 million and £180 million ($221.50 million to $241.63 million), with an adjusted operating margin forecasted at around 7%. Year-to-date, STV shares have decreased by 34.24%.

British investment holding firm Ocean Wilsons Holdings experienced a decline of 10.6%, bringing its share price to 1,305p; this marks its largest one-day percentage drop since August 2018. The stock is among the biggest losers in the London market. The company has entered into an agreement with Hansa Investment for an all-share merger, aiming to establish a diversified investment entity with over 900 million pounds ($1.21 billion) in net assets. OCN has lost approximately 1% year-to-date.

Shares of Tasty PLC, a British restaurant operator, have increased by 90% to 1.18 pence. The company has verified discussions with David Page, the former CEO of PizzaExpress, and Nicholas Wong, the former CFO of The Fulham Shore, regarding their appointment to the board. Additionally, Tasty PLC has stated that it is evaluating funding options, which include raising equity capital. Despite recent gains, TAST shares are down 5% year-to-date.

Technical & Trade View

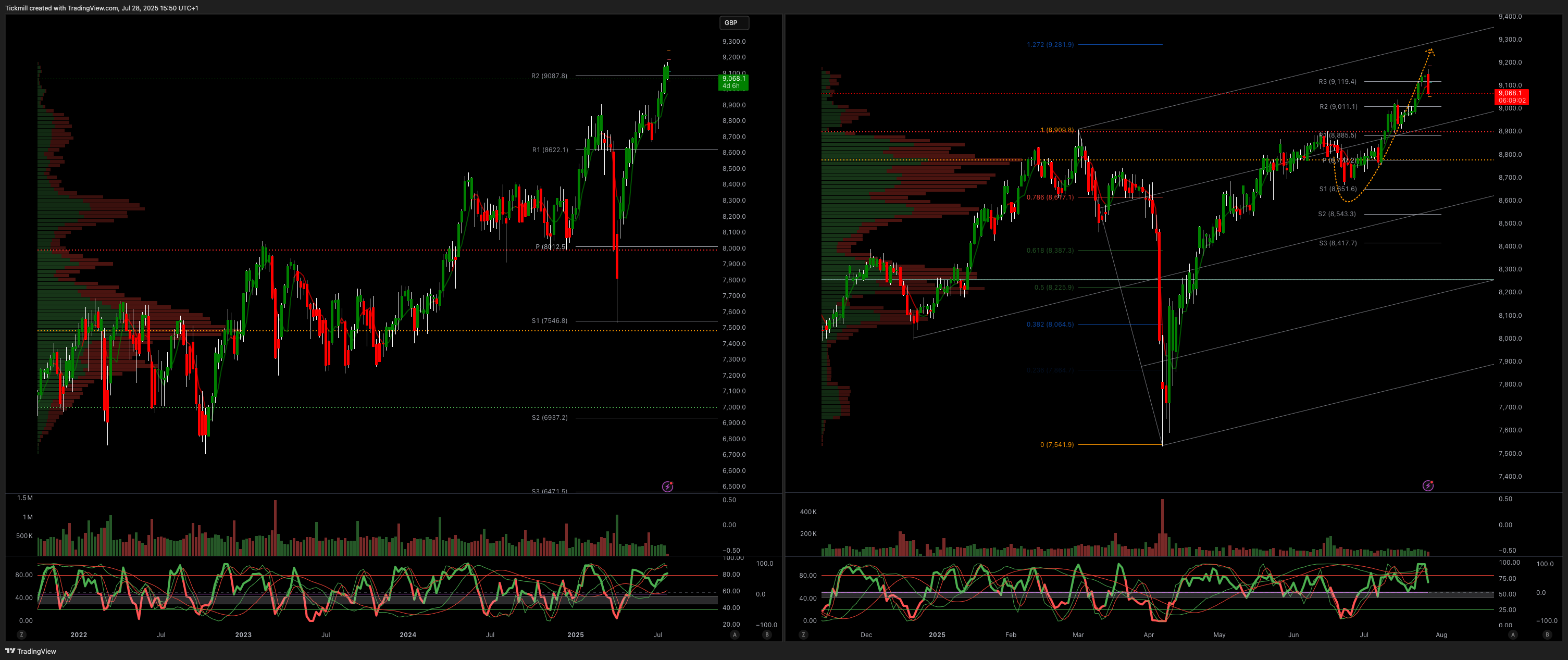

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!