The FTSE Finish Line: July 25 - 2025

The FTSE Finish Line: July 25 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's primary stock indexes declined on Friday as investors evaluated a variety of corporate earnings and looked forward to news on EU-U.S. trade negotiations. The globally focused FTSE 100 dropped by 0.3%, retreating from its highest point achieved on Thursday, yet still poised to mark its fifth consecutive weekly increase. Data indicated that British retail sales increased by 0.9% in June, bouncing back partially from a significant 2.8% decline in May, which marked the largest drop since December 2023. A survey revealed that consumer confidence decreased this month in anticipation of potential tax hikes later in the year, leading households to bolster their savings. In the stock market, construction and materials sectors experienced a downturn, falling by 1.8%, notably impacted by Marshalls, which plummeted by 21.6% due to a disappointing forecast for full-year adjusted pre-tax profits. Precious metal mining stocks dropped by 1.7%, reflecting a decrease in gold prices, with Hochschild Mining down 2.8%, Endeavour Mining declining by 1.3%, and Fresnillo slipping by 2.2%. In contrast, the automobile sector saw an increase of 0.7%. Investors are keen to find out if the European Union can finalise a trade agreement with the U.S. ahead of President Donald Trump's August 1 deadline. At the same time, British Prime Minister Keir Starmer plans to urge Trump to expedite a conclusive agreement to reduce tariffs on British steel, as reported by the Financial Times.

Single Stock Stories & Broker Updates:

Shares of Rightmove dropped by as much as 4.6% to 758.6p, making it one of the biggest losers on the FTSE 100 index. The UK's largest property portal anticipates that revenue growth for the second half of 2025 will be less than the 10% growth seen in the first half. RMV continues to project overall revenue growth between 8% and 10% for the entire year. Prior to Thursday's closing, the stock had increased by nearly 24% in 2025.

Shares of Mitchells & Butlers, a British pub and restaurant chain, rose by 6.4% to 307.2p, making it the top performer in the FTSE mid-cap index. The company reported a 5% increase in like-for-like sales for Q3, attributed to early summer boosting customer attendance at its outlets. It also anticipates that annual results will meet the upper end of market expectations. Including today's movements, the stock has gained 25.3% year-to-date.

NatWest shares have risen by 1.4% to 508p, making it one of the top performers on the FTSE 100 index. The company reported an 18.4% increase in operating pretax profit for the first half of the year and announced a share buyback program worth 750 million pounds ($1.01 billion). Year-to-date, the stock is up 26%, compared to an 11% rise in the FTSE overall.

JD Sports shares fell 2.2% to 91.14p after partner Puma cut its annual outlook, citing currency issues and U.S. tariffs. Puma now expects a sales decline of at least 10%, instead of previous low single-digit growth predictions. JD is down 3.02% YTD.

Shares of Softcat, an information technology firm, increased by 1.6% to 1,634p. Brokerage Panmure Liberum has upgraded the stock to "buy" from "hold," while maintaining a target price of 1,800p. According to Panmure Liberum, Softcat is well-positioned to take advantage of the ongoing growth in Cloud, AI, and cybersecurity, with Cloud and software vendors anticipated to experience double-digit growth rates in CY25/26. In May, Softcat raised its annual operating profit forecast. Including recent gains, the stock is up 7.1% year-to-date.

Shares of Close Brothers increased by as much as 12% to 461p, reaching their highest level since September 2024. The stock is the leading gainer on the FTSE mid-cap index, which has declined by 1.86%. The company has announced the sale of its execution services and securities business, Winterflood, to Marex for £103.9 million ($139.91 million). So far this year, the stock has nearly doubled in value.

Jupiter Fund Management falls 5% to 128p; H1 2025 underlying pre-tax profit down 36% y/y; net inflows of 300 mln pounds in Q2 vs 500 mln outflows in Q1; YTD JUP up 51.33%.

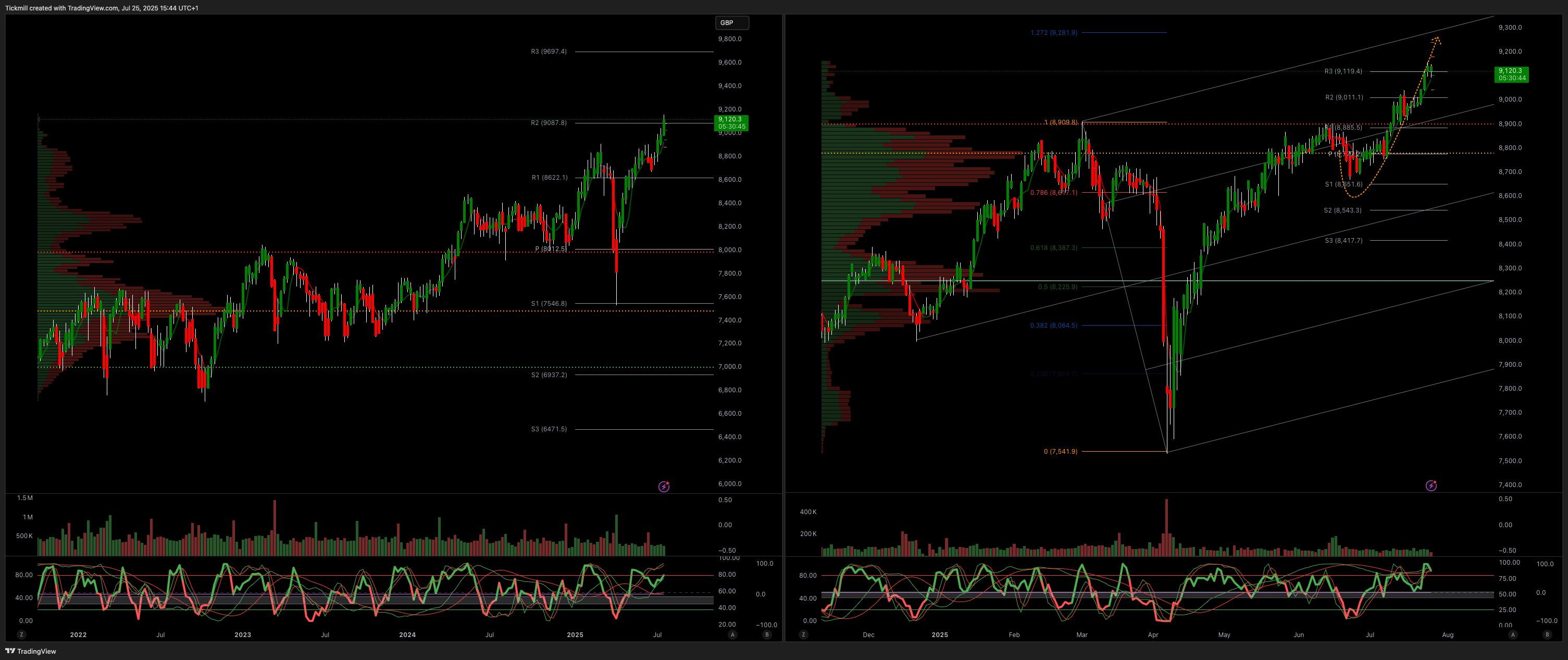

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9280

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!