The FTSE Finish Line: July 24 - 2025

The FTSE Finish Line: July 24 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's primary stock indices increased on Thursday, with the blue-chip index reaching a record intraday high, driven by positive corporate earnings and hope for a possible trade deal between the EU and the U.S. During the May meeting of the Bank of England, there was an unexpected three-way voting division; Thursday's PMI data prepares markets for another split decision next month. The data indicated that British business activity experienced only modest growth in July, with employers reducing jobs at the quickest rate in five months. However, the rate of price increases charged by companies accelerated for the first time since April. The key question for the BoE is determining which factor is more significant—rising inflation or declining job growth. Last month was more straightforward, with six votes in support of maintaining the current policy and three in favour of a cut. However, if August appears tumultuous, it wouldn't require much more disagreement to reach a 3-4-2 vote, which wouldn't foster confidence. Currently, market estimates suggest there is approximately an 80% likelihood of a 25 basis point reduction.

Single Stock Stories & Broker Updates:

Centrica's shares have fallen by as much as 2.61% to 154.6 pence. The stock is among the biggest losers on the FTSE 100 index. The company reported a half-year adjusted operating profit of 549 million pounds ($744.61 million), which represents a decline of approximately 46.9% year-over-year. Nevertheless, despite the drop on Thursday, the stock has risen about 17.3% year-to-date.

Shares of Howden Joinery have risen by as much as 9.87% to 918p, reaching a nine-month peak. The stock is the top performer in the FTSE 100 index, which has increased by 0.5%. The company reported a half-year profit before tax of £117.2 million ($158.96 million), marking a 4.4% year-over-year increase. It is on track to meet its targets for 2025. With this session's increase, HWDN has gained approximately 15.25% year-to-date.

Vodafone's shares increased by 2.3% to 85.08p, marking the highest level since May 2023. The company's Q1 organic service revenue saw a rise of 5.5%. The CEO of Vodafone mentioned that the company is nearing a return to service revenue growth in Germany. Year-to-date, VOD has grown by approximately 24%.

Technical & Trade View

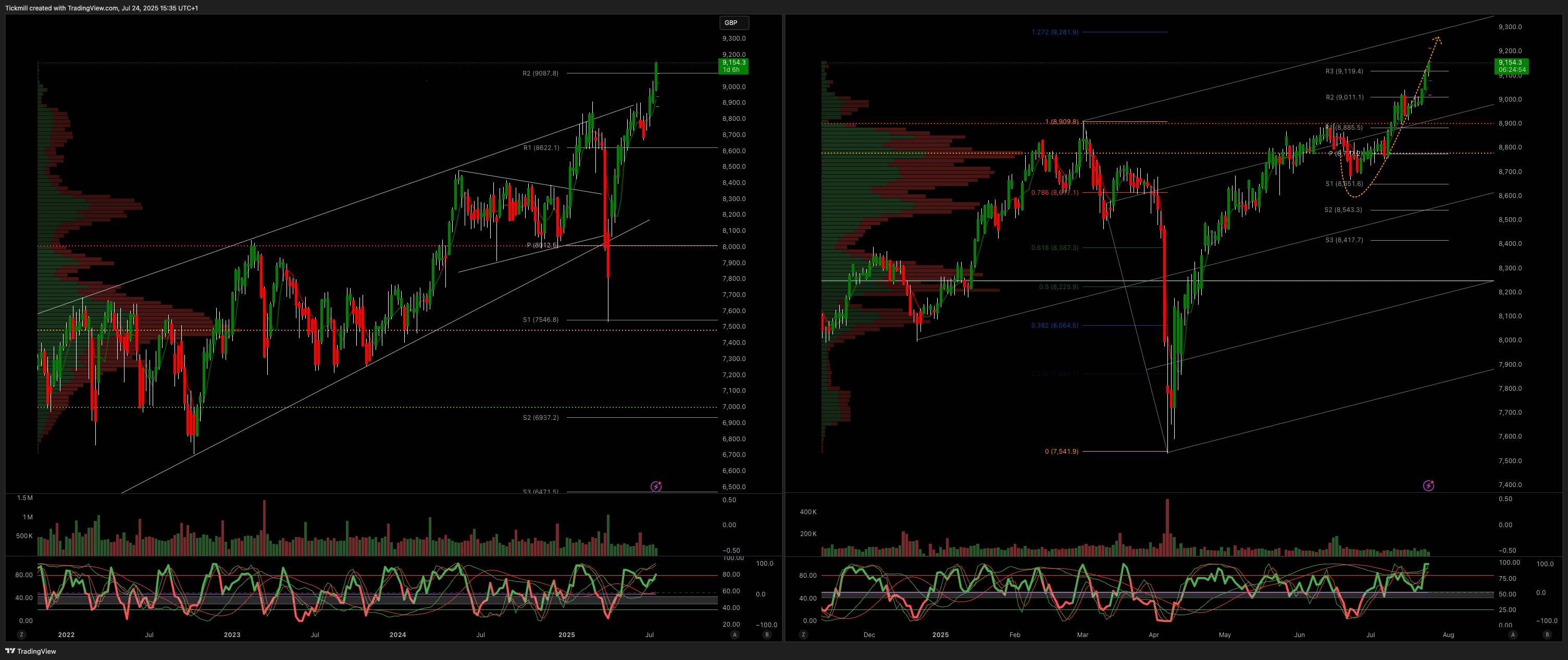

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!