The FTSE Finish Line - July 24 - 2023

FTSE Marking Time Ahead Of Central Bank Policy Updates Ahead

On Monday, the UK's FTSE 100 index remained flat, with gains in telecoms firm Vodafone Group offsetting losses in financial stocks. Vodafone Group saw a significant increase of 4.7% in its stock price after reporting accelerated revenue growth in the first quarter. Additionally, the company announced the appointment of Luka Mucic, former CFO of SAP, as its new finance chief. However, the travel and leisure sector, which includes major UK airline firms, experienced a decline of 0.6% following cautionary statements from Ryanair about travel demand for the rest of the year. UK banks also eased 0.5% after a strong performance last week, where they gained over 4%. Looking ahead, investors are closely watching for the interest rate decisions from the U.S. Federal Reserve, European Central Bank, and the Bank of Japan, which are scheduled to be announced later this week. These central bank decisions are likely to have significant impacts on the global financial markets.

A recent survey indicated that Britain's private sector is experiencing its slowest growth rate in six months in July. The survey revealed that business orders have stagnated amid the challenges posed by rising interest rates and persistently high inflation. Investors and analysts expect the Bank of England to take further monetary policy measures in response to the persistent inflationary pressures in the country.

In the blue chip index, Ocado Group saw a significant jump of 9.9% after the online supermarket group and Norwegian robotics firm AutoStore settled patent litigation claims through a deal.

On the negative side of the ledger, S4 Capital, a company founded by Martin Sorrell, faced a sharp decline of 16.2% after it lowered its annual revenue and margin outlook. Insurer Prudential saw a decline of 2.3% following a reduction in its price target by Citigroup.

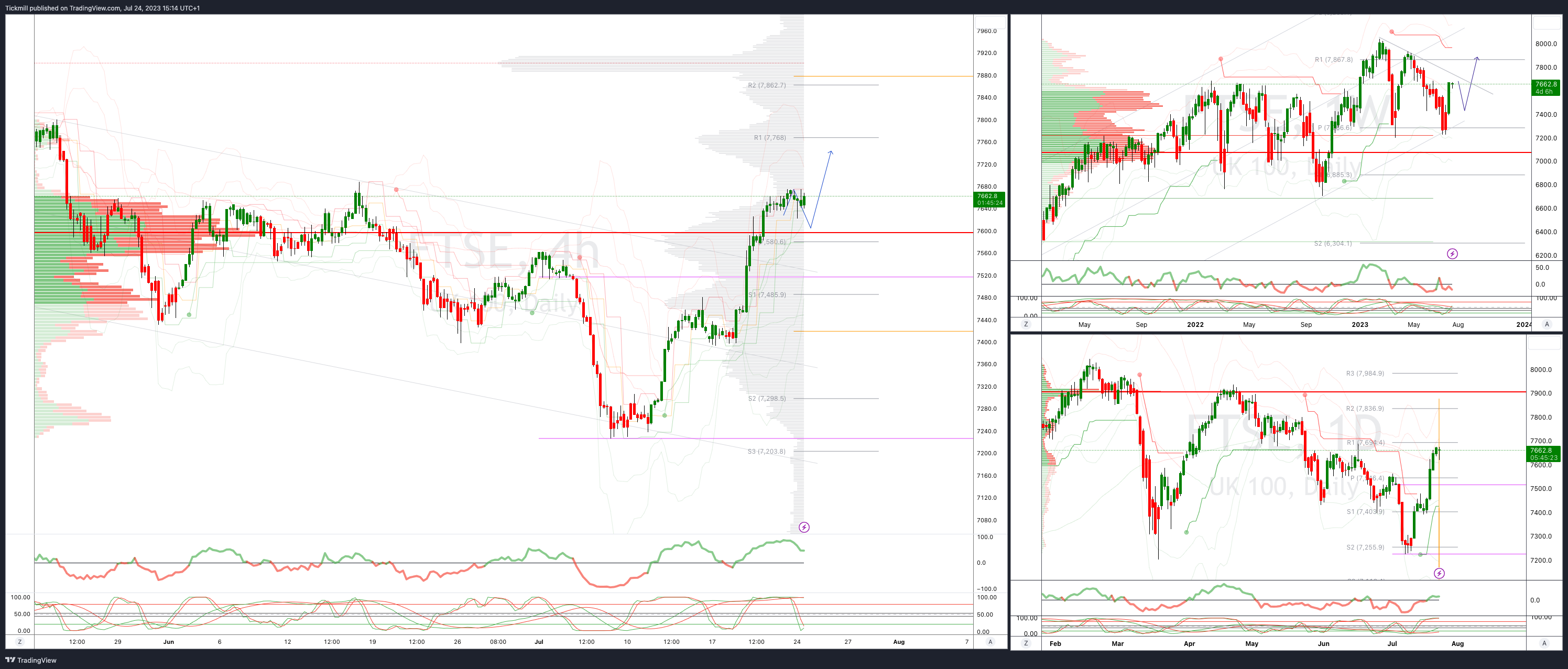

FTSE Intraday Bullish Above Bearish below 7550

Below 7490 opens 7380

Primary support is 7400

Primary objective 7700

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!