The FTSE Finish Line - July 23 - 2024

The FTSE Finish Line - July 23 - 2024

FTSE Reverses Lower As Copper’s Decline Weights On The Miners

On Tuesday, London's FTSE 100 saw a decrease as copper miners had a significant impact on the market due to lower copper prices. However, positive updates from companies helped to limit the overall decline. The blue-chip FTSE 100 index was down by 0.74% following its strongest session in over a week on Monday, while the mid-cap FTSE 250 showed a marginal increase. Industrial metal miners experienced a 1.7% loss, with major players like Rio Tinto and Glencore each slipping over 1% as a result of pressure on copper prices caused by growing concerns about sustained weakness in Chinese demand.

Glencore, a miner and commodities trader, saw its shares decline by 2.4% to 432.9 pence, making it the top loser on the FTSE 100 index. This drop came after analysts at HSBC reduced the price target from 455p to 435p due to a decrease in commodity prices in June, driven by global uncertainty from elections, conflicts, and trade tensions. HSBC also lowered peer Anglo American's price target to 2300p from 2450p, citing the removal of GEMCO sales volumes from its estimates following a temporary closure of GEMCO's operations. As a result, Anglo American's shares fell by 2.2% to 2,184p, also ranking among the top losers on the FTSE 100 index. Year-to-date, Glencore's shares have fallen by 8.2%, while Anglo American's have risen by 10.8%.

Compass Group, a British catering company, has seen its shares rise by 3% to 2,257p, making it the top gainer on the FTSE 100 index. The company has raised its full-year guidance, expecting underlying operating profit to grow by more than 15% and organic revenue to increase by more than 10%, compared to previous guidance of profit increasing towards 15% and revenue towards 10%. In the third quarter, organic revenue growth exceeded analysts' estimates, coming in at 10.3%. The company also reported accelerated net new business growth in Q3, with pricing moderating in line with inflation. The stock of Compass Group has risen by about 2% year-to-date.

Beazley, a UK insurer, sees a 2.9% increase in its shares to 668.50p, making it one of the top percentage gainers in the FTSE 100 Index. Despite a global IT glitch on Friday, the insurer maintains its outlook and states that it will not change its current guidance for the full year. The IT outage, caused by a software update from cybersecurity firm CrowdStrike, affected various industries including banks and media companies. Beazley's stock is up approximately 28% year-to-date, including the gains from the current session.

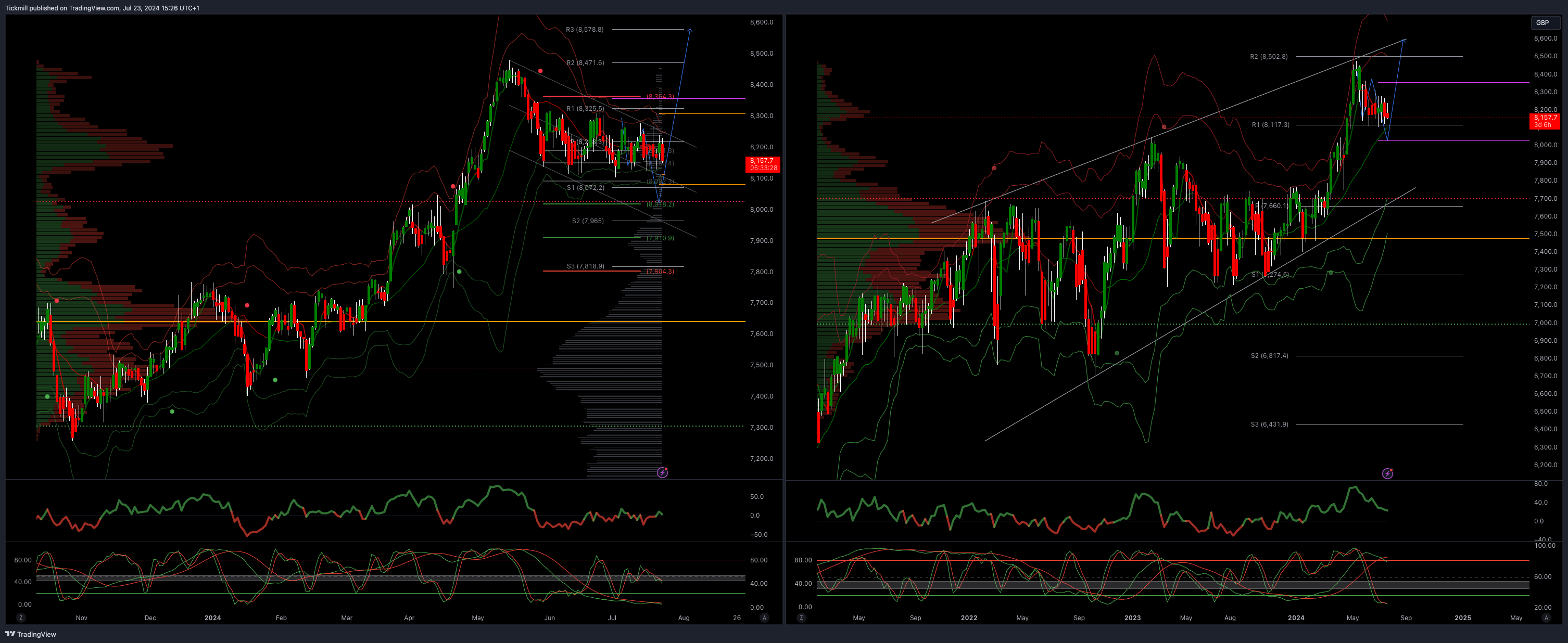

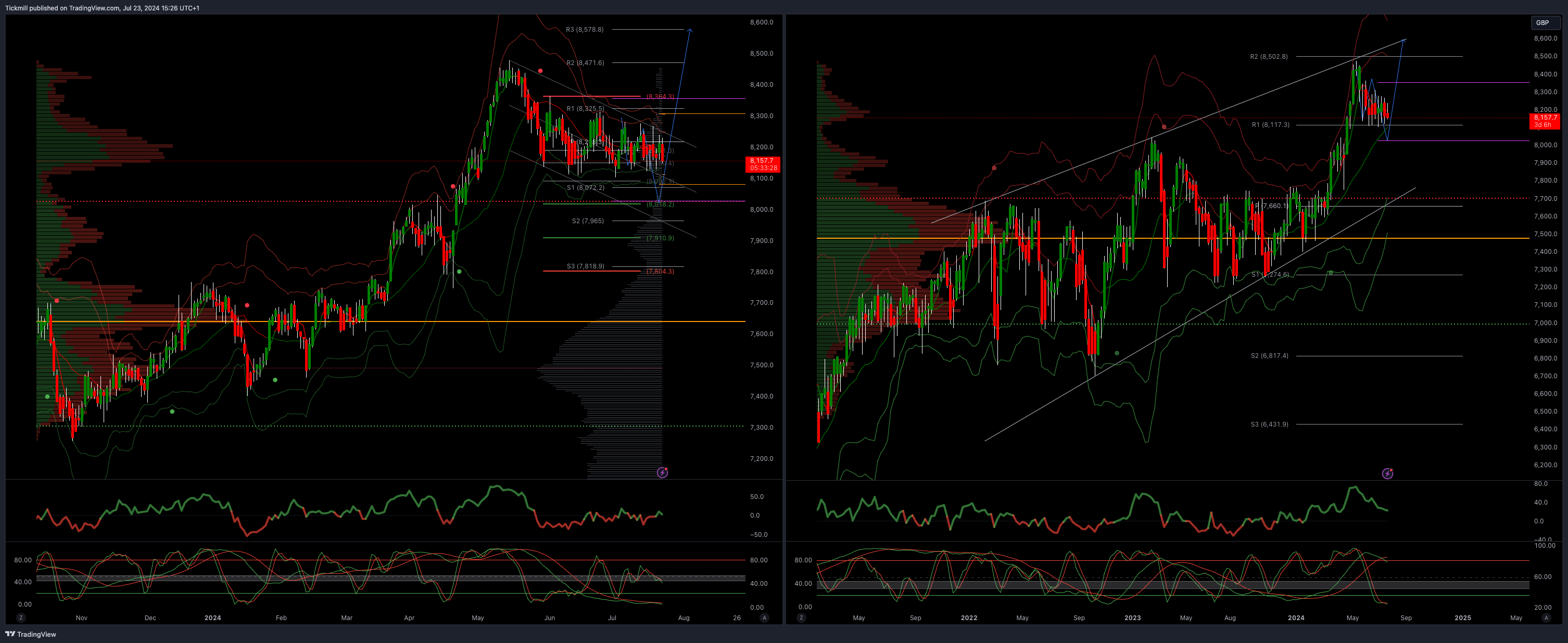

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bearish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!