The FTSE Finish Line: July 2 - 2025

The FTSE Finish Line: July 2 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

Reduced cuts to welfare are reigniting concerns over the UK's fiscal stability. The GBP/USD currency pair has dropped from a 3.5-year high of 1.3787 on Wednesday to a one-week low of 1.3581. The implied volatility in foreign exchange markets has surged, increasing the cost of standard FX options. Risk reversals in options trading indicate a higher volatility premium for GBP puts compared to calls, with 1-month 25 delta risk reversals shifting to 0.5 for GBP puts from 0.1 for GBP calls. There's a correlation between spot prices and risk reversals that is likely pushing implied volatility higher as GBP/USD declines. Recent worries about barriers or triggers at 1.4000 are currently on hold. The market seems to be theorising that Reeves might be dismissed. Nonetheless, the Prime Minister's press secretary asserts that Reeves has the Prime Minister's complete backing. The EUR/GBP has reached a five-month peak at 0.8650, and UK 10-year yields climbed to a high of 4.68%. The market movements resemble a bond vigilante reaction, with both the GBP and gilts declining. Consequently, a decrease in gilt yields will be necessary for a recovery of the GBP.

The FTSE's most valuable company, AstraZeneca, is reportedly considering shifting its listing to the U.S., according to the Times on Thursday, citing multiple sources. The CEO appears frustrated with the insufficient financial support for establishing new laboratories and manufacturing facilities in Europe and views a full U.S. stock listing as a potential pathway to gaining more favourable treatment in the United States. The UK stock market has recently missed out on major initial public offerings, including the money transfer firm Wise and the online fast fashion giant Shein, as Brexit-related challenges continue to impact market valuations in the region.

Single Stock Stories & Broker Updates:

Spectris shares rose 4.6% to 4006.9p, their highest since September 2021, after accepting a takeover offer from KKR valuing the company at approximately £4.7 billion ($6.46 billion). Shareholders will receive £40 per share, which includes £39.72 in cash and a 28p interim dividend. KKR's offer is 6.3% above Advent's prior offer of £37.63 per share. Year-to-date, SXS shares are up 59.6%.

Shares of SSP Group rose 7.8% to 187.4p, their highest in over 6 months, making them the top gainer on the FTSE 250 index. The company is filing for an Indian IPO of its airport lounge joint venture, TravelFood Services, with an IPO price set between 1,045 and 1,100 rupees, indicating a market cap of 137.6 to 144.8 billion rupees ($1.61 to $1.69 billion). SSPG will acquire an additional 1.01% stake, raising its total to 50.01% in TFS. Prior to Tuesday, the stock had dropped 3.8% in 2025.

Shares of Topps Tiles rose 9% to 36.98p, becoming the top gainer in the FTSE Small Cap index. The company reported 10.1% growth in Q3 adjusted sales, up from 4.1% in H1, and expects a slightly higher H2 adjusted gross margin. The recently acquired CTD Tiles business is anticipated to break even by Q4. Analysts at Peel Hunt expressed confidence in Topps Group's performance and market share growth through self-help initiatives and acquisitions. Year-to-date, TPT stock is down 2.68%.

Shares of Secure Trust Bank rose 7% to 854 pence, a 10-month high. The company will cease vehicle financing to enhance its return on average equity and anticipates 284 job cuts by 2030, with 78 in 2025. It plans to streamline costs as the loan book declines, aiming to cut over £25 million in operating expenses by 2030. YTD, STBS has increased approximately 134%.

Greggs shares fall 13.01% to 1720p, marking their biggest one-day drop since January 9. The stock is the second-biggest loser on the FTSE 250 index. The company expects annual operating profit to be modestly below last year, with June sales affected by high temperatures. H1 total sales reached 1.03 billion pounds ($1.42 billion), up 6.9% YoY. Year-to-date, the stock is down ~31%.

Technical & Trade View

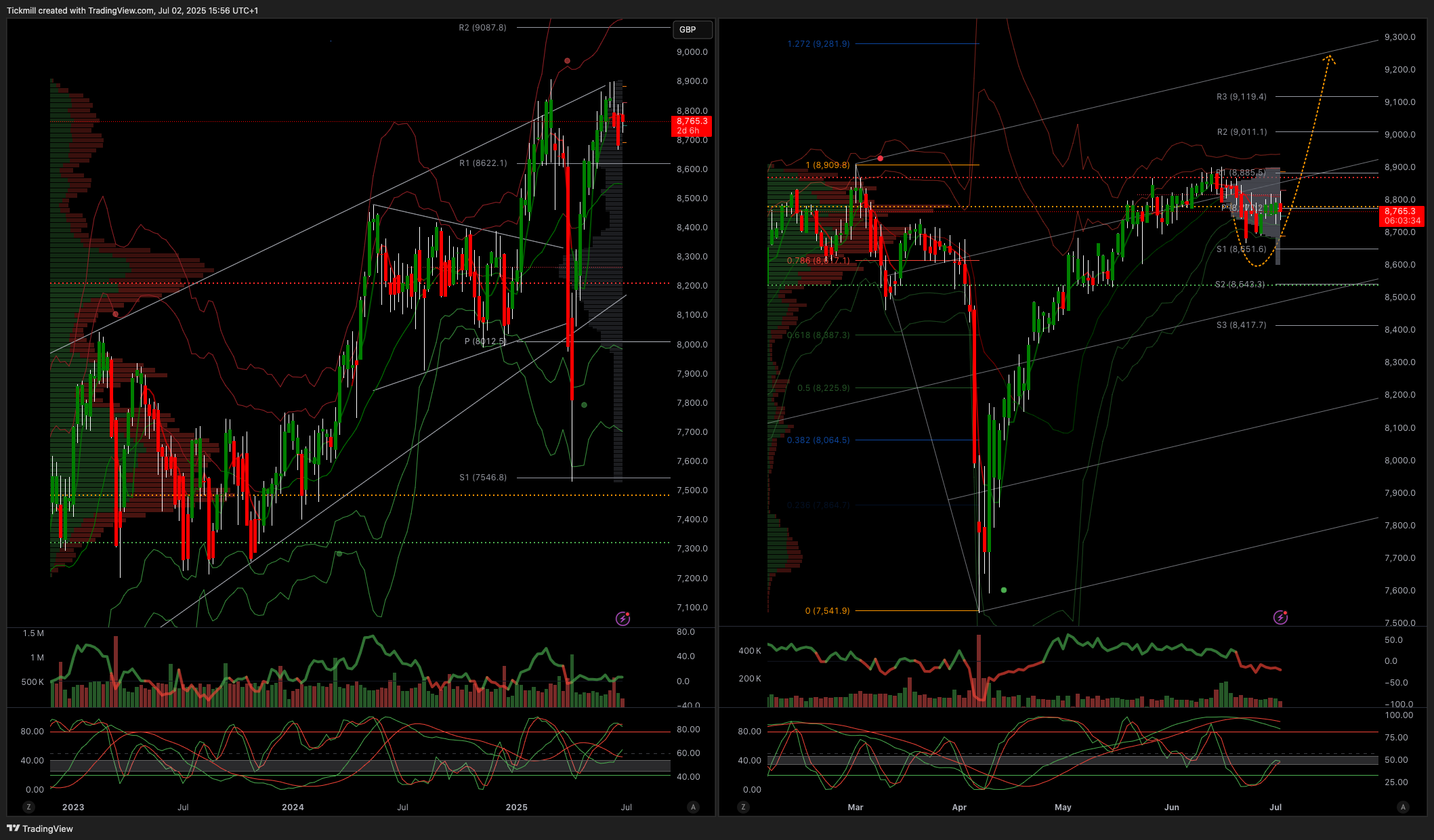

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!