The FTSE Finish Line - July 19 - 2024

The FTSE Finish Line - July 19 - 2024

FTSE Closing The Week In The Red Amidst Global Tech Outage

London stocks experienced a decline on Friday as investors reacted to a decrease in domestic retail sales in June, coupled with a drop in commodity prices and global tech turmoil. The FTSE 100 index fell by 0.11%, indicating a downward trend for the week. The FTSE 250 also decreased. The decline in precious metal miners, with a 2.5% drop, heavily impacted the index. Fresnillo experienced a 5.4% decrease, leading to the lowest position in the FTSE 100, in line with the decline in spot gold prices by more than 1%. Industrial metal miners also fell by 1.9% due to the decrease in copper prices, which reached a three-month low without Chinese stimulus measures. On the other hand, aerospace and defence stocks saw a 0.2% gain amidst the broader declines, following discussions between senior executives from British defence firms and Ukrainian President Volodymyr Zelenskiy regarding the need to enhance military support in the country's conflict with Russia.

The latest domestic retail sales data revealed a 1.2% decline in June, exceeding the estimated 0.4% fall, leading to an increased likelihood of an August cut to 43%, up from approximately 39% on Thursday. This follows recent data indicating a slowdown in wage growth and inflation at the Bank of England's 2% target.Personal goods and retail stocks experienced declines of 2.8% and 0.6% respectively. In London, Hargreaves Lansdown saw a 1% decrease despite strong growth in new customers and net new business in the fourth quarter. LSEG Group's shares also slightly declined following an outage on its Workspace news and data platform that affected user access worldwide.

Looking ahead, focus will shift to corporate earnings in the United States and the UK next week. U.S. inflation numbers will be closely monitored as the last crucial dataset before the Federal Reserve's next rate cut decision.

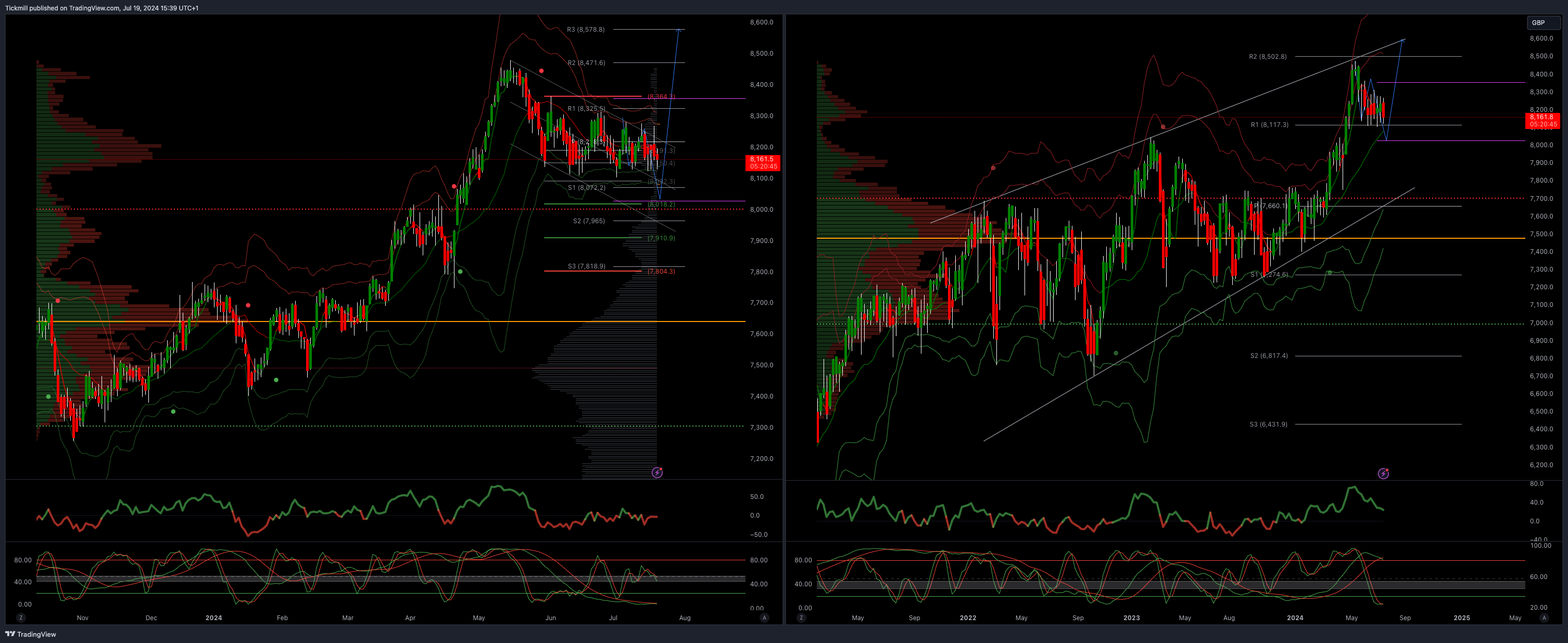

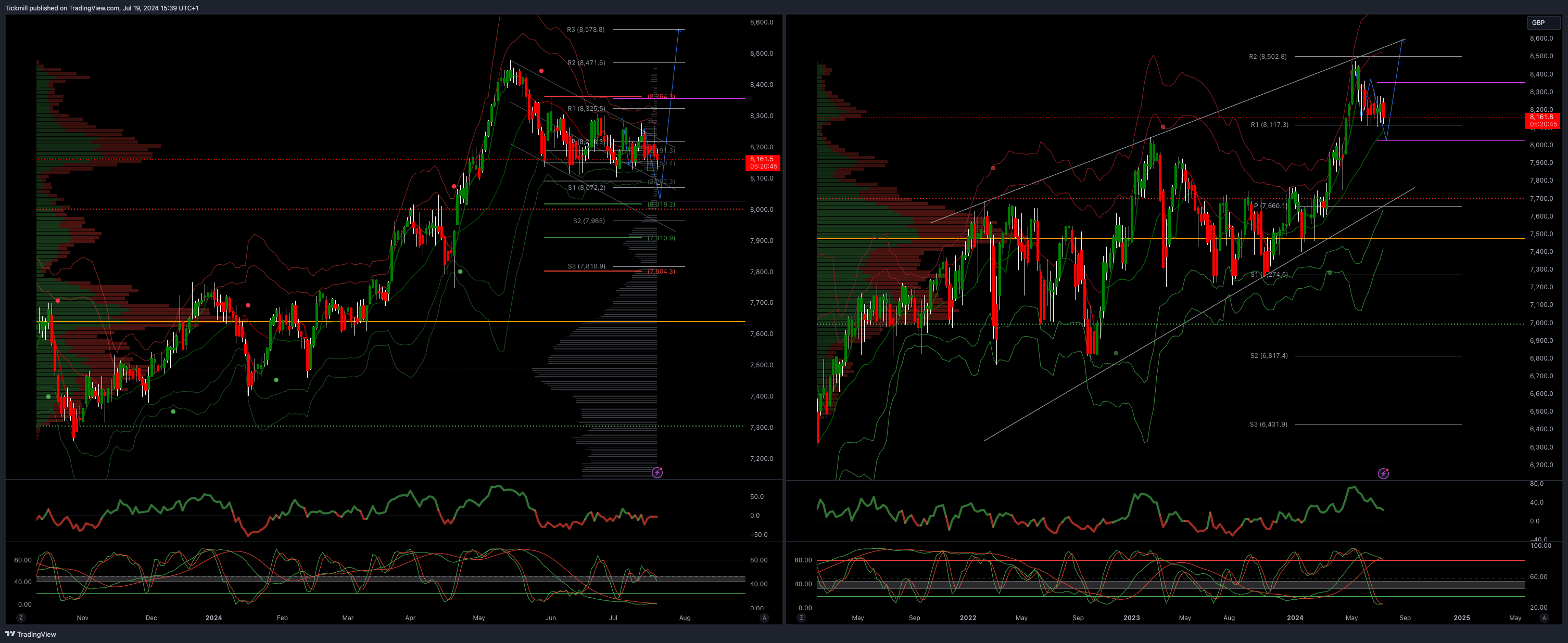

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bearish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!