The FTSE Finish Line: July 14 - 2025

The FTSE Finish Line: July 14 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

The UK's leading stock index remained just below its record peak reached last week as investors evaluated the direction of U.S. tariffs and domestic interest rates, with AstraZeneca rising due to positive results from its drug trials. Britain's labour market experienced a significant slowdown in June, with job seekers' availability rising at the fastest rate since the COVID-19 pandemic, based on data also monitored by the Bank of England. The BoE is anticipated to lower interest rates next month for the fifth time since August last year, with traders estimating an 89% likelihood of a 25 basis points reduction, according to information compiled by LSEG. The country's inflation data, scheduled for release on Wednesday, will provide new insights regarding the central bank's interest rate strategy. Investors will be on the lookout for updates on the nation's fiscal status when Finance Minister Rachel Reeves, along with BoE Governor Andrew Bailey, delivers the annual Mansion House address to London's financial community on Tuesday.

Single Stock Stories & Broker Updates:

Shares of Associated British Foods have risen 3.6% to 2,122p, leading the FTSE blue-chip index. Brokerage Panmure Liberum has upgraded the stock from "Hold" to "Buy" and increased the target price from 1,900p to 2,600p. "We believe the market overlooks the rapid recovery of Sugar profits and also underestimates the favourable margins at Primark," stated Panmure Liberum.

Shares of British fund manager Ashmore Group rose by as much as 2.5% to 172p, making it one of the top gainers in the FTSE mid 250 index. The company reported net outflows of $800 million for the quarter ending June 30, compared to analysts' consensus estimate of $900 million, as per a company poll. Including today’s gains, the stock is up 7.4% year-to-date.

Technical & Trade View

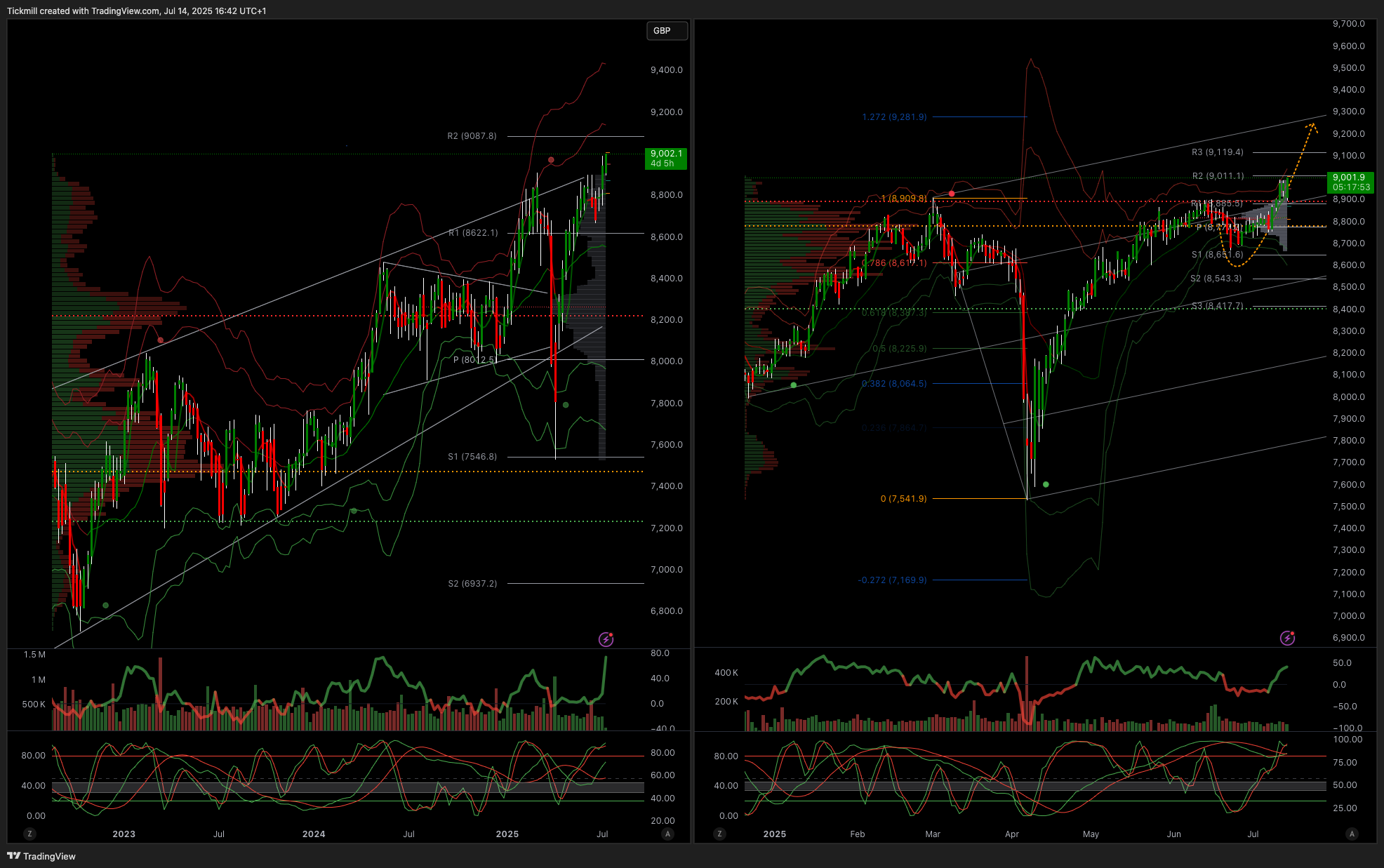

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!