The FTSE Finish Line: July 10 - 2025

The FTSE Finish Line: July 10 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

The UK stock market reached a new all-time high on Thursday, propelled by significant increases in the mining sector. The FTSE has risen approximately 9.3% this year, on track to achieve its best annual results in four years. The general sentiment in major European markets is notably positive today, fuelled by hopes of a possible trade agreement between the U.S. and the European Union. EU trade chief Maros Sefcovic mentioned that there has been substantial progress on a framework trade deal, and an agreement could potentially be reached within days. Shares of Anglo American Plc increased by over 5%, while Rio Tinto and Glencore saw rises of 4.7% and 4.5%, respectively, and Antofagasta gained 3.4%.

The UK economy started Q2 weak, with economic activity contracting by -0.3% month-on-month, according to April's GDP report. Markets whisperers anticipate this downward trend to continue into May, projecting a further -0.1% m/m decline compared to the market's more optimistic median forecast of +0.1%. This outcome would bring year-on-year growth closer to +0.5%. The anticipated decline highlights ongoing struggles in the manufacturing sector, which faces challenging operating conditions amid fragile domestic confidence and subdued global demand—particularly poor performance in goods exports. Meanwhile, the services sector is expected to stagnate despite April's weakness. If these forecasts materialise, the Bank of England's modest Q2 GDP growth target of +0.25% will become increasingly challenging to achieve. Additionally, this economic slowdown would exacerbate pressures on the government, compounding concerns over the UK's poor growth record and its implications for fiscal sustainability. Such developments would intensify worries about borrowing and debt levels while fuelling speculation about potential measures needed to address the fiscal gap in the upcoming fall budget.

Single Stock Stories & Broker Updates:

WPP shares rose 1.8% to 436.4p after hiring Microsoft exec Cindy Rose as CEO, effective September 1, replacing Mark Read. The company is down ~47% YTD.

Vistry Group's shares rise by 4% to 651.8p as H1 profits meet expectations, with an adjusted operating profit of around £125 million. Strategic initiatives are the company's primary focus for profit growth by FY25. Peel Hunt notes improved outlook for affordable housing due to a £39 bln program. Year-to-date, VTYV has gained about 13%.

Jupiter Fund Management shares rise 10.3% to 119.6p, their highest in over two years. The company plans to buy CCLA for £100 million; the deal is expected to boost EPS from the start. It aims to return 50% of FY25 performance fee-related revenue. With today's gains, the stock is up ~38% YTD.

Capricorn Energy shares rise 2.4% to 230.5p, making it a top gainer on the FTSE small-cap index (+0.2%). Peel Hunt upgrades the stock rating to "buy" and raises the price target to 310p from 210p, citing better fiscal terms from the merger of eight Egyptian concessions and expected production growth by 2026/27. The average recommendation from 5 analysts is "buy," with a median price target of 310p. Year-to-date, CNE is down 21.5%, while the FTSE is up 4.9%.

PageGroup shares up 3.7% at 277.8p; 2025 operating profit forecast around £22M vs £52.4M in 2024; stock down 19.3% YTD.

Liontrust Asset Management shares rise ~5% to 380p, making it a top gainer on the FTSE small-cap index, which is up 0.2%. Peel Hunt upgrades the stock to "buy" from "add." The wealth manager's AUM update for June 30 shows continued outflows, offset by asset value recovery, with AUM unchanged at £22.6 billion ($30.74 billion). While flows remain negative, there are early signs of improvement as institutions diversify, contributing to the stock's rebound. The stock is rated "buy" on average, with a median price target of 430p; it is down ~18% this year.

Hostelworld's shares fell over 9% to 128.5p, becoming one of the top losers in the FTSE small cap index. The company reported a ~23% decline in H1 adjusted EBITDA to €7.4 million due to increased marketing costs, though these costs have since reduced. It expects FY adjusted EBITDA to meet market expectations of €19.9 million. Year-to-date, HSW stock is down 9%.

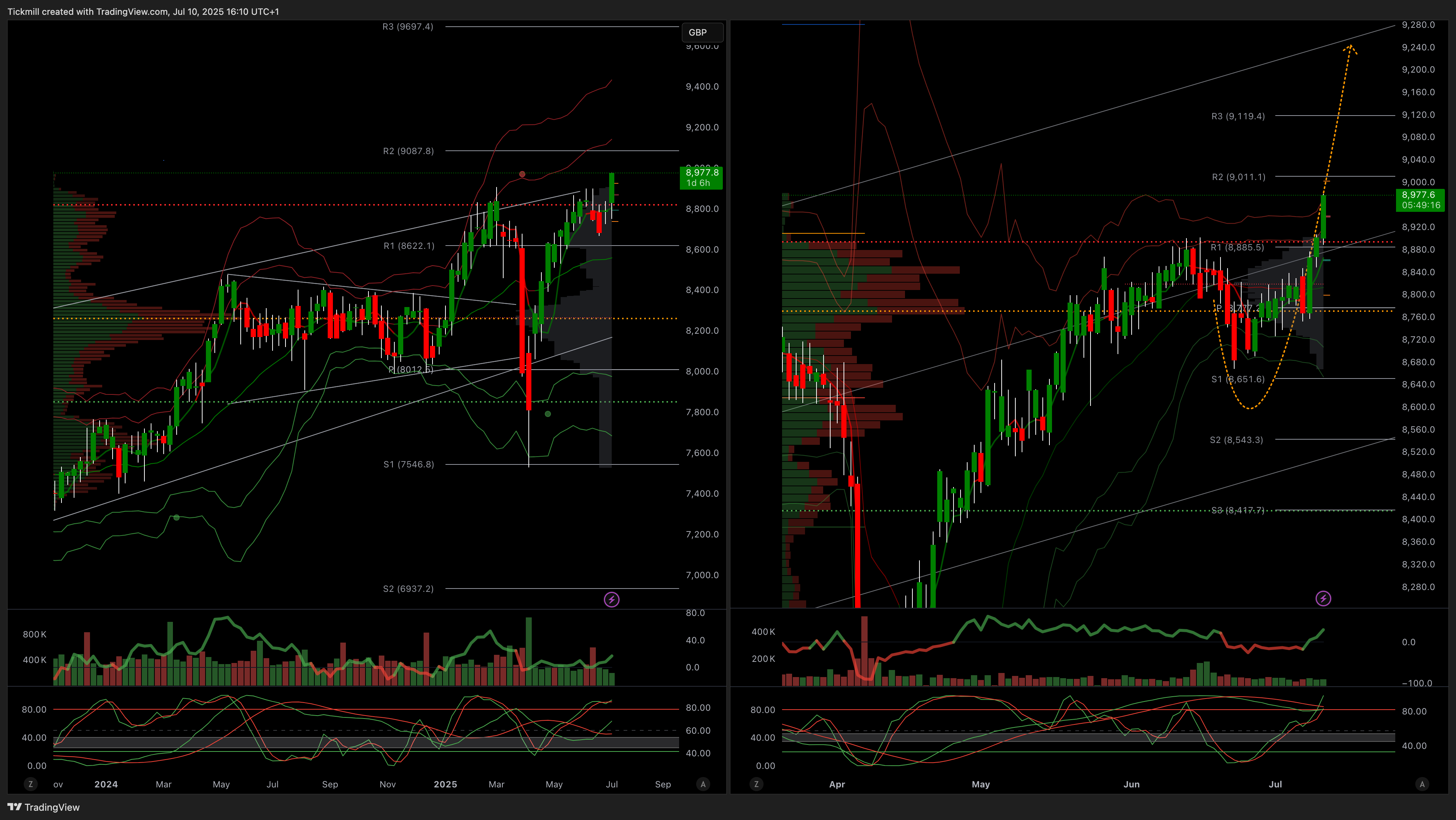

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!