The FTSE Finish Line: January 29 - 2025

The FTSE Finish Line: January 29 - 2025

FTSE Rubber Hits The Road As Auto Parts Sector Soars On Takeover News

The UK's primary stock indices increased on Wednesday, driven by gains in the automobiles and parts sector. The primary contributor to that increase was a 11.2% rise in shares of Dowlais Group following the announcement by U.S. auto parts manufacturer American Axle and Manufacturing that it plans to acquire GKN Automotive's parent company in a cash-and-stock transaction, which values the London-listed company at approximately 1.16 billion pounds ($1.44 billion).

Following Finance Minister Reeves' unveiling of growth strategies, the pound saw a slight downturn. The initiatives presented aimed at bolstering Britain's economy through re-establishing connections with the European Union and enhancing its distinctive relationship with the United States. While the measures introduced by the Chancellor may not trigger immediate economic growth, they hold the potential to nurture long-term economic expansion that could be advantageous for future governments. The blue-chip FTSE 100 rose by 0.3%, and the midcap FTSE 250 advanced by 0.5%, although it underperformed compared to its European counterparts amid a wider tech rally following ASML's impressive quarterly results.Energy stocks declined by 0.4% following a drop in oil prices attributed to a rise in U.S. crude inventories and eased worries regarding Libyan supply. In contrast, Fresnillo, Mexico's second-largest gold producer, emerged as one of the top performers on the FTSE 100 with a 2.3% surge after announcing full-year gold production figures that slightly surpassed market forecasts.

Single Stock Stories:

Miner Fresnillo's shares have increased by 1.9% to reach 663.25 pence. Fresnillo announced that full-year gold production reached 631.6 koz, slightly surpassing the guidance range of 580 koz to 630 koz. The company reported a 14.8% rise in full-year lead production and an 8.3% increase in zinc production compared to the previous fiscal year. Full-year silver production stood at 56.3 moz, meeting the outlined expectations. CEO Octavio Alvídrez attributed the robust profitability in 2024 to improved cost efficiency and higher metal prices. The company anticipates the full-year gross profit to fall within the range of $1.2 billion to $1.3 billion, marking a surge of over 135%. Fresnillo's stock has witnessed an approximate 8.8% rise over the course of 2024.

Pennon Group's shares plummeted by as much as 7.8% to 475p, marking their lowest point since August 2011 and positioning the stock among the top percentage losers on the FTSE 250 index. The British water utility company announced the launch of a fully underwritten rights issue totalling approximately 490 million pounds ($610.1 million) to finance investments of 3.2 billion pounds in its water businesses. Furthermore, Pennon Group disclosed a 13 for 20 rights issue involving approximately 185.9 million shares at 264p per new ordinary share. The rights issue price represents a significant 35.2% discount to the theoretical ex-rights price, based on Tuesday's closing price of 500.81p, after adjusting for the upcoming interim dividend of 14.69p.In response to this news, peer Severn Trent experienced a 1.3% decline in their stock value. Notably, Pennon Group observed a 21% drop in their stock performance over the course of 2024.

Diageo Plc, a spirits maker, saw its shares tumble by up to 2% to 2,446p, positioning the stock among the top percentage losers on the FTSE 100 index. On the other hand, luxury conglomerate LVMH reported a 1% increase in Q4 sales on Tuesday. However, shares plummeted by about 5% following the company's year-end report, disappointing investors who were expecting stronger signs of recovery from the renowned sector bellwether. It is worth noting that Diageo holds a stake in LVMH's drinks unit, Moet Hennessy. Earlier in the week, Diageo confirmed that it has no plans to divest its stake in Moet Hennessy, refuting media reports suggesting a review of the investment. Despite the recent setback, Diageo managed an 11% gain in 2024.

AJ Bell's shares dipped by as much as 5.1% to 425p. The company reported total assets under administration (AUA) amounting to 95.3 billion pounds ($118.58 billion), reflecting a notable 17% increase year-over-year. Analyst James Allen from Panmure Liberum noted, "The market may have been expecting a better performance in the Advised business in the mix given both IntegraFin and Quilter reported very strong net inflows over the same period earlier this month." In the Advised platform, Q1 AUA stood at 57.2 billion pounds, showing growth from the previous quarter's 56.1 billion pounds. CEO Michael Summersgill expressed optimism, stating, "The strong start to the year positions us well as we approach the busy tax year-end period." Despite the recent decline, AJ Bell's shares had surged by approximately 38% over the past 12 months.

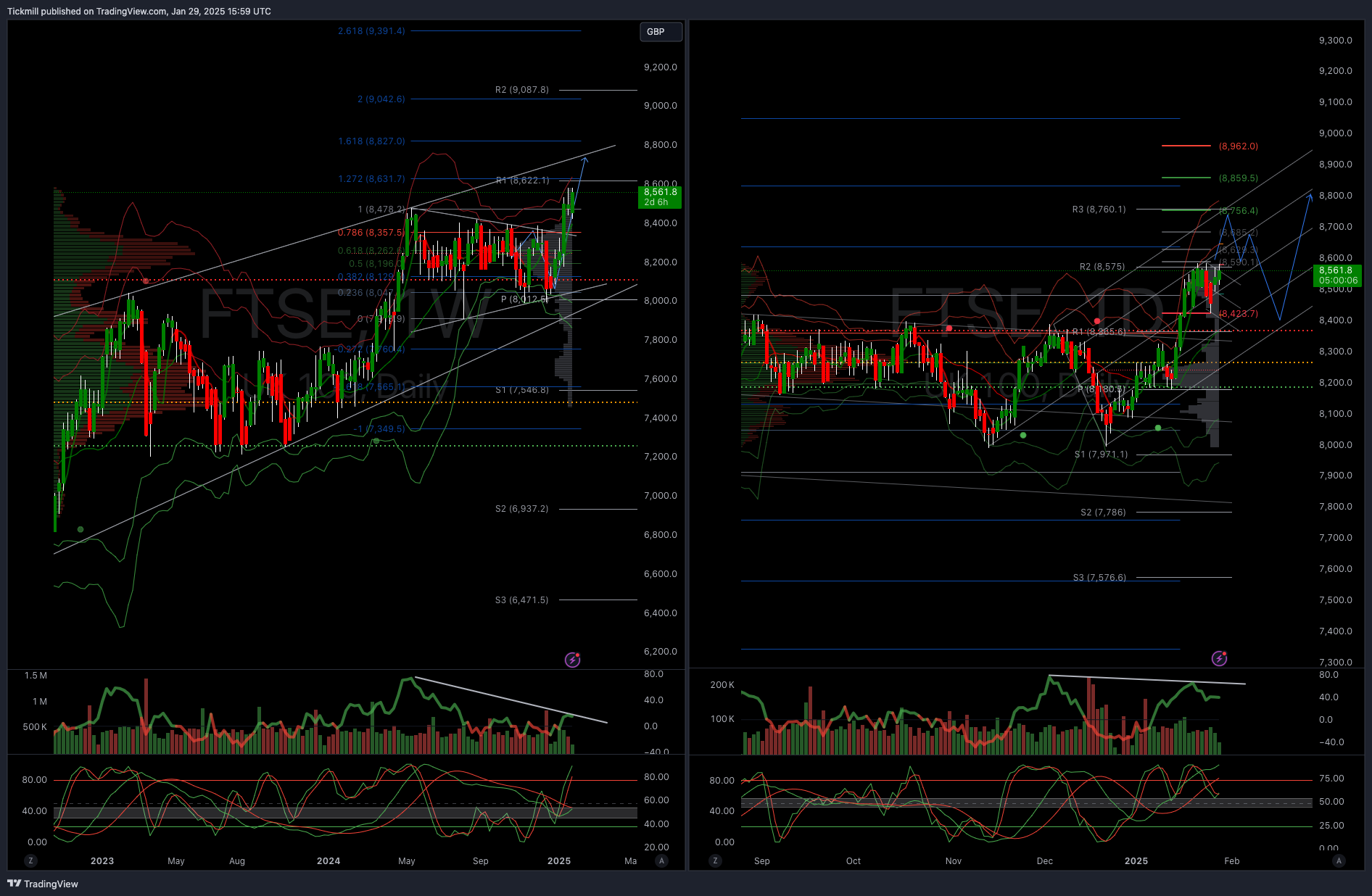

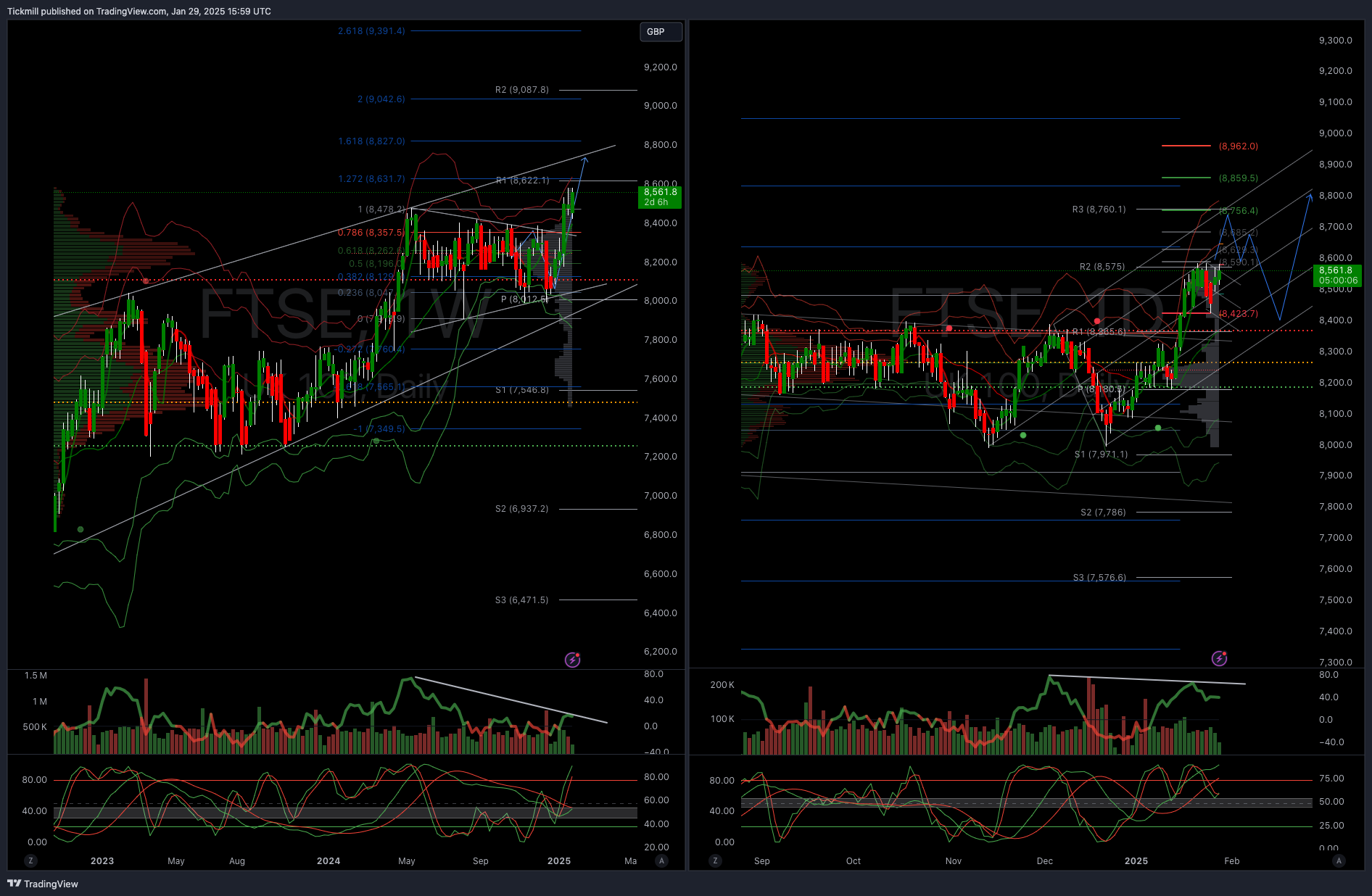

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8400

Primary support 8400

Below 8400 opens 8225

Primary objective 8600

Daily VWAP Bullsih

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!