The FTSE Finish Line: February 3 - 2025

The FTSE Finish Line: February 3 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE Falls In Unison WIth Trump Tariff Risk Off Sentiment

The FTSE 100, Britain's main stock index, fell on Monday and appeared set for its biggest decline in nearly four months due to concerns that U.S. tariffs might trigger a global trade conflict. UK shares fell in line with a worldwide decline triggered by concerns that U.S. President Donald Trump's tariffs on Canada, Mexico, and China could signal the beginning of a trade war, potentially hindering global economic growth. In January 2025, the S&P Global UK Manufacturing PMI registered at 48.3, which is slightly higher than the preliminary estimate of 48.2 and an increase from December's 11-month low of 47.0. However, the index still indicates a significant decline in operating conditions, with manufacturing output decreasing for the third month in a row due to a drop in new orders for the fourth consecutive month, driven by weak demand both domestically and internationally.

Single Stock Stories:

Share prices of Speedy Hire, the construction and industrial tools provider, experienced a sharp decline of 27.9%, reaching 19.84p amid news that full-year profitability is unlikely to meet expectations. Despite showing promising year-on-year growth in the quarter ending December 31, 2024, with a 5% rise in hire revenue for December, the company remains concerned over its financial performance. Speedy Hire's net debt is expected to reach approximately 123 million pounds ($151 million) by the end of January, compared to 113 million pounds from the previous year. This announcement highlights the challenging economic environment and competitive landscape that companies in the construction and industrial tools sector are currently navigating. Peel Hunt, the investment bank, has already slashed its FY25 and FY26 estimates by an estimated £8.5 million to £10.5 million, reflecting cautiousness and a possibly bleak outlook for the company's future performance. In 2024, Speedy Hire's shares already experienced a decline of approximately 31%, exemplifying the company's vulnerability to market pressures and underscoring the need for resilient, agile strategies in the current economic climate.

Ultimate Products, the owner of homeware brands such as Salter and Beldray, witnessed a drop in stock prices of as much as 28.5%, hitting the lowest peak since July 2020. The stock stood among the top percentage losers across the London Stock Exchange, reflecting concerns about the company's order book and growth prospects. Ultimate Products stated that its H2 order book fell from 24% at the start of the fiscal year 2025 to 13% currently. This decrease resulted from the challenging trading conditions faced by the group's retail customers, which slowed the pace of new orders. While the company anticipates its revenue for the year ending July 31 to be relatively stable compared to the previous fiscal year, the recent reports suggest challenges that the company must address. As Ultimate Products embarked on a 40% gain in 2024 and operates in a competitive market environment, the recent developments indicate potential obstacles to long-term growth. The company needs to deal with the current market volatility and navigate the challenging trading conditions faced by retail customers carefully.

Technical & Trade View

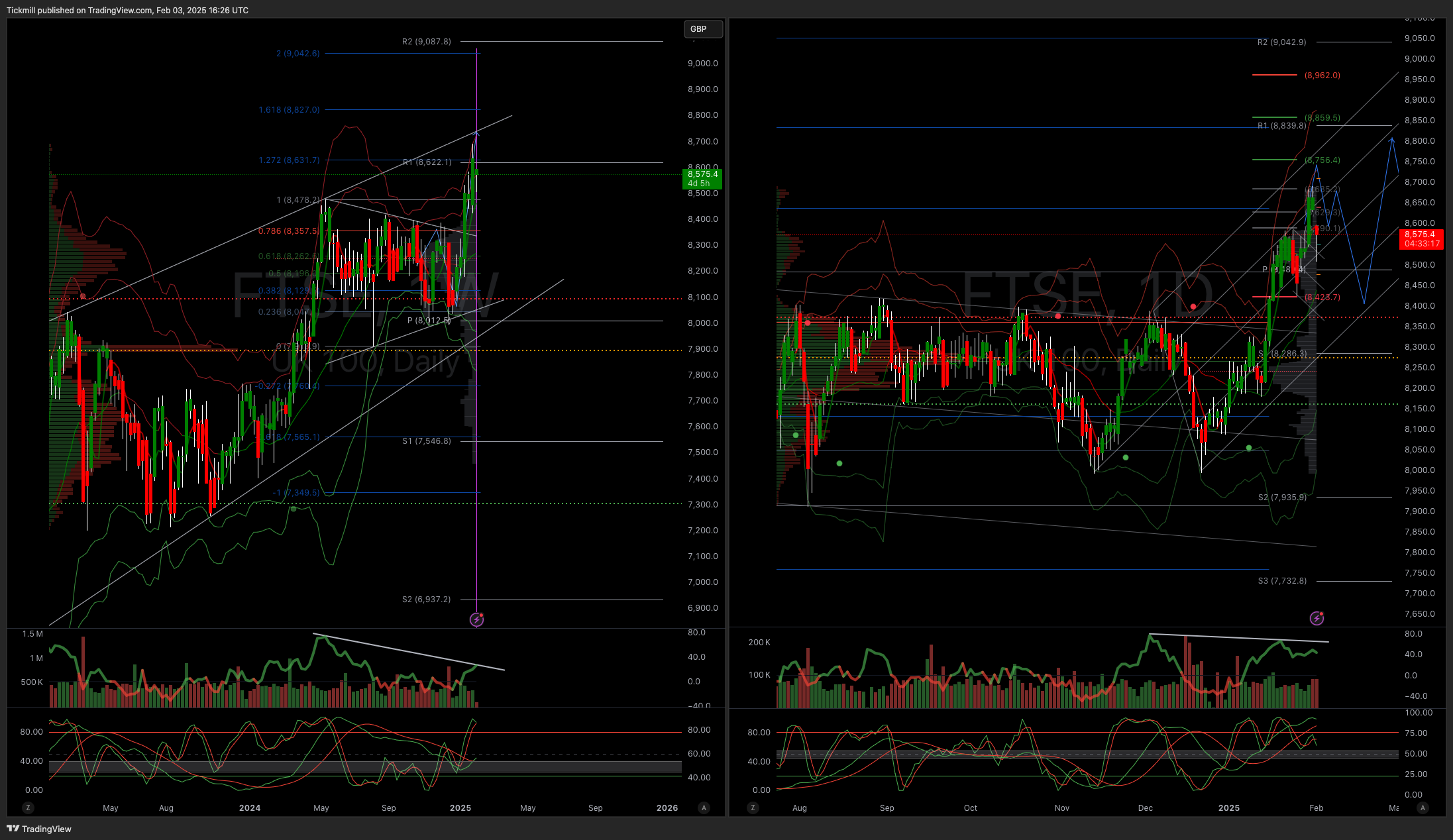

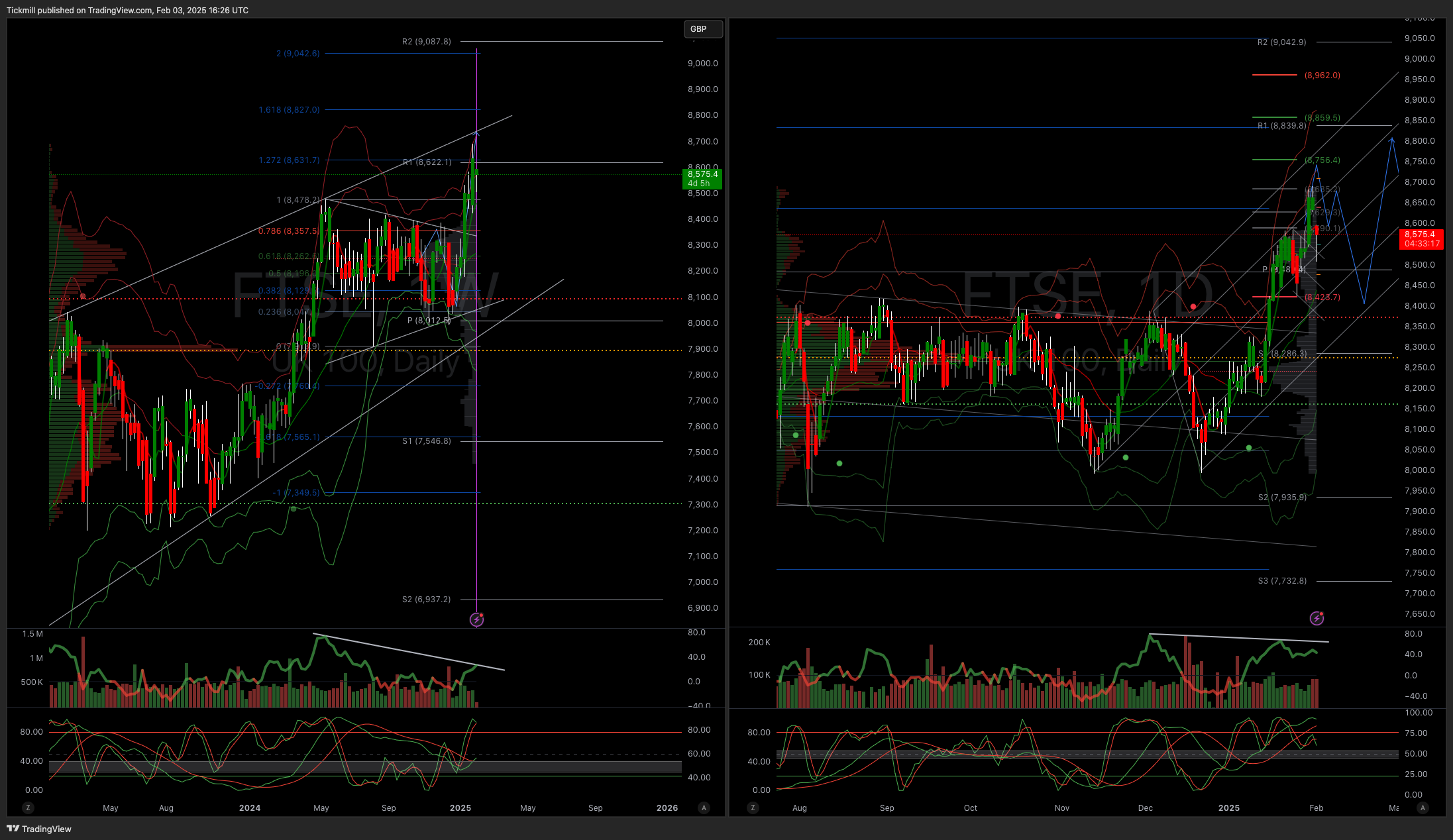

FTSE Bias: Bullish Above Bearish below 8400

Primary support 8400

Below 8400 opens 8225

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!