The FTSE Finish Line: December 13 - 2024

The FTSE Finish Line: December 13 - 2024

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE Flat Heading Into The Close As GDP Miss Spooks Investors

The UK economy contracted unexpectedly for the second consecutive month in October, just ahead of the new government's initial budget announcement. Analysts surveyed by Reuters had predicted a 0.1% growth for October. Reeves' budget announcement on October 30, which will directly influence GDP figures starting in November, introduced significant tax hikes for businesses. The Bank of England is anticipated to maintain its interest rates at the upcoming policy meeting. Nevertheless, the data may lead traders to consider a higher likelihood of quicker rate reductions next year. In a separate development, there is positive news for Rachel Reeves, as British consumer confidence reached a four-month peak in December, with households feeling more optimistic about their financial situations, according to a survey, following other indicators that revealed a decline in business sentiment after the budget announcement.

Single Stock Stories:

Shares of Impax Asset Management Group, an investment manager, have dropped 17% to 272p, making it one of the biggest losers in London stocks. The company announced that St. James's Place will end its mandate for IPX to manage the Sustainable & Responsible Equity Fund. This mandate was the only one IPX held with SJP and accounted for approximately £5.2 billion ($6.57 billion) in assets under management as of November 30. IPX anticipates that the termination will have an annual revenue impact of about £12.7 million. As of the last closing, the stock has decreased by 40.5% year-to-date.

Tullow Oil, listed in London, has seen a decline of approximately 4%, bringing its price down to 25p, making it one of the top percentage losers on the FTSE Small Cap index. Meanwhile, U.S. oil and gas company Kosmos Energy is reportedly in preliminary discussions regarding an all-share acquisition of Tullow Oil, which focuses on West Africa. Tullow addressed media speculation on Thursday, clarifying that there is no guarantee of any offers being made or the specifics of any potential offers. On Thursday, TLW ended the session up by 5.6%. As of the last closing, TLW has dropped around 33% this year.

Broker Updates:

The UK benchmark index is down by more than 10% relative to the market since 2022, "driven by pronounced weakness in energy and GBP strength," BofA says. They see limited potential for further downside given the recent upgrade of the energy sector and expectations for downside for cyclicals vs defensives, which helps the more defensive make-up of the UK market.

Technical & Trade View

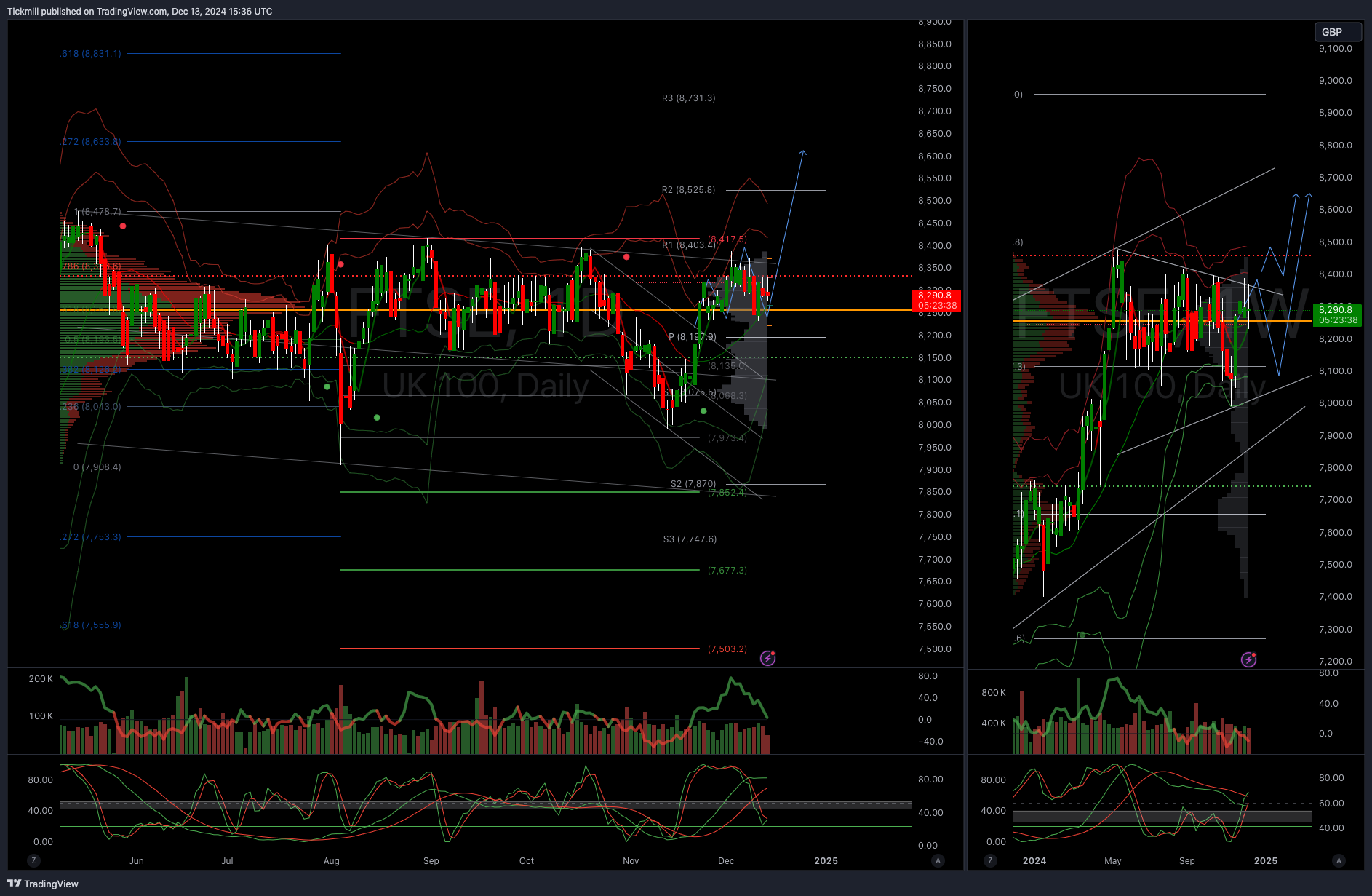

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!