The FTSE Finish Line 1/10/25

On Wednesday, London's FTSE 100 hit a new intraday high, driven by advancements in the healthcare sector, as investors evaluated the impact of the U.S. government shutdown on the publication of important economic indicators. Healthcare stocks performed exceptionally well, climbing 4.6%. Major companies like AstraZeneca saw a 6.1% increase, Hikma increased by 3.6%, and GSK rose by 2.6%, aligning with their European peers. This surge followed an announcement from Pfizer and President Donald Trump that the U.S.-based pharmaceutical company had agreed to reduce prescription drug prices for the Medicaid program in return for tariff relief. Nonetheless, caution lingered in global markets due to worries about the U.S. government shutdown. Many federal operations in the U.S. were put on hold on Wednesday, fostering uncertainty at a time when markets are particularly alert to cues regarding the Federal Reserve’s monetary policy. According to mortgage lender Nationwide Building Society, British house prices increased by 0.5% in September, which was slightly more than anticipated, following a 0.1% decline in August. In contrast, an index tracking the UK's homebuilding firms fell by 0.5%.

Shares of Tate & Lyle dropped by as much as 11.5% to 398p, marking their lowest point since August 2009. The stock is the biggest decliner on the FTSE Mid 250 Index, which decreased by 0.3%. The food ingredients company anticipates a decline in FY revenue and adjusted core profit by low single digits, a shift from its previous forecast of at least 4-6% revenue growth and profit growth exceeding sales. The company stated that near-term demand remains tough but is hopeful for an improvement in performance in Q4. As of the last close, the stock has fallen approximately 31% year-to-date.

Greggs' shares have surged 11.5% to 1,790p, making it the top performer on the FTSE mid-cap index. The bakery and fast-food chain announced a 6.1% increase in total sales for Q3, with like-for-like sales in company-managed shops rising by 1.5% year over year. The company reported an improvement in business performance for August and September following a challenging July due to the heat. The board maintains its expectations for the overall yearly results. Jefferies noted, "It's reassuring to see Greggs uphold its fiscal year guidance and anticipate a boost in like-for-like sales as we move into Q4." Year-to-date, including today's gains, the stock is down approximately 39.1%.

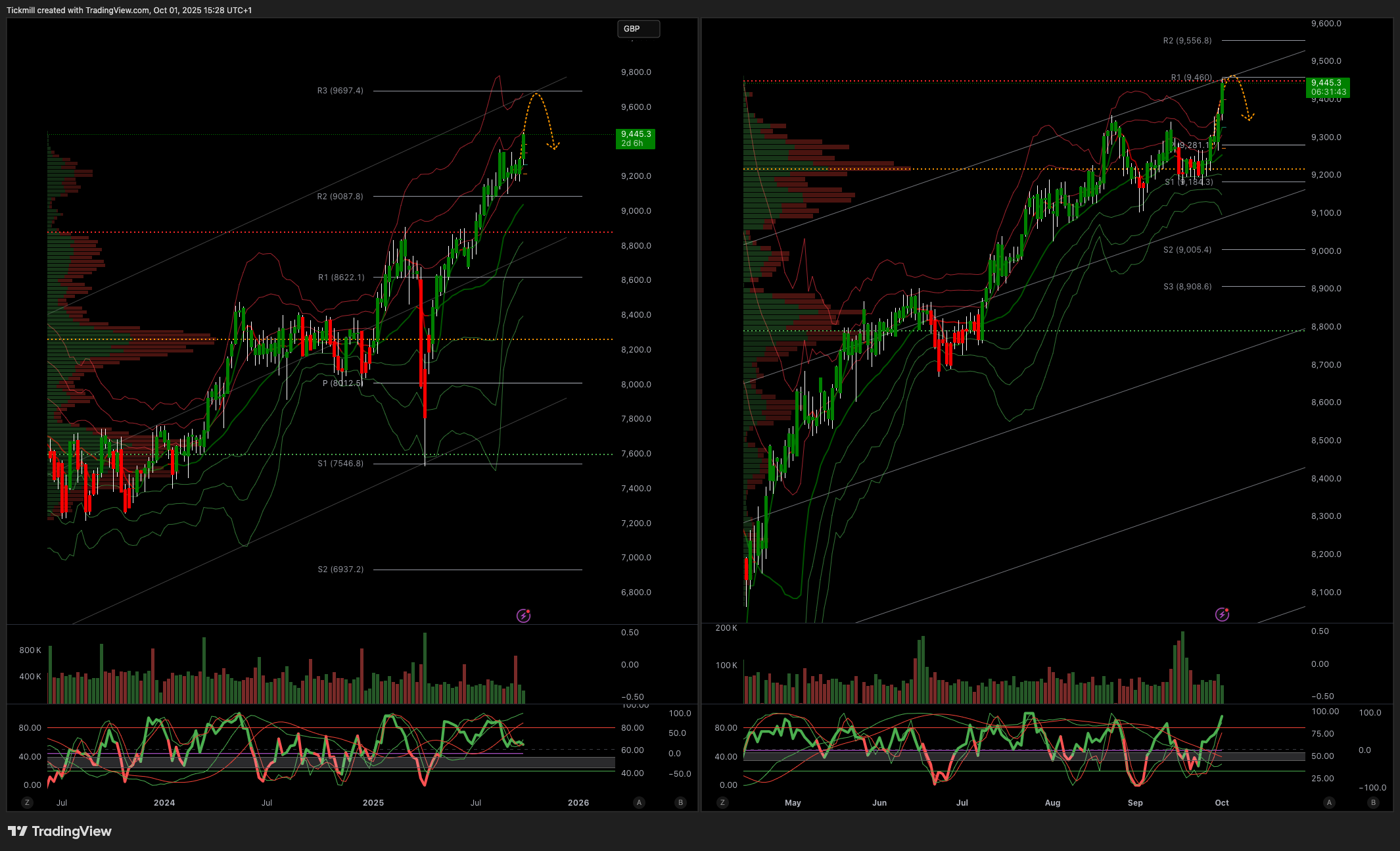

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9300

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!