SP500 LDN TRADING UPDATE 6/6/25

SP500 LDN TRADING UPDATE 6/6/25

WEEKLY & DAILY LEVELS

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=35xAmx3SxDA&t=9s

WEEKLY BULL BEAR ZONE 5795/5805

WEEKLY RANGE RES 6020 SUP 5805

DAILY BULL BEAR ZONE 5920/10

DAILY RANGE RES 5999 SUP 5880

2 SIGMA RES 6059 SUP 5820

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 19.50

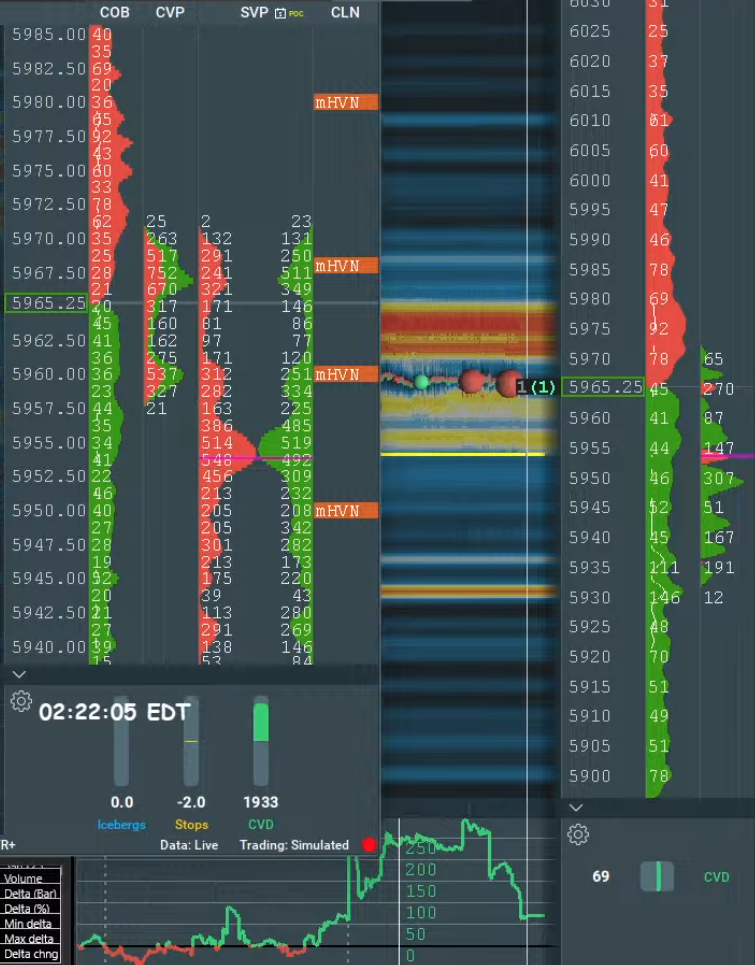

DAILY MARKET CONDITION – BALANCE – 6009/5928

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 5 POINTS)

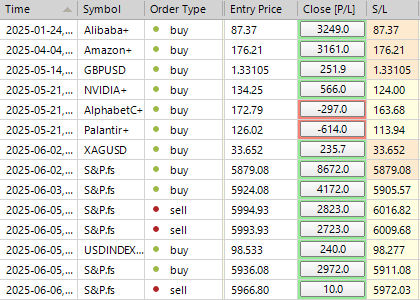

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: AHEAD OF NFP RELEASE

FICC and Equities | June 5, 2025 |

Market Overview:

- S&P 500: -53bps, closing at 5,939, with MOC flows of $4.1B to buy.

- Nasdaq 100 (NDX): -80bps, ending at 21,547.

- Russell 2000 (R2K): -5bps, finishing at 2,097.

- Dow Jones: -25bps, closing at 42,319.

- Volume: 17.4B shares traded across U.S. equity exchanges vs YTD daily average of 16.5B shares.

- VIX: +495bps, ending at 18.48.

- Commodities: Crude +64bps ($63.25), Gold -69bps ($3,375).

- Rates & FX: U.S. 10YR yield +4bps (4.39%), DXY -3bps (98.75).

- Bitcoin: -388bps, closing at $100,572.

Session Highlights:

A volatile trading session saw stocks finish lower, driven primarily by the Trump-Musk feud on X. Tesla (TSLA) sank 14%, accounting for roughly 40% of the S&P 500's decline. Broader market activity was subdued, with dispersion evident beneath the surface.

- Earnings Spotlight:

- MongoDB (MDB): +13% after a strong beat, raised guidance, and buyback announcement.

- AVGO: -2% after-hours on an inline/slightly better-than-expected quarter, but with strong guidance. Positioned as a "9" on a 1-10 scale of expectations.

- Sector Strength:

- Cruise lines outperformed, with Norwegian Cruise Line Holdings (NCLH) up 5% amid continued positive checks from banks.

- Supercap tech and select large-cap biotech with positive commercial momentum continued to see steady long-only demand.

- Key Underperformer:

- Lululemon (LULU): -21% post-bell on underwhelming Q1 and Q2 sales. The focus remains on Q2 and FY EPS due to potential margin impacts.

Derivatives Market:

- Volatility remained stable as skew steepened on the move lower.

- Preference for expressing long vol views via short-dated calls, particularly into July, over zero-day straddles.

- NDX options attractive as the spread to SPX for 1-month ATM options is near 3-year lows.

- UBER June 2025 $90 calls look appealing at just over $1, especially with the upcoming robotaxi launch.

- NFP straddle priced at 0.90%.

Jobs Report Preview:

Market expectations for tomorrow's Nonfarm Payrolls (NFP) remain muted compared to historical trends. GIR estimates:

- Nonfarm Payrolls: +110K (below consensus of +125K).

- Unemployment Rate: Unchanged at 4.2%.

- Average Hourly Earnings (AHE): +30bps MoM.

Market Sentiment:

- Activity levels were subdued, with our desk assigning a "5" on a 1-10 scale.

- Floor activity closed -2.5% for sale vs a 30-day average of +66bps. Both LOs and HFs ended as slight net sellers, particularly in macro products and discretionary names.

Commentary from John Flood on NFP:

The market is pricing in just over two Fed rate cuts for the remainder of 2025. A "sweet spot" for equities tomorrow would be a stronger-than-expected NFP print, ideally in the range of 150K–200K.

- Sub-100K Print: Could amplify concerns about a growth slowdown, pressuring equities.

- 300K+ Print: May trigger a "good data is bad for stocks" reaction, as the Fed could delay rate cuts.

- A weak print would likely have a more damaging impact on the market than an overly strong one.

Retail Investor Behavior:

Retail investors have consistently bought stocks throughout the year. Our data suggests this trend will only reverse if significant job losses occur.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!