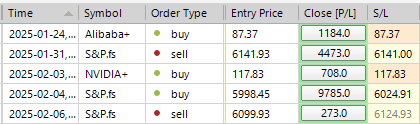

SP500 LDN TRADING UPDATE 6/02/25

SP500 LDN TRADING UPDATE 6/02/25

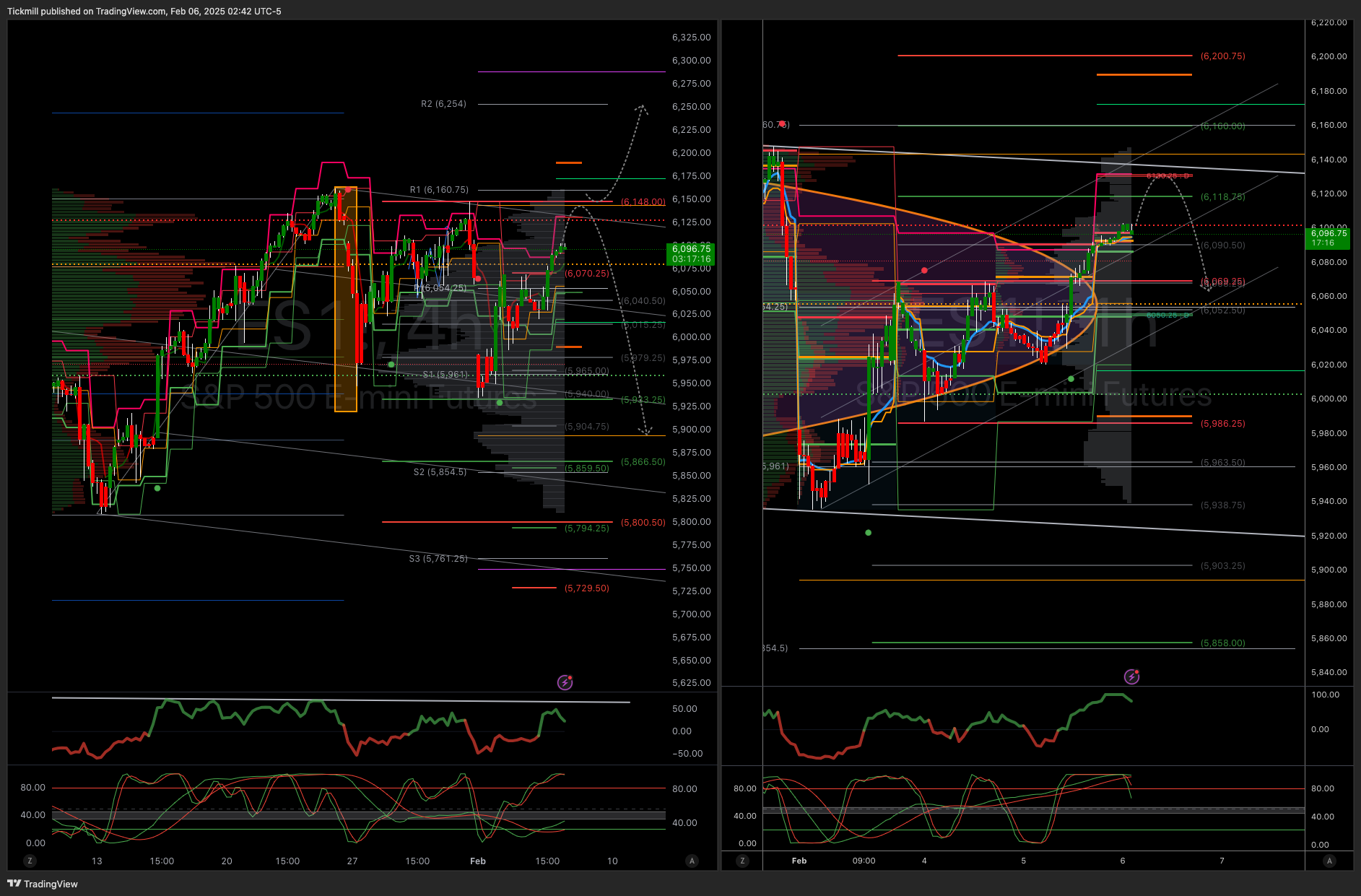

WEEKLY BULL BEAR ZONE 5900/5890

WEEKLY RANGE RES 6086 SUP 5878

DAILY BULL BEAR ZONE 6058/68

DAILY RANGE RES 6133 RANGE SUP 6048

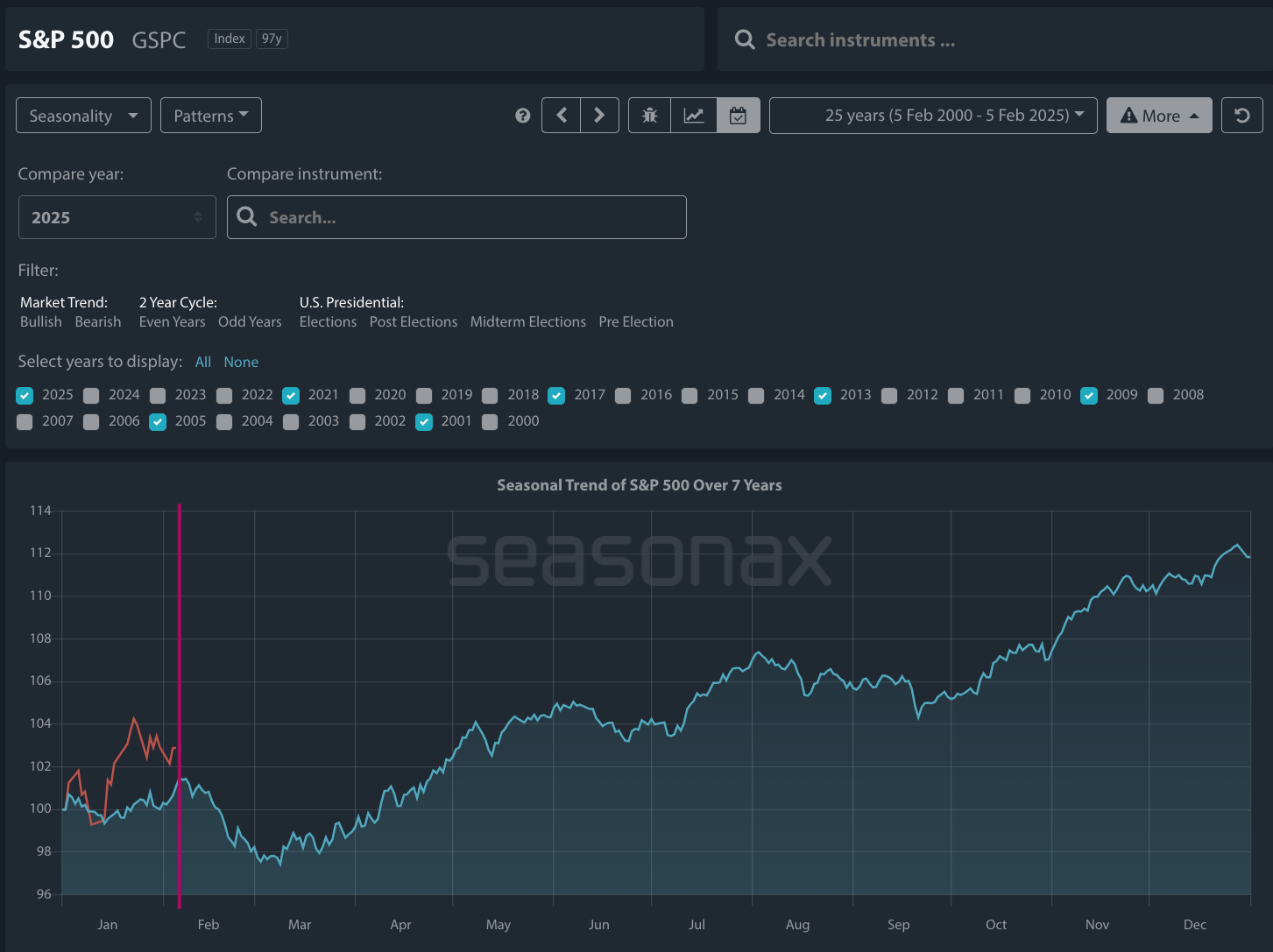

***NOTE WE ARE HEADING INTO A WINDOW FOR POTENTIAL EXTENDED VOLATILITY FROM TOMORROW AS OUTLINED IN THE WEEKLY VIDEO UPDATE BELOW - PERSONALLY WILL BE LEANING INTO RANGE/STRUCTURAL RES IN COMING SESSIONS - I HAVE AMENDED MY STOP TO B/E ON THE 6141 SHORT TO ACT AS A CORE SWING POSITION TO TRADE AROUND INTO THE BEGINNING OF MARCH - REMEMBER VOLATILITY DOES NOT IMPLY CRASH CONDITIONS, WE CAN WITNESS LARGE SWINGS WITHIN A PULLBACK - I WILL CONTINUE TO TRADE FROM BOTH LONG AND SHORT SIDE INTRADAY AT MY LEVELS, BUT MY BIAS WILL BE TO LEAN HEAVIER AGAINST RESISTANCE.***

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MICRO >

FICC and Equities

5 February 2025 | 11:07PM UTC

The S&P rose by 39 basis points, closing at 6061 with a market-on-close buy of $1.1 billion. The NDX increased by 42 basis points to 21658, the R2K climbed 114 basis points to 2316, and the Dow gained 71 basis points, ending at 44873. A total of 13.88 billion shares were traded across all U.S. equity exchanges compared to a year-to-date daily average of 16 billion shares. The VIX was down 837 basis points at 15.77, crude oil fell 213 basis points to 71.16, the U.S. 10-year yield decreased 8 basis points to 4.42, gold rose 66 basis points to 2861, and the DXY dropped 30 basis points to 107.63, while bitcoin gained 77 basis points to 97285.

Stocks finished higher despite GOOG dropping 7% and declines in TSLA, AAPL, and AMZN. Secular growth and SMID tech stocks responded positively to the move in rates (the 10-year yield eased 9 basis points to 4.41% following a mixed to weak ISM services report), especially as they are predominantly insulated from current concerns regarding capital expenditures in the market (both in infrastructure and CSP). Our economists maintained the forecast for January's nonfarm payroll growth at +190k, which is above the consensus expectation of +170k.

Our floor activity rated a 7 on a scale of 1 to 10 for overall engagement levels. Executed flow was up 2% compared to the 30-day average of +60 basis points. Long-only (LO) investors saw a net buying of $1 billion, driven by macro products, while hedge funds were net sellers of $1 billion due to scattered supply across different sectors. Payments surged higher following earnings reports, with notable cover demand in Fixed Income and Wealth Management. Alternatives continue to show lackluster performance, with ARES tracking similar trends to APO, KKR, & BX. In the healthcare sector, there has been significant frustration with the continued outperformance and rebound of XLV since the beginning of the year, particularly as today's pain points were around unexpectedly sharp upward movements where tactical specialist positioning is leaning short (AMGN, NVO, TEM, etc.). Additionally, the surprising weakness in UNH, triggered by a now-deleted tweet, affected HUM and CVS, underscoring the fragility of positioning around an emerging long Medicare recovery thesis.

Our private banking report this morning noted that hedge funds have net bought U.S. healthcare stocks for the fifth consecutive session (18 out of the last 20), driven by long positions and short covers (1.3 to 1). Almost all subsectors exhibited net buying, with Life Sciences Tools & Services, HC Providers & Services, and Biotech leading the way. The long/short ratio in U.S. healthcare stands at 2.36, which is in the 85th percentile compared to the past year and the 32nd percentile compared to the past five years. Rubner shared an interesting point regarding retail demand: "four of the top five retail demand imbalances occurred in 2025." This aligns with various details we have seen circulating outside the walls of GS.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!