SP500 LDN TRADING UPDATE 5/6/25

SP500 LDN TRADING UPDATE 5/6/25

WEEKLY & DAILY LEVELS

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=35xAmx3SxDA&t=9s

WEEKLY BULL BEAR ZONE 5795/5805

WEEKLY RANGE RES 6020 SUP 5805

DAILY BULL BEAR ZONE 5920/10

DAILY RANGE RES 6036 SUP 5916

2 SIGMA RES 6096 SUP 5856

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 19.50

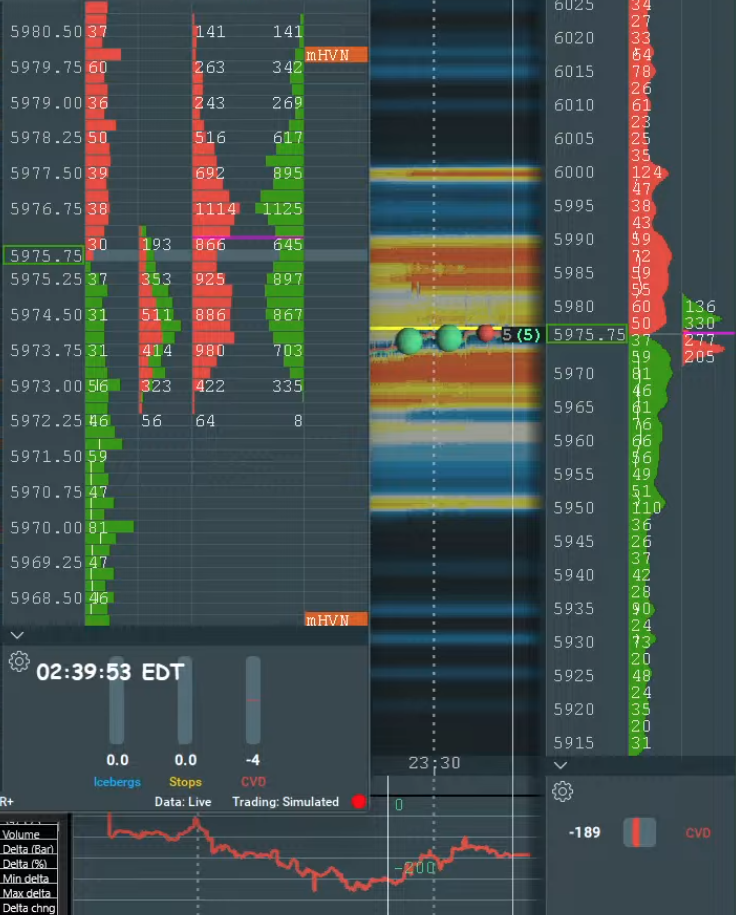

DAILY MARKET CONDITION - ONE TIME FRAMING UP ENDS 5974

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 5 POINTS)

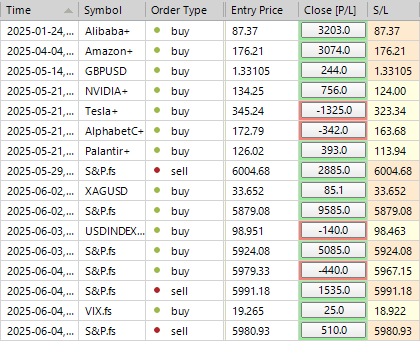

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

JPM TRADING DESK VIEWS

SPX unchanged at +0.0%, NDX up +0.3%, RTY down -0.2%. WTI crude oil decreased by 88 basis points to $62.85, NatGas slipped 16 basis points to $3.72, UK NatGas also dropped 16 basis points to £0.8336. Gold remained steady at $3,373, while Silver fell 4 basis points to $34.50. The 10-year Treasury yield stands at 4.355%, and the VIX is at 17.61.

Equities fluctuated within a 40 basis point range today, ultimately closing unchanged. The most significant movements occurred in UST: bond yields dropped 8-10 basis points across the curve due to three dovish macroeconomic data releases (ADP, ISM - Services, and the Beige Book). So far, May labor data has been mixed, with stronger ISM - Services employment contrasting with a miss in ADP. Friday's NFP is anticipated to give a clearer indication. The market expects a 130k survey, compared to a 120k whisper from BBG and 177k previously. We consider 100k as a critical threshold to evaluate the recession narrative.

- Market insights on ISM - Services and opinions from JPM Economists.

- Broadcom (AVGO) earnings are scheduled for tomorrow: Preview from JPM Spec Sales’ Josh Meyers; JPM Research analyst Harlan Sur is optimistic heading into the earnings print, citing underestimated growth drivers.

- The ECB meeting tomorrow is pricing in a 25 basis point cut; focus will be on staff projections (JPM Economists foresee a sharper slowdown in the second half of 2025 followed by a modestly above-trend recovery in 2026; see here).

- A bullish equity signal: Nikos considers the disparity between the short interest in SPY and QQQ ETFs as a positive sign for equities.

CATALYSTS TOMORROW (WEEK AHEAD)

US Macro Data:

- 7:30 AM ET: Challenger Job Cuts

- 8:30 AM ET: Trade Balance, Nonfarm Productivity (Revision), Unit Labor Costs (Revision), Initial/Continuing Jobless Claims

US Earnings:

- Companies reporting: AVGO, DOCU, FLYY, IOT, MDRX, MTN, RBRK, TTAN, VSCO

Global Macro Data:

- Germany: Factory Orders at 2:00 AM ET

- Eurozone: ECB announcement at 8:15 AM ET

EQUITY & MACRO NARRATIVE

US Market Intelligence on ISM Services:

- The report was net negative due to a surge in the inflation index and a decline in the services index. Combined with Monday’s negative ISM Manufacturing data and concerns over ADP this morning (despite low correlation between ADP and NFP), equities quickly dropped back to post-ADP levels.

Key Highlights:

1. Sector Dislocation: Business quotes were mixed, with Finance and Retail showing strong demand and growth. This aligns with Q1 earnings trends.

2. Employment Strength: Employment activity in the services sector returned to expansion in May after two months of contraction.

Outlook:

Friday’s NFP report is expected to provide clarity on the mixed labor market signals observed so far.

TRADING DESK COMMENTARY

• Briggs Barton (Consumer) - DLTR Reaction: The -8% drop in DLTR seems somewhat excessive, especially considering the mixed results/guidance, the recent long positioning driven by hedge funds, and the stock's prior outperformance (+6% yesterday post-DG). While the move retraces gains from the last few days, it likely needed more momentum to push higher today. At ~16x the new EPS guidance (assuming the numbers hold and comp trajectory remains solid), coupled with positive commentary on market share and customer acquisition, the setup and risk/reward outlook merit further discussion.

• Jack Atherton (TMT) - Ad Tech Moves: Seeing significant inbound interest on META, U, APP, RDDT, and TTD. However, not much concrete news beyond a risk-on sentiment (lower rates) and AI optimism (e.g., NVDA momentum, TSM commentary, AVGO positivity, META/CEG deal). Digital advertising continues to be a key beneficiary post the "deepseek moment" earlier this year, tied to the reduced cost of AI utilization. Notably, during a conference presentation, NVDA’s VP of Hyperscale/HPC highlighted improvements in AI model accuracy (89% vs. 66% previously) at no additional cost, which underscores the sector's efficiency gains.

• Briggs Barton (Consumer) - COST Results: US core comps at +5.5% missed Street expectations of +6.4%. However, buyside expectations varied more than usual, with some anticipating a potential downside miss. While below consensus, the results might not be as disappointing relative to buyside sentiment.

• Joshua Meyers (TMT) - MRVL Strength: There's no clear consensus on MRVL’s recent strength. Speculation includes Taiwan rumors about Alchip re-taping Trainium 3, though Alchip has reportedly confirmed the pilot is proceeding without issues. Additionally, TSM CoWoS allocation later this month could provide clarity. Some point to MRVL’s BoA presentation, where Matt performed well, though the stock dipped afterward with no new revelations. Others speculate a tier-2 CSP win announcement at MRVL’s investor day. Positioning data shows MRVL is modestly crowded long, possibly influencing the move. Open to further insights from the group.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!