SP500 LDN TRADING UPDATE 3/7/25

SP500 LDN TRADING UPDATE 3/7/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=JGai0yB4XYE&t=218s

WEEKLY BULL BEAR ZONE 6220/10

WEEKLY RANGE RES 6295 SUP 6150

DAILY BULL BEAR ZONE 6255/45

DAILY RANGE RES 6336 SUP 6218

2 SIGMA RES 6396 SUP 6158

GAP LEVELS 6147/6077/6018/5843/5741/5710

VIX BULL JULY CONTRACT BEAR ZONE 21.35 DAILY BULL BEAR ZONE 18

DAILY MARKET CONDITION - ONE TIME FRAMING UP - 6238

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

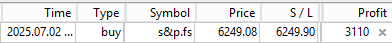

TRADES & TARGETS

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: AHEAD OF NFP RELEASE

FICC and Equities | July 2, 2025 | 9:15 PM UTC

Market Overview:

- S&P 500: -47bps, closing at 6,227 with MOC of $2.4B to buy.

- NASDAQ (NDX): +73bps, closing at 22,641.

- Russell 2000 (R2K): +140bps, closing at 2,244.

- Dow Jones (DJIA): -2bps, closing at 44,484.

- Volume: 17.1B shares traded across all U.S. equity exchanges vs. YTD daily average of 16.8B shares.

- VIX: -113bps, closing at 16.64.

- Crude Oil: +312bps, closing at $67.50.

- U.S. 10-Year Yield: +3bps, closing at 4.28%.

- Gold: +52bps, closing at $3,367.

- DXY: -3bps, closing at 96.79.

- Bitcoin: +2bps, closing at $109,247.

Sector Performance:

Momentum shifted higher with cyclicals outperforming defensives, despite a weaker-than-expected ADP number. High Beta momentum pairs (GSPRHIMO) fell -147bps due to strong performance from the short leg (GSXULMOM), which includes smaller-cap companies with higher leverage and exposure to materials, health care, and energy.

Retail stocks gained on news of a trade deal between Trump and Vietnam, while Tesla (TSLA) rallied 5% on better-than-expected delivery numbers after a 13% decline over the last six days.

- Most Short Indices:

- GSCBMSAL: +3%

- GSCBMSIT (Tech): +6%

- GSCBMSEN (Energy): +4.5%

- HF VIP vs. Most Short (GSPRHVMS): -3%

Managed care (GSHLCMCR) was a major focus, with the group down -10.5% following Centene (CNC) withdrawing its 2025 guidance, citing weaker market growth and significantly higher morbidity in its Marketplace membership. CNC dropped -40%, leading to capitulation in the sector. Despite hopes for a rebound or statements from peers, no such developments materialized.

Economic Data Expectations:

Nonfarm Payrolls (NFP) data is due tomorrow. Our estimates:

- NFP: +85K for June (below consensus of +110K and the 3-month average of +135K).

- Average Hourly Earnings (AHE): +0.3% month-over-month, seasonally adjusted.

- Unemployment Rate (U/E): Expected to edge up to 4.3%, reflecting increased labor market slack.

Activity Levels:

Overall activity was moderate, rated 6/10 on our scale. The floor finished +420bps vs. the 30-day average of -49bps. Long-only investors were slight net sellers, with supply in health care, REITs, and macro products, while demand was seen in tech. Hedge funds were flat, with demand in staples and financials offset by supply in industrials.

Derivatives Insight:

Heading into NFP, the market is pricing in muted top-line moves, with greater attention on Tuesday’s momentum unwind. The SPX straddle for NFP is expected to close below 60bps, which is surprising given potential rate cut implications tied to the jobs data.

The desk anticipates market stress from either extreme:

- Hot readings could remove rate cuts from consideration.

- Weak readings could heighten concerns about economic health.

Despite this two-way risk, the desk prefers owning mid-dated volatility, particularly on the topside in SPX, over short-dated gamma. September and October 25-delta call implied vols, trading at a low 12-vol handle, appear to be the most attractive opportunities.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!