SP500 LDN TRADING UPDATE 3/06/25

SP500 LDN TRADING UPDATE 3/06/25

WEEKLY & DAILY LEVELS

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=35xAmx3SxDA&t=9s

WEEKLY BULL BEAR ZONE 5795/5805

WEEKLY RANGE RES 6020 SUP 5805

DAILY BULL BEAR ZONE 5890/5900

DAILY RANGE RES 6009 SUP 5889

2 SIGMA RES 6069 SUP 5829

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 19.50

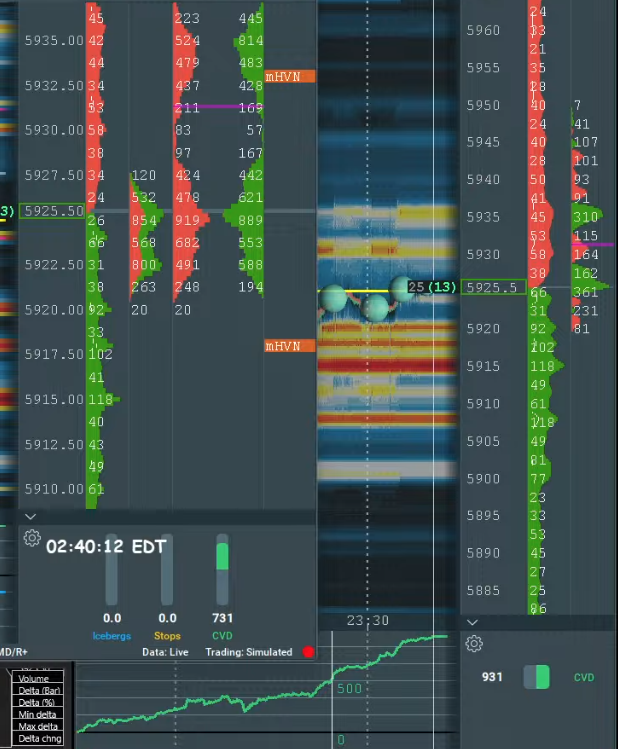

DAILY MARKET CONDITION - BALANCE 5853/5956

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 7 POINTS)

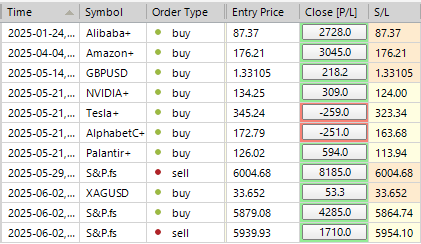

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: DRIFTING HIGHER

FICC and Equities | 2 June 2025 |

Market Performance:

- S&P 500: +41bps, closing at 5,935 with a Market-on-Close (MOC) imbalance of $160mm to SELL.

- Nasdaq 100 (NDX): +71bps, closing at 21,491.

- Russell 2000 (R2K): +19bps, closing at 2,070.

- Dow Jones Industrial Average: +8bps, closing at 42,305.

Volume & Volatility:

- Total shares traded: 15.9bn across all U.S. equity exchanges (below YTD daily average of 16.6bn).

- VIX: -113bps, closing at 18.36.

Commodities & Other Assets:

- Crude Oil: +285bps, closing at $62.52.

- U.S. 10-Year Yield: +4bps, settling at 4.43%.

- Gold: Unchanged at $3,381.

- DXY (Dollar Index): -63bps, closing at 98.70.

- Bitcoin: -17bps, ending at $104,764.

Market Sentiment:

Stocks drifted higher despite mixed-to-weak ISM Manufacturing data and negative weekend headlines. Key concerns included:

- Trump doubling tariffs on steel and aluminum imports to 50%.

- China accusing the U.S. of undermining the trade truce.

- Japan maintaining a hard stance on U.S. tariffs.

- Rising geopolitical tensions between Ukraine and Russia.

Sector Performance:

- Rate-sensitive sectors underperformed:

- Homebuilders: -1.3%.

- Credit-sensitive names (e.g., Ford, GM): -3%.

- Leveraged balance sheet stocks (e.g., CZR, MGM, HTZ, Macy’s): Weakness noted.

Yields edged higher amid renewed trade war fears and inflationary concerns. Additionally, Jamie Dimon highlighted potential cracks in the debt sector.

Post-Bell Developments:

- U.S. extended tariff pauses on select Chinese goods until August 31 (Source: Bloomberg).

Trading Floor Activity:

- Overall activity level: 4/10.

- Floor performance: -4% for sale vs a 30-day average of +26bps.

- Long-Only (LO) funds: Net sellers (-$1.3bn), driven by Tech, Macro, and Consumer sectors.

- Hedge Funds (HFs): Flat overall, with buying interest in Healthcare and Discretionary sectors offset by selling in Communication Services.

Derivatives Market:

- Quiet start to the week as markets digested tariff-related headlines.

- Hedge Funds continued net buying of U.S. Tech for the third consecutive week.

- Elevated single-name overwriting and underwriting for August to capture premiums into summer.

- Increased inbound interest in megacap tech upside; Supercap Tech viewed as a “defensive growth proxy.”

- “Mag 7” posted its best quarterly positive EPS surprise since Q3 2023 and remains attractively valued historically.

Key Observations:

- Buying of SPX upside noted, alongside unwinding of QQQ hedges.

- Heavy macro focus expected this week with ISM Services (Wednesday) and Non-Farm Payrolls (Friday) on the calendar.

Straddle Outlook:

- Rest of the week’s implied straddle priced at ~1.50%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!