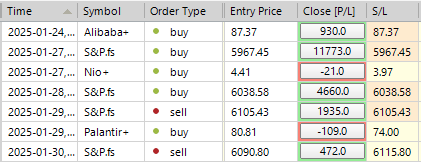

SP500 LDN TRADING UPDATE 30/01/25

SP500 LDN TRADING UPDATE 30/01/25

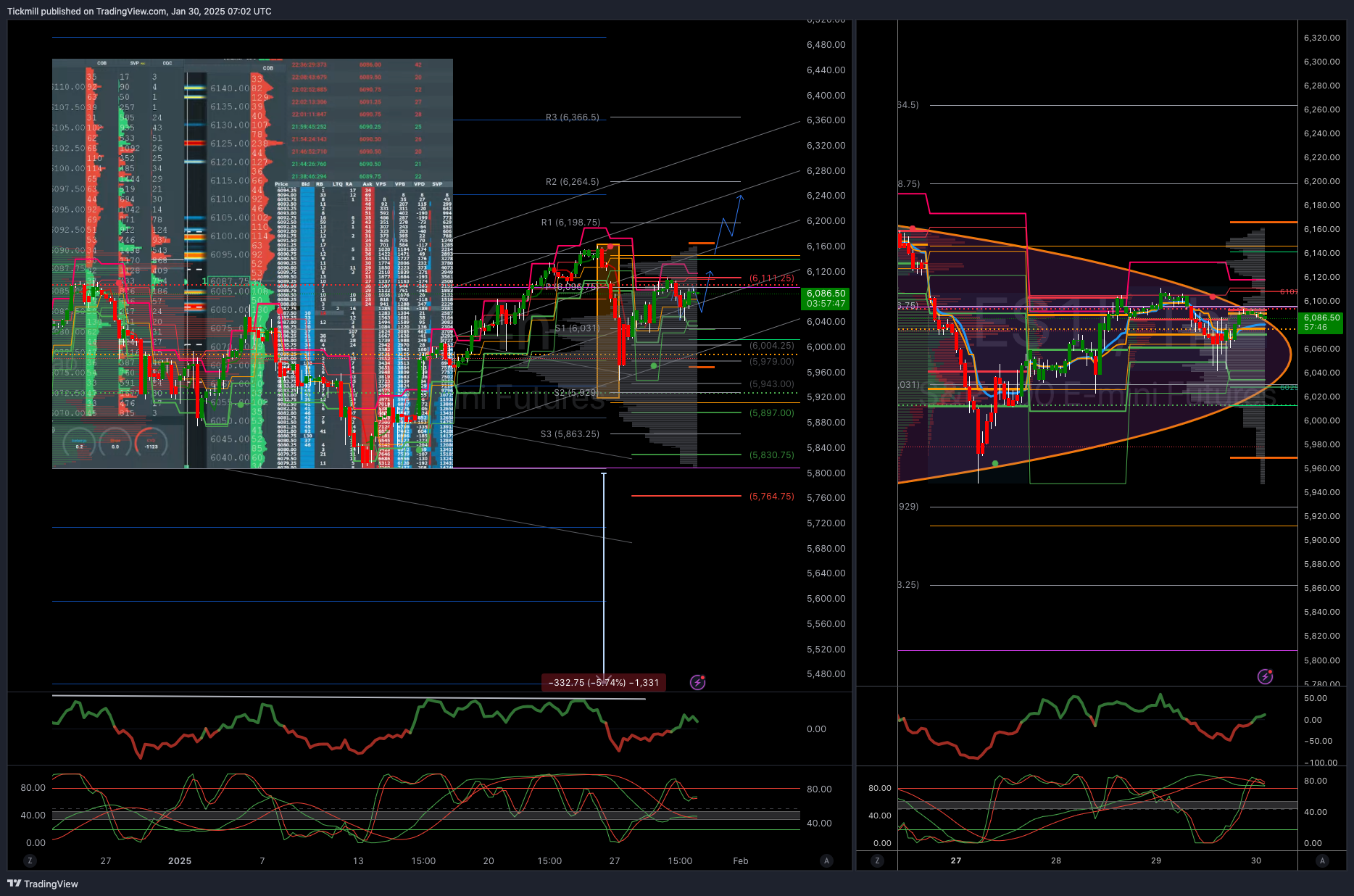

WEEKLY BULL BEAR ZONE 5970/60

WEEKLY RANGE RES 6185 SUP 6019

DAILY BULL BEAR ZONE 6035/45

DAILY RANGE RES 6120 RANGE SUP 6035

ETH GAP ZONE 6102-6132 RTH GAP FILL 6122

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 6145/60>WEEKLY RANGE RES

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: TECH DISAPPOINTS

S&P down 47bps, closing at 6039 with a market-on-close sell of $500mm. NDX decreased by 24bps to 21411, R2K fell 25bps to 2283, and Dow dropped 31bps to 44713. A total of 12.9 billion shares were traded across all U.S. equity exchanges, compared to a year-to-date daily average of 16 billion shares. VIX increased by 91bps to 16.56, Crude oil fell 114bps to 72.94, U.S. 10-year yield remained unchanged at 4.53, gold decreased by 26bps to 2756, DXY rose by 11bps to 107.98, and Bitcoin surged by 391bps to 104250.

Equities drifted lower today, with a sense of quiet as many market participants took a break after two days of intense trading and ahead of the FOMC meeting (which was widely expected to result in no change in Fed Funds and some softened language on inflation progress... the market is now pricing in the first full cut in June) and a significant night of earnings, most of which were disappointing overall.

MSFT fell by 4% (Azure growth came in light at +31% versus expectations of +32-33%; positioning score 6.5/10); TSLA also reported slightly below expectations, with revenues and gross margins underwhelming and the 2025 delivery guidance vague (only indicating expected growth without quantifying it; positioning score 5/10). META declined by 1% (solid Q4 revenue beat, but Q1 revenue guidance fell short of street expectations ($39.5-41.8bn vs. consensus $41.67bn... however, there is a significant FX headwind) and guiding '25 expenses above $114-119mn versus expectations of around $115; positioning score 7.5/10).

It's important to note that the earnings expectations are indeed higher this quarter, with street consensus at 8% for S&P 500 year-over-year EPS growth (the prior quarter's consensus was 3%, but the actual result was 8%). The positioning expectations have reset lower in tech, with the Mag7 names collectively net sold for the second consecutive week leading into this week’s AI frenzy. The aggregate long/short ratio in this group now stands at 3.09, which is in the 5th percentile compared to the past year and the 8th percentile compared to the past five years.

Our flor was a 5 on a 1-10 scale regarding overall activity levels. Overall executed flow ended up +284bps compared to a +58bps 30-day average. Long-only funds finished as net buyers of $1 billion, driven by demand in discretionary stocks following SBUX earnings (+8%), and we expect substantial defense against any pullback in the stock from this point, as it appears to be a story stock with a narrative shifting after some initial setbacks last year. Hedge funds ended balanced with scattered demand across tech and macro products versus supply in industrials.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!