SP500 LDN TRADING UPDATE 29/05/25

SP500 LDN TRADING UPDATE 29/05/25

WEEKLY & DAILY LEVELS

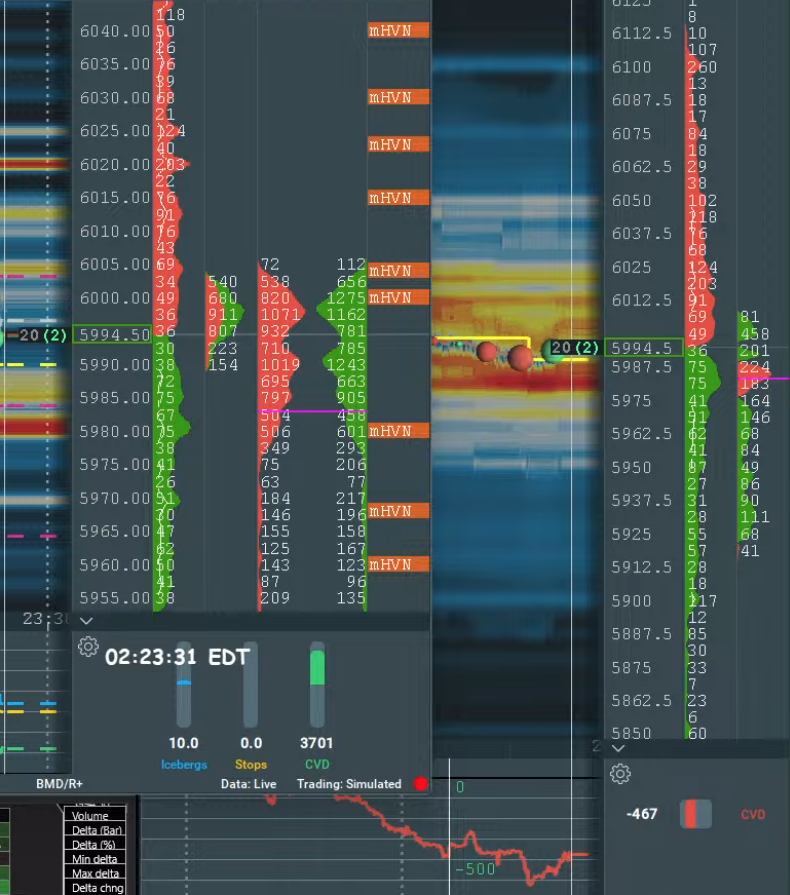

WEEKLY BULL BEAR ZONE 5840/50

WEEKLY RANGE RES 5945 SUP 5849

DAILY BULL BEAR ZONE 5955/45

DAILY RANGE RES 5986 SUP 5865

2 SIGMA RES 6046 SUP 5805

GAP LEVELS 5925

VIX BULL BEAR ZONE 18

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

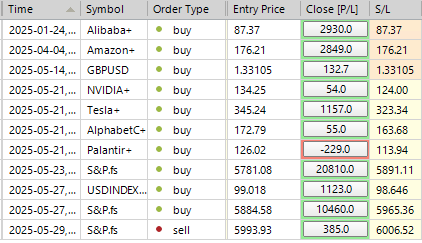

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET 2 SIGMA RANGE RES

SHORT ON TEST/REJECT OF DAILY 2 SIGMA RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: FOCUS ON NVDA

FICC and Equities | 28 May 2025 |

Market Indices:

- S&P 500: -56bps, closing at 5,888 with MOC volume of $1.4B to SELL.

- NASDAQ 100 (NDX): -45bps, ending at 21,318.

- Russell 2000 (R2K): -105bps, finishing at 2,067.

- Dow Jones: -58bps, closing at 42,098.

Trading Volume & Volatility:

- Total shares traded: 15.5B across all U.S. equity exchanges (below YTD daily avg. of 16.5B).

- VIX: +185bps, now at 19.31.

Commodities & Other Assets:

- Crude Oil: +156bps, trading at $61.84.

- U.S. 10-Year Treasury Yield: +3bps, now at 4.47%.

- Gold: -18bps, priced at $3,322.

- DXY (Dollar Index): +38bps, at 99.87.

- Bitcoin: Unchanged, holding at $107,397.

Market Sentiment:

A sluggish day for equities with minimal news flow ahead of major tech earnings tonight.

Post-Bell Earnings Highlights:

- CRM: +5% after beating expectations and raising guidance (scored 5.5/10 on our positioning scale).

- NVDA: +4% on mixed results but better-than-feared overall (scored 7.5/10 on our scale). Key points:

1. Gross margin miss (61% vs. consensus 71%), though anticipated.

2. Q2 revenue guidance of $45B, in line with consensus and buyside expectations.

3. Positive commentary on China/H2O impact ($8B on Q2 revenues) and gross margin outlook ("working toward mid-70% range by year-end").

FOMC Minutes:

No surprises, with themes echoing Powell’s previous comments:

1. Emphasis on waiting for clarity, balancing risks on both sides of the mandate.

2. Increased focus on upside inflation risks.

3. Discussions on potential changes to the 2025 framework review, including inflation-targeting language.

Institutional Activity:

- Overall activity levels scored a 4/10.

- Floor activity: -1% for sale vs. 30-day average of +59bps.

- Institutional flows:

- LOs (Long-Only Funds): Net sellers (-$1B), with supply concentrated in tech and industrials.

- HFs (Hedge Funds): Balanced flows, selling tech while buying discretionary and macro products.

Derivatives Market:

- Choppy equity markets with continued flattening of skew.

- Flows were predominantly restructuring post-yesterday’s moves (rolling puts up and out).

- Growing interest in hedging around the July 9th tariff deadline.

- Suggested trade: VIX Jul 25 40 call spread (~14x max payout).

- NVDA saw notable call buying ahead of earnings. However, "overwrite and vol harvest" flows suggest limited upside realization.

- NVDA 1-day implied move: 6.33%.

- SPX straddle for tomorrow: 0.95%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!