SP500 LDN TRADING UPDATE 30/04/25

SP500 LDN TRADING UPDATE 30/04/25

WEEKLY & DAILY LEVELS

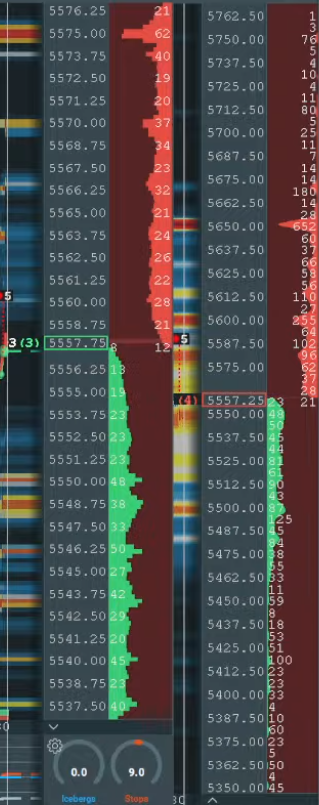

WEEKLY BULL BEAR ZONE 5482/92

WEEKLY RANGE RES 5700 SUP 5400

DAILY BULL BEAR ZONE 5505/15

DAILY RANGE RES 5603 SUP 5485

2 SIGMA RES 5845 SUP 5245

5610 - 5339 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 30 POINTS)

WEEKLY ACTION AREA VIDEO https://www.youtube.com/watch?v=ZrfpPpegL-k&t=80s

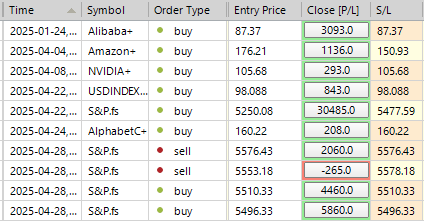

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: FLAT PERFORMANCE

FICC and Equities | April 28, 2025 | 8:39 PM UTC

- S&P 500: +6 basis points, closing at 5,528 with a Market on Close (MOC) buy order of $3.4 billion.

- Nasdaq 100 (NDX): -3 basis points at 19,427.

- Russell 2000 (R2K): +42 basis points at 1,965.

- Dow Jones: +28 basis points at 40,227.

- Volume: 17 billion shares traded across U.S. exchanges, above the year-to-date daily average of 16.3 billion shares.

- Volatility Index (VIX): +113 basis points at 25.12.

- Crude Oil: -170 basis points at $61.90.

- U.S. 10-Year Treasury Yield: -2 basis points at 4.21%.

- Gold: +191 basis points at 3,361.

- Dollar Index (DXY): -54 basis points at 98.93.

- Bitcoin: +36 basis points at $94,620.

Market sentiment was "aggressively unchanged" amidst a defensive and volatile trading day, influenced by several factors: a report from semianalysis.com on a slowdown in Microsoft's data center construction, social media buzz around DeepSeek's new R2 model release, and a Wall Street Journal report on Huawei's development of a new AI chip aiming to compete with NVIDIA (which closed down 2%). Trading volumes were down 20-30%, indicating potential market fatigue and anticipation of a busy week with significant tech earnings reports.

Fund Flows:

- Goldman Sachs Prime Brokerage: Gross exposure remains high (81st percentile for 1 year; 94th for 3 years), while net exposure is low (5th percentile for 1 year; 53rd for 3 years).

- Buybacks: Approximately 40% of S&P 500 companies are out of blackout periods, expected to reach 65% by the end of the week. The corporate repurchase window from April to May is historically strong, accounting for 20% of annual execution.

- CTAs: Anticipate $3 billion in S&P 500 purchases in a flat market this week.

- Pension Rebalancing: Expected to buy $4 billion in U.S. equities by month-end.

Trading activity was rated a 4 out of 10, with investors largely inactive. The floor finished near flat compared to a 30-day average of -26 basis points. Long-only funds ended as net sellers by $700 million, driven by macro trends in tech, while hedge funds were net sellers by $800 million across various sectors. The Federal Reserve is currently in blackout, shifting focus to micro data with 40% of S&P market cap reporting this week, including Microsoft (Wednesday), Amazon (Thursday), and Apple (Thursday).

Derivatives:

- Volatility was bid during the morning selloff, with clients adding short-dated downside protection in SPX/SPY, QQQ, and IWM ahead of a catalyst-heavy week. Investor sentiment turned bearish as optimism about a China trade deal faded. Significant hedge rolls occurred, with $6 million/$7 million vega rolled in QQQ and SPY, respectively. As the market rallied in the afternoon, trading flows were quiet, and volatility bids compressed.

- Focus remains on Mag7 earnings, with the group up 7.9% last week on better-than-expected results. Key earnings to watch include Microsoft and Meta on Wednesday, and Apple and Amazon on Thursday. Jobs data is also in focus, with GIR's non-farm payroll estimate at +140k versus the street's +130k.

- For vanilla hedges, our desk recommends owning SPX 1-month puts outright. May 16, 2025, 30 delta puts cost only 1.1% (-2.7% lower from current levels) and have a ~24 volatility, which appears low. The straddle for the rest of the week is ~2.27%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!