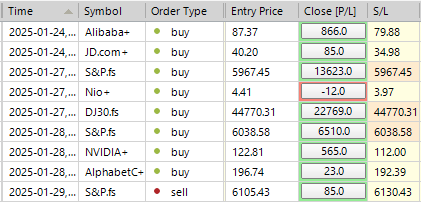

SP500 LDN TRADING UPDATE 29/01/25

SP500 LDN TRADING UPDATE 29/01/25

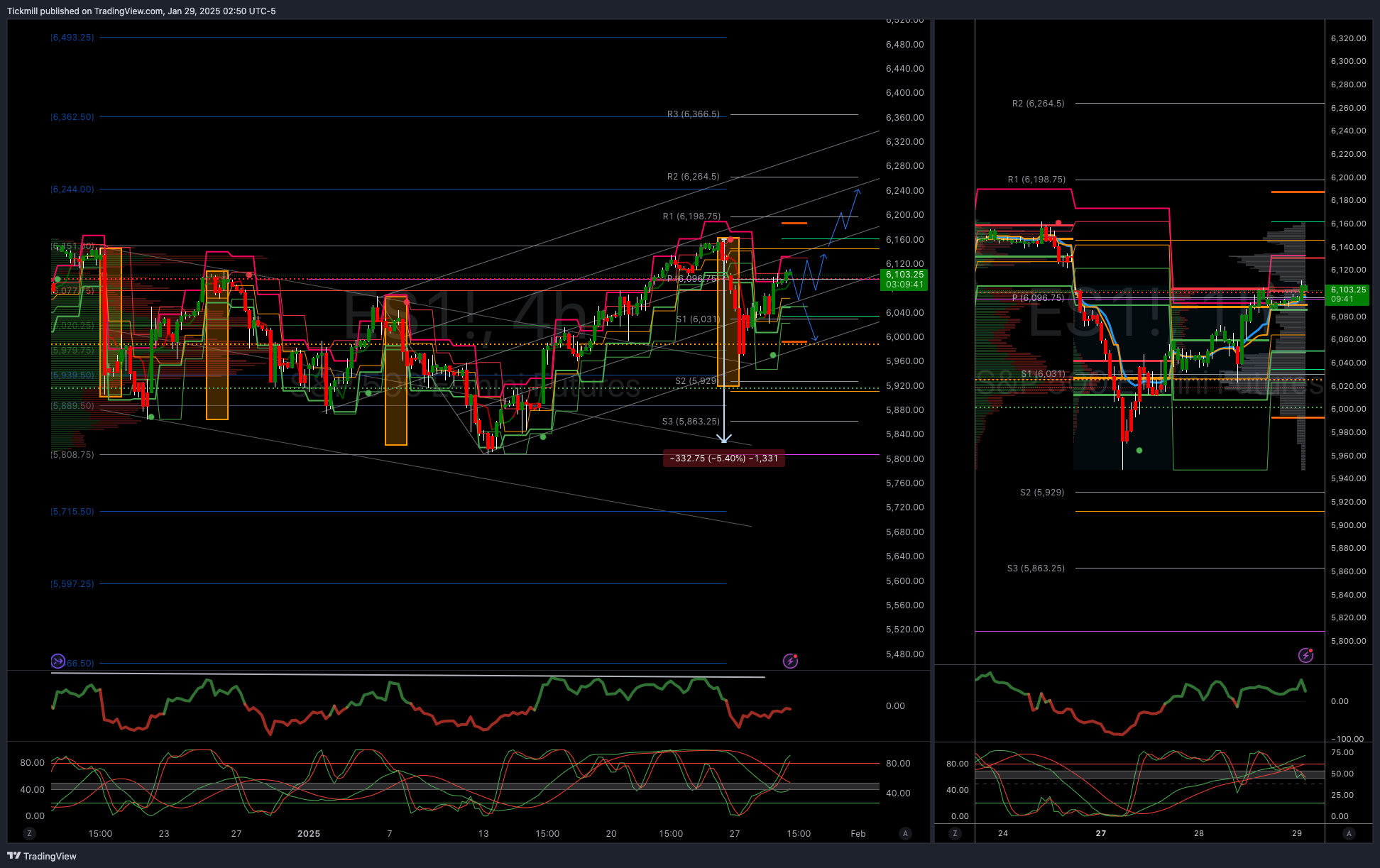

WEEKLY BULL BEAR ZONE 5970/60

WEEKLY RANGE RES 6185 SUP 6019

DAILY BULL BEAR ZONE 6070/80

DAILY RANGE RES 6133 RANGE SUP 6049

ETH GAP ZONE 6102-6132 RTH GAP FILL 6122

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 6160>WEEKLY RANGE RES

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: WHIPLASH

FICC and Equities

28 January 2025 | 10:00PM UTC

SPX +92bps closing at 6067 with a MOC of $2.7bn to SELL. NDX +159bps at 21463, R2K +21bps at 2288, and Dow +31bps at 44850. A total of 13.85bn shares were traded across all US equity exchanges compared to a year-to-date daily average of 16bn shares. VIX -832bps at 16.41, Crude +90bps at 73.82, US 10 yr unchanged at 4.53, gold +82bps at 2763, DXY +51bps at 107.89, and bitcoin +9bps at 101440.

There was a whiplash effect with a partial recovery in tech despite the lack of new information (NVDA +9% today and “only” down about 8% this week) while Equal Weight remained weak. Yesterday was “special” as our private banking data indicates that the average fundamental long/short hedge fund lost 110bps of year-to-date performance amidst the largest notional net selling in US single stocks since September 2024 (-2.5SDs), driven by risk unwinds through long liquidations.

Today's discussions (once again) highlighted a reasonable debate on whether recent developments actually alter the architectural views held just a week ago regarding power/silicon/manufacturing, or if this situation is more of a prudent market reset on valuations amidst market complexity and strong year-to-date price action (currently, TSM, VST, GEV types are up for the year while names like NVDA, MRVL, ANET have managed to recover to being down 3-5% year-to-date).

What’s next? It seems that near-term volatility may persist, but we can expect more “hard reads” from corporates in the coming days (e.g., insights on the “inference” cycle and, consequently, the status of the tools necessary for driving AI adoption and, in turn, AI monetization). Ty Callahan

Our floor rated a 5 on a 1-10 scale regarding overall activity levels. Overall executed flow ended +196bps compared to a -58bps 30-day average. Clearly, we are not out of the DeepSink woods yet, but price action and trading activity on our desk were robust.

Long-only funds finished as net buyers by +$700m, driven by sectors like tech, healthcare, and staples. There was significant attention on software, with the sector performing strongly...many names remain heavily shorted: APP, RDDT, CRWD, DDOG, NET types. Hedge funds ended as slight net sellers, influenced by supply in macro products and healthcare versus demand in tech (notably software).

Market volumes remain explosive, up +43% compared to the 20-day moving average (though down 20% from yesterday). S&P Top of Book liquidity and bid-ask spreads are both performing well (in the 80th+ percentiles over a 1-year look back). The FOMC meeting is scheduled for 2pm tomorrow, followed by earnings reports from IBM, META, MSFT, and TSLA after the market close. AAPL is set to report on Thursday. We are optimistic that these earnings and management commentary will be solid and constructive

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!