SP500 LDN TRADING UPDATE 28/05/25

SP500 LDN TRADING UPDATE 28/05/25

WEEKLY & DAILY LEVELS

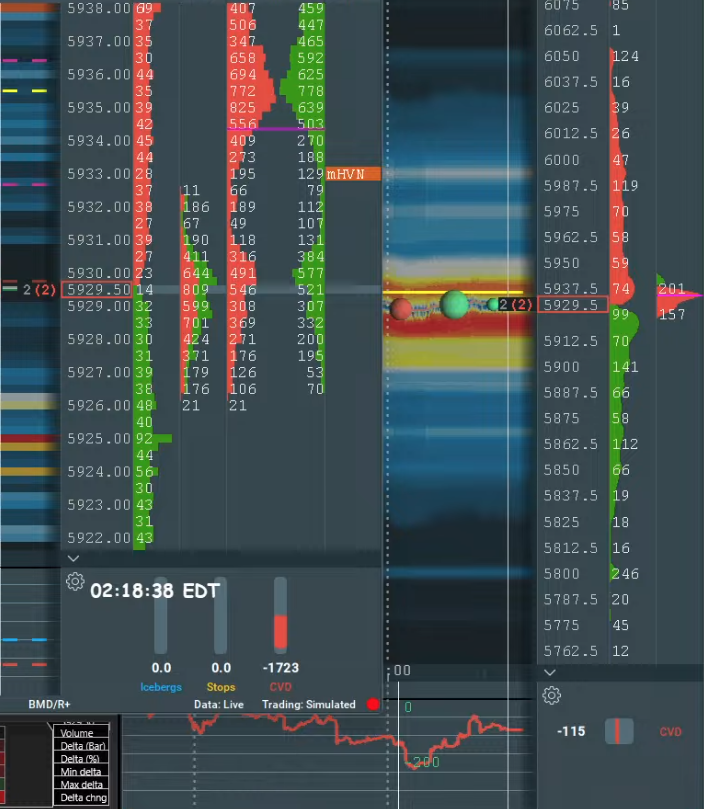

WEEKLY BULL BEAR ZONE 5840/50

WEEKLY RANGE RES 5945 SUP 5849

DAILY BULL BEAR ZONE 5905/5895

DAILY RANGE RES 6000 SUP 5880

2 SIGMA RES 6059 SUP 5821

GAP LEVELS 5843

VIX BULL BEAR ZONE 19.50

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

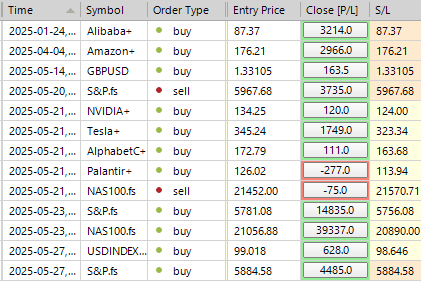

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MELT-UP

FICC and Equities | 27 May 2025 |

S&P closed +205bps at 5,852 with a MOC of $290m to SELL. NDX gained +239bps to 21,414, R2K rose +260bps to 2,096, and the Dow added +178bps to close at 42,343. Trading volume reached 17 billion shares across all U.S. equity exchanges, exceeding the YTD daily average of 16.5 billion shares. The VIX dropped 7.8% to 18.96. Crude oil declined 76bps to $61.06, the U.S. 10-year yield fell 6bps to 4.44%, gold dropped 186bps to $3,331, the DXY rose 68bps to 99.60, and Bitcoin edged up 26bps to $109,907.

Market sentiment was driven by light institutional activity at the start of the week, as indices surged higher in what appeared to be a technical reaction to overnight global bond market movements. Reports suggested Japan plans to reduce its super-long bond issuance to curb rising yields, creating ripple effects. Additionally, retail buying and momentum chasing underpinned the rally, fueled by news of Trump delaying his 50% EU tariff threat from June 1 to July 9, aligning it with the 90-day reciprocal tariff expiration. This backdrop created challenges for short positions.

All eyes are on NVDA's earnings report tomorrow, with the desk rating positioning at 7.5 out of 10. The stock is now ~50% above its April low and ~10% below all-time highs, though it has been range-bound over the past 12 months amidst normalizing revenue beat sizes and mixed headlines (geopolitical, AI ROIs, competition). Desk flows indicate more balanced two-way trading in recent weeks, marking a shift from the broad-based thematic inflows seen in prior quarters.

Floor activity was moderate, rated a 4 out of 10 overall. The floor finished +4% to buy versus a 30-day average of +69bps. Both LOs and HFs were net buyers (~$1 billion), primarily driven by macro products and sector covers, especially in tech and consumer.

DERIVATIVES: After Friday’s skew bid, we saw aggressive flattening alongside today’s rally. Short-dated volatility also experienced a significant crush as flows remained relatively muted. With NVDA earnings on the horizon, positioning remains at a 7.5 out of 10. For hedging opportunities, the NVDA July 125 put (47v / 27d) appears attractive, while the 30 May 130/120 put spread offers a potential ~5x return..

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!