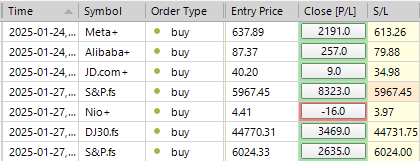

SP500 LDN TRADING UPDATE 28/01/25

SP500 LDN TRADING UPDATE 28/01/25

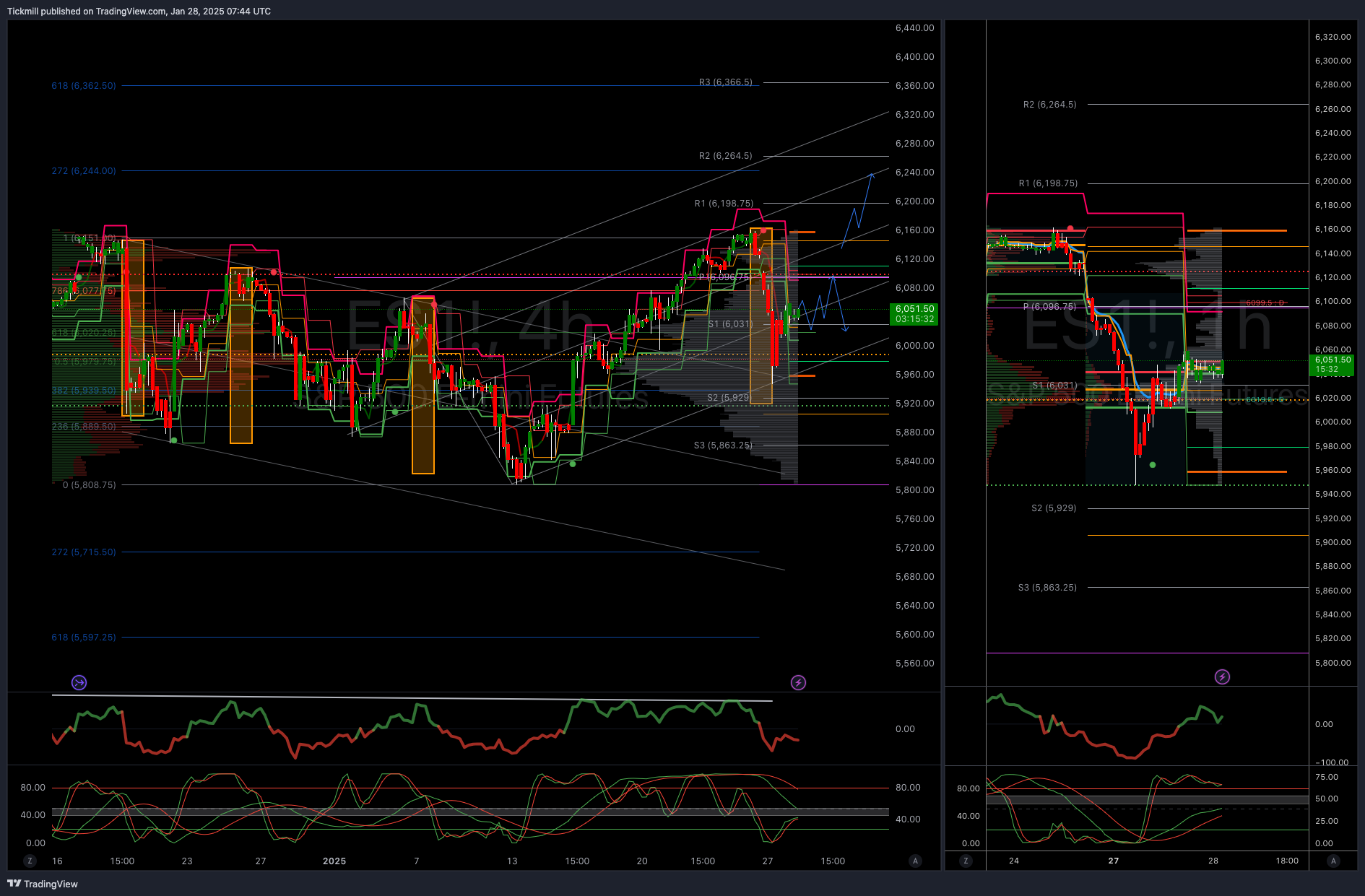

WEEKLY BULL BEAR ZONE 5970/60

WEEKLY RANGE RES 6185 SUP 6019

DAILY BULL BEAR ZONE 620/10

DAILY RANGE RES 6092 RANGE SUP 6108

ETH GAP ZONE 6102-632 RTH GAP FILL 6122

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST REJECT 5930 TARGET 5980

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: DEEPSEEK

FICC and Equities | 27 January 2025 | 10:11 PM UTC

S&P down 146bps, closing at 6012 with a market-on-close sell of $575mm. NDX decreased by 297bps to 21127, R2K fell 106bps to 2283, while Dow rose 65bps to 44713. A total of 17.19 billion shares were traded across all U.S. equity exchanges, compared to a year-to-date daily average of 16 billion shares. VIX increased by 2054bps to 17.90, Crude oil dropped 217bps to 73.04, U.S. 10-year yield fell 9bps to 4.52, gold decreased by 97bps to 2743, DXY fell 5bps to 107.39, and Bitcoin dropped 224bps to 102219.

Equities experienced a significant decline, particularly in the global AI sector, which is facing intense pressure due to competition concerns stemming from China’s Deepseek, a Chinese AI startup that has reportedly showcased AI models delivering comparable performance to leading AI chatbots at a fraction of the cost. This development raises doubts about the prevailing assumption that the future of AI will necessitate ever-increasing amounts of computing power, energy, and resources for development.

So far, the market has favored both companies investing in AI (such as AMZN, MSFT, GOOGL, OpenAI, etc.) and those supplying the necessary tools (like NVDA, AVGO, VRT, and the semiconductor sector in general), leading to a substantial accumulation of length and market capitalization in both groups. This situation is undermining investor confidence across the entire ecosystem, primarily because the alleged low cost of the Deepseek model challenges the need for similar levels of spending and investment going forward. (h/t Peter Bartlett)

Market breadth was robust, with rotational forces favoring defensive stocks (index construction is important both on the way down and up). 350 S&P stocks ended the day higher (Equal Weight +2bps), while NVDA saw a 17% drop, breaking below the 200-day moving average for the first time in over two years. AI Semiconductors (GSCBSMHX) fell 12%, marking their worst day since COVID; AI (GSTMTAIP) dropped 9%, a 6 sigma move; Power Up America (GSENPOW) decreased by 14%, a 7 sigma move; HF VIP vs. VIP Short (GSTHVIPP) fell 4%, a 6 sigma move; High Beta Momentum (GSPRHIMO) dropped 9%, a 5 sigma move.

Our floor rating was a 7 on a scale of 1-10 regarding overall activity levels. Overall executed flow ended at -438bps compared to a 30-day average of -44bps. Unsurprisingly, our desk leaned heavily towards selling after a combination of long-only funds reducing risk and shorts targeting semiconductors, with most of the supply coming at the session's start. Overall, long-only funds finished as approximately $2.5 billion net sellers, while hedge funds were only slightly net sellers, which aligns with last week’s significant de-grossing activity—long sales and short covers combined—being the largest we’ve observed on our prime brokerage book in six months. An intra-day flash from prime brokerage indicated long/short performance holding steady... Fundamental long/short was down 70bps due to beta, while quants were up (more details to follow tomorrow).

On a positive note, today marked the beginning of the S&P 500 buyback open window. We estimate this window will remain open from today until March 14. Our flows last week were light as we were still navigating through the blackout period. We anticipate an increase in flows throughout February as we are now in an open period. Aside from the Deepseek situation, this week was expected to be packed with events... Bank of Canada decision (Wednesday morning; a 25bp rate cut is anticipated), FOMC decision (Wednesday afternoon; no rate change is expected), ECB decision (Thursday morning; 25bp cut expected), U.S. GDP for Q4, U.S. PCE for December, and U.S. Employment Cost Index for Q4 (Friday morning). The RFK Jr. hearing is scheduled for January 29, with Gabbard on January 30. On the micro front, 41% of S&P market capitalization is set to report, with four of the Magnificent Seven companies reporting (TSLA, MSFT, META on Wednesday // AAPL on Thursday).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!