SP500 LDN TRADING UPDATE 27/6/25

SP500 LDN TRADING UPDATE 27/6/25

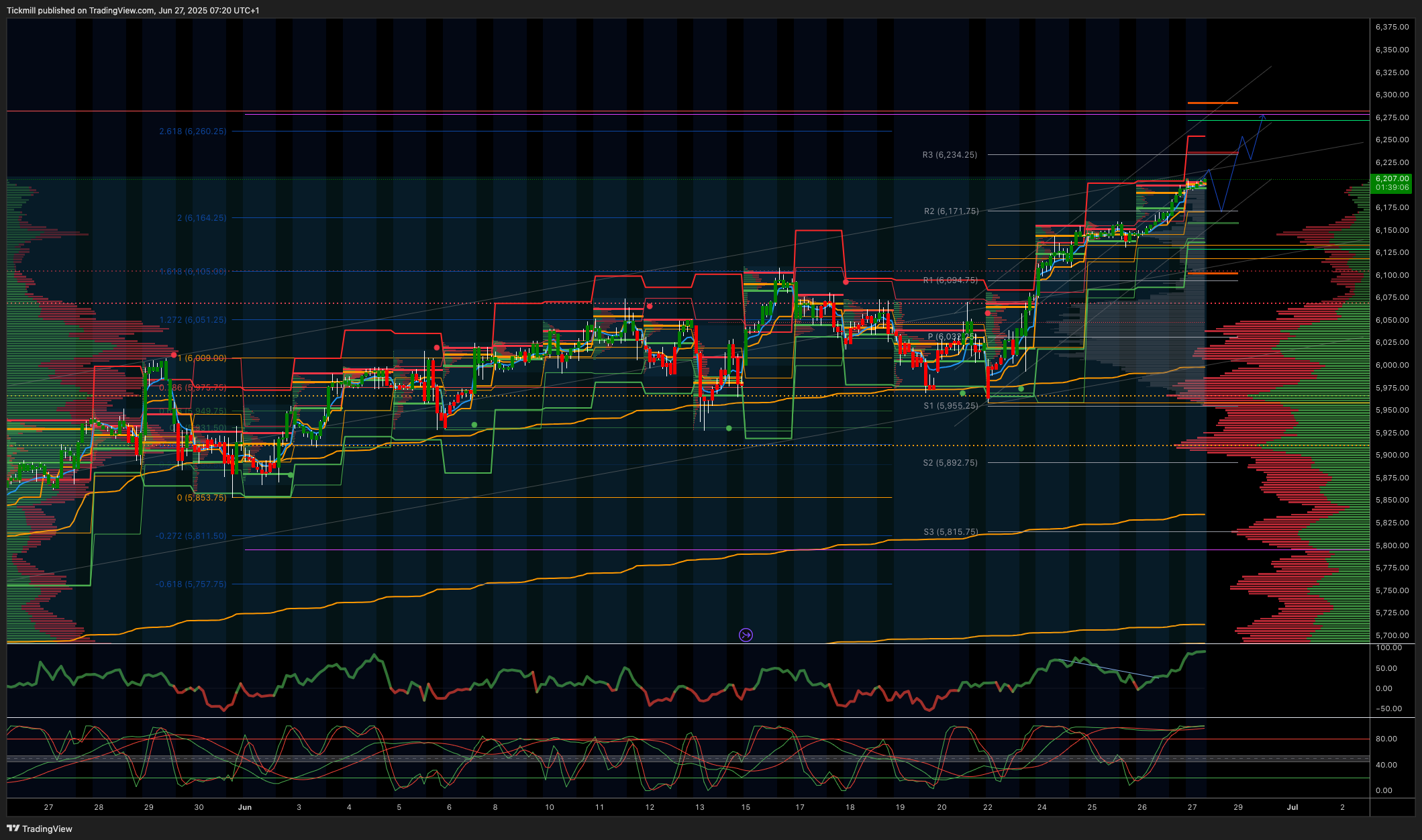

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=JGai0yB4XYE&t=218s

WEEKLY BULL BEAR ZONE 6050/60

WEEKLY RANGE RES 6130 SUP 5900

DAILY BULL BEAR ZONE 6170/60

DAILY RANGE RES 6254 SUP 6136

2 SIGMA RES 6314 SUP 6076

GAP LEVELS 6147/6077/6018/5843/5741/5710

6166.5 PRIOR ALL TIME HIGHS

VIX BULL JULY CONTRACT BEAR ZONE 21.35 DAILY BULL BEAR ZONE 19.75

DAILY MARKET CONDITION - ONE TIME FRAMING UP - 6159

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

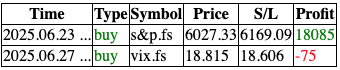

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET 6234 > DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MARKET RALLY CONTINUES

FICC and Equities | June 26, 2025 | 8:48 PM UTC

The S&P 500 rose by 80 basis points, closing at 6,141, just three points shy of its all-time high, despite a Market on Close (MOC) sell order totaling $3.6 billion. The Nasdaq 100 (NDX) climbed 94 basis points to reach a new all-time high at 22,447. The Russell 2000 (R2K) surged 154 basis points to 2,186, and the Dow Jones Industrial Average gained 94 basis points, ending at 43,386. Trading volume across all U.S. equity exchanges was 16.2 billion shares, slightly below the year-to-date daily average of 16.7 billion shares. The VIX decreased by 1% to 16.59, crude oil prices increased by 82 basis points to $65.44, the U.S. 10-year Treasury yield fell by 5 basis points to 4.24%, gold edged up by 5 basis points to $3,345, the DXY dropped by 39 basis points to 97.30, and Bitcoin rose by 22 basis points to $107,611.

The market rally remains supported by key factors: 1) An improving macroeconomic environment with easing geopolitical tensions, rising probabilities of rate cuts, and reduced tariff concerns. 2) Continued enthusiasm for AI-related investments. 3) Underweight positioning, with the long/short ratio still in the 19th percentile over a one-year look-back period. 4) Favorable technical indicators, including compressed volatility and strong retail interest. Copper-exposed stocks, such as GSXGCOPP, rose by 6%, likely influenced by a Goldman Sachs upgrade, which raised the peak price forecast to $10,050 in August, with a slight decline to $9,900 by year-end. PONY shares jumped 12% following a New York Times report on preliminary talks with Uber.

Looking ahead, the U.S. Personal Consumption Expenditures (PCE) report is due tomorrow, along with a significant liquidity event related to the R2K rebalancing.

Our trading floor activity was rated a 5 on a 1-10 scale, with overall activity levels finishing 163 basis points above the 30-day average of -63 basis points. Skews were mild, with long-only funds and hedge funds ending roughly flat, as activity remained subdued ahead of tomorrow. Long-only funds sold financials and REITs while buying large-cap tech stocks. Hedge funds sold industrials and energy stocks while buying healthcare and macro products. Post-market, Nike (NKE) remained unchanged after-hours. Expectations were for a beat driven by sales and margins, but while revenue exceeded expectations, margin improvements were smaller than anticipated, mainly due to gross margins being in line. The focus for Nike is on the 2026 guidance, with insights expected for Q1 and possibly H1 2026, though not for the full fiscal year. We believe the 2026 EPS target is likely below consensus, estimated at $1.25-$1.50 compared to the consensus of $1.90.

Equity Capital Markets (ECM): As we conclude Q2 2025, U.S. registered equity issuance stands at $45.6 billion across 148 offerings (excluding SPACs) for the quarter and $92.6 billion across 297 offerings year-to-date. This quarter's issuance is over 25% higher than Q2 2024 levels and approximately 2% above 2024 year-to-date figures. The market is in a strong position, especially after sentiment improved following Liberation Day in early April, driven by positive developments in the IPO market, such as CRCL's $1.2 billion IPO, now up 700%. We expect issuance to continue increasing in late July and early August, with a focus on the fall, potentially spurred by successful IPOs in growth tech, late-stage AI, and crypto assets. High-profile IPOs on the public file include StubHub and Klarna, with potential 2025 IPOs from Medline, Figma, Kraken, Gemini, and Genesys.

Derivatives: A busier day with a realized move to the upside in the S&P 500, nearing its all-time high. Volatility is rising alongside the rally, especially as we break through the 6,125 level. This marks the first time in a week that we've seen sustained interest in volatility. Despite this, gamma tenors remain at low volatility levels. The straddle for tomorrow is priced at $32 and is expected to close below 50 basis points again. We continue to favor topside volatility and see potential in going further out on the curve

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!