SP500 LDN TRADING UPDATE 2/7/25

SP500 LDN TRADING UPDATE 2/7/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=oq93tBk6v_Q&t=9s&pp=0gcJCcMJAYcqIYzv

WEEKLY BULL BEAR ZONE 6220/10

WEEKLY RANGE RES 6295 SUP 6150

DAILY BULL BEAR ZONE 6240/50

DAILY RANGE RES 6307 SUP 6189

2 SIGMA RES 6367 SUP 6129

GAP LEVELS 6147/6077/6018/5843/5741/5710

6166.5 PRIOR ALL TIME HIGHS

VIX BULL JULY CONTRACT BEAR ZONE 21.35 DAILY BULL BEAR ZONE 19.75

DAILY MARKET CONDITION - ONE TIME FRAMING UP - 6227

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

TRADES & TARGETS

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW

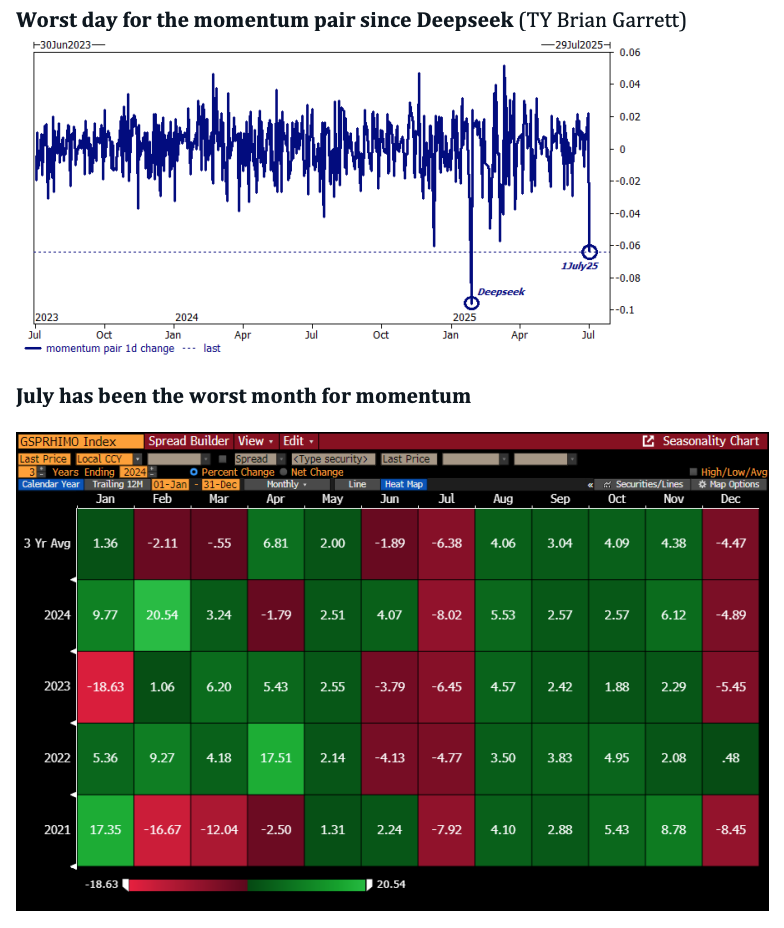

U.S. EQUITIES UPDATE: MOMENTUM UNWIND

FICC and Equities | 1 July 2025 | 8:49 PM UTC

Market Summary:

- S&P 500: -11bps, closed at 6,198 (Equal Weight +112bps) with MOC $2.3b to BUY.

- NASDAQ 100 (NDX): -89bps at 22,478.

- Russell 2000 (R2K): +93bps at 2,195.

- Dow Jones: +91bps at 44,494.

- Volume: 18.2b shares traded across all U.S. equity exchanges vs YTD daily average of 16.8b shares.

- Volatility Index (VIX): +60bps at 16.83.

- Crude Oil: +97bps at $65.74.

- U.S. 10-Year Yield: +2bps at 4.25%.

- Gold: +126bps at $3,349.

- DXY (Dollar Index): -17bps at 96.71.

- Bitcoin: -188bps at $105,585.

Key Observations:

No clear catalyst emerged for today’s sharp momentum unwind. The GSPRHIMO momentum pair dropped -7%, marking its worst performance since Deepseek (5-sigma move). Both Asset Managers and Hedge Funds are in “question and watch” mode, with no evident fundamental driver behind the shift to value (RTY/SPW > NDX/SPX).

Possible Drivers:

1. Start of a new quarter, prompting new ideas, reversion plays, and reluctance to sell YTD winners until post-Q2.

2. Fed Chair Powell’s remarks at the ECB Forum in Sintra, stating, “wouldn’t take any meeting off the table,” when asked about potential rate cuts in July.

3. Anticipation ahead of Thursday’s Non-Farm Payrolls (NFP) report (Goldman Sachs forecast: +85k; consensus: +113k; prior: +139k). Mixed data today: JOLTS job openings increased, while ISM manufacturing rose but showed weak composition.

Activity Levels:

- Overall activity was moderate, scoring a 6/10.

- Floor finished -68bps for sale vs the 30-day average of -46bps.

- Long-Only (LO) funds were net sellers of $2b, with broad supply across all sectors, heavily concentrated in mega-cap tech.

- Hedge Funds (HFs) were net sellers of $1b, driven by supply in tech, industrials, and discretionary sectors, while showing demand in healthcare.

Performance Update (Goldman Sachs PB):

- Fundamental L/S: -40bps.

- Systematic L/S (quants): ~flat.

The situation remains uncomfortable but manageable, with further clarity expected tomorrow.

Derivatives Market:

Despite stress in momentum, index volatility markets showed no signs of panic.

- IWM topside vol buyers emerged in the morning to hedge, but overall flows were muted.

- RUT volatility is bid due to outperformance, while NDX volatility is offered amid underperformance.

- SPX volatility is gradually softening as the index’s trading range remains tight.

Tomorrow’s one-day straddle is expected to mark a new local low, closing near 40bps in SPX. Midterm topside vols in SPX remain more attractive than gamma, despite today’s dramatic gamma reset. Dealer long SPX gamma is likely to continue pinning the market through NFP, with the one-day straddle projected to cost less than 60bps heading into the event.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!