SP500 LDN TRADING UPDATE 27/03/25

SP500 LDN TRADING UPDATE 27/03/25

WEEKLY & DAILY LEVELS

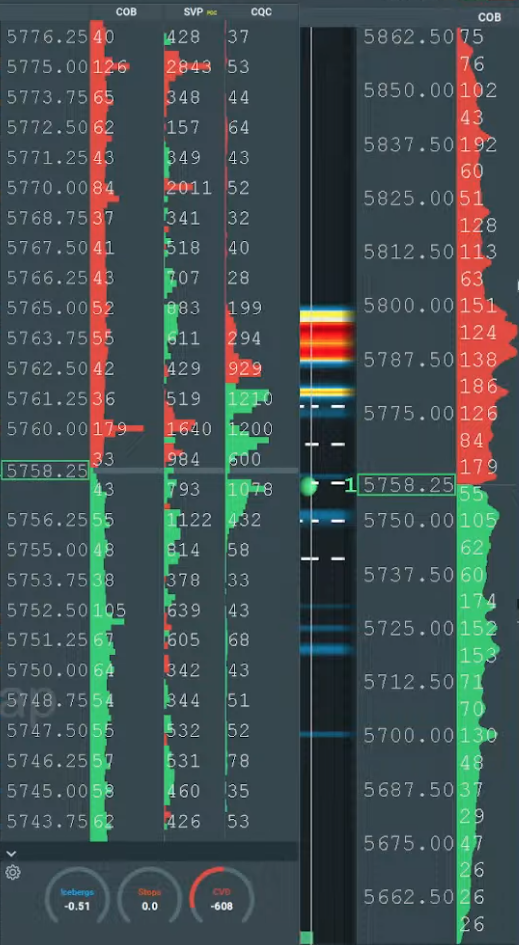

WEEKLY BULL BEAR ZONE 5690/5700

WEEKLY RANGE RES 5850 SUP 5590

DAILY BULL BEAR ZONE 5700/10

DAILY RANGE RES 5798 SUP 5711

2 SIGMA RES 5913.5 SUP 5605.5

5837 50% RETRACE FROM ATH’S

5640 MARCH CONTRACT GAP

5912 ABC CORRECTION TARGET

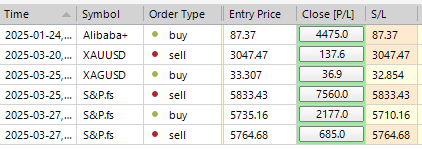

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BB ZONE TARGET DAILY/WEEKLY RANGE RES

LONG ON ACCEPTANCE ABOVE WEEKLY RANGE RES TARGET 5912

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT OF 5912 TARGET 5837

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES OVERVIEW: PRESSURE

FICC and Equities

Market Performance:

- S&P 500: Down 112bps, closing at 5,712 with a Market-on-Close (MOC) imbalance of $2B to buy.

- Nasdaq 100 (NDX): Down 183bps, ending at 19,916.

- Russell 2000 (R2K): Down 104bps, closing at 2,090.

- Dow Jones Industrial Average (Dow): Down 31bps, finishing at 42,454.

Volume and Volatility:

- Total volume: 15.7B shares traded across U.S. equity exchanges, slightly above the YTD daily average of 15.4B shares.

- VIX: Up 688bps to 18.33.

Commodities and Rates:

- Crude Oil: Up 94bps to $69.65.

- U.S. 10-Year Treasury Yield: Up 4bps to 4.35%.

- Gold: Down 7bps to $3,052.

- DXY (Dollar Index): Up 34bps to 104.53.

- Bitcoin: Down 12bps to $87,178.

Market Dynamics:

A notable day of rotational pressure impacted all corners of the market, albeit with no clear catalyst. Despite the broader market being only modestly lower, specific drivers such as NVDA and TSLA contributed significantly to the Nasdaq's decline, accounting for nearly half of its negative return at one point.

Key Themes Identified by Clients:

1. Technical Levels: NDX failing to hold its 200-day moving average overnight.

2. Seasonality: Continued choppiness ahead of April 2nd.

3. Sector-Specific Concerns: Negative sentiment surrounding Datacenter/AI (e.g., China NVDA environmental issues, Cowen’s bearish note, and BABA "bubble" commentary).

4. Quarter-End Positioning: Trading dynamics and portfolio adjustments.

Interestingly, sector flows did not align with market price action. For instance, there was demand in semiconductors, suggesting that top-down macro traders, rather than bottom-up stock pickers, were driving the market.

Trading Activity:

- Activity on our floor was moderate, rated a 4 out of 10.

- Net selling: Our floor ended 4% net sellers compared to a 30-day average of -128bps.

- Long-Only (LO) funds: Net sellers of -$2B.

- Hedge Funds (HF): Net sellers of -$900M.

- Selling pressure was concentrated in macro expressions of Tech and Healthcare.

Yesterday’s large-cap pharma sell-off (a 2.75% move, equivalent to 2.5 standard deviations) saw acute HF supply in Ireland-exposed names. Today, selling broadened across client types and names, even though price action was less severe, likely reflecting ongoing adjustments to manufacturing and IP domiciling exposure.

Derivatives Market:

- Volatility: Volatility was bid during the sell-off but did not significantly outperform. Flows remained muted, and the session felt relatively quiet.

- Hedging: Clients selectively added hedges in SPX downside (targeting April regular expiry) and the VIX complex, where call buying persisted.

- Liquidity: Technical conditions have improved compared to two weeks ago, with better futures liquidity and longer dealer gamma at current spot levels.

Outlook:

The market realized a 55bps straddle today, and pricing suggests a 1.15% move for the remainder of the week. While the session was subdued overall, ongoing tariff-related headlines remain a focal point for market participants.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!